This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

I applied for a 2nd Chase Ink Business Preferred in January when the public offer was 80k bonus points after $5k spend in 3 months. It wasn’t an automatic approval and you can read that post about my experience if you’re interested. Once I received my card in the mail, the public offer had increased to 100k bonus points after $15k spend. I thought this was within reason for my business and sent Chase a secure message to see what the policy was on matching to the Chase Ink Business Preferred 100k offer. It’s actually the best of both worlds and I figured you would be interested to see how I approached it via secure message in case you’re in a similar position.

Referrals give the “referrer” a 20k point bonus upon new account approval. Pretty amazing referral bonus

Chase Ink Business Preferred 80k Referral offer is still populating

thanks for using ours!

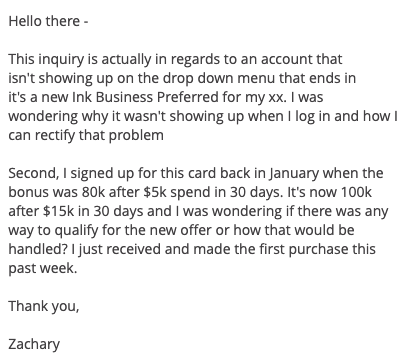

Here is the message I sent Chase

For some reason my account wouldn’t populate via the normal add account features on Chase.com and the rep added the account per my request.

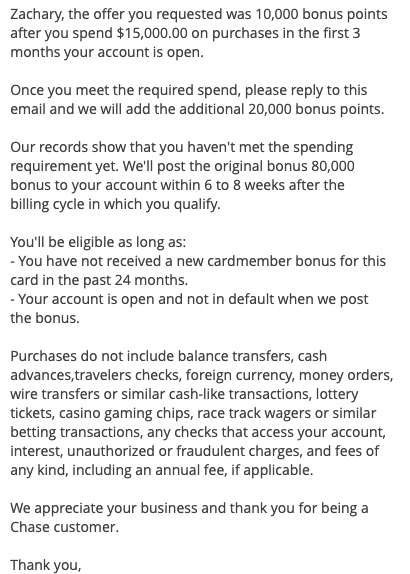

And their response

This is consistent with what other people have received which is the best of both worlds. I can still earn 80k after $5k spend in 3 months, but if I happen to hit the $15k in 3 months, I get another bonus 20k. Can’t really beat that.

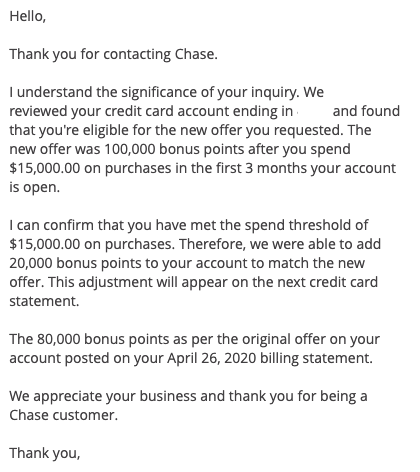

And the points have credited…

What I’ll do with the additional “15k” Ultimate Rewards

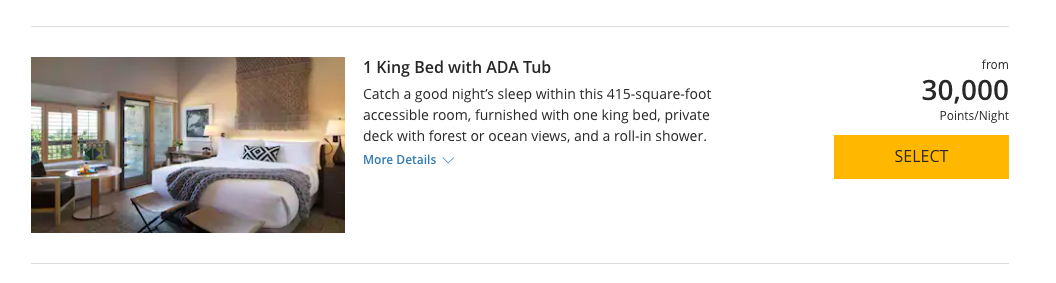

I have to say…You should always look at opportunity cost. I pushed an extra $10k spend on the card, earning just 1x on the purchases, when I could have earned 1.5x with the Chase meaning I netted 15k Ultimate Rewards vs 20k. I have a little something I’d like to do that involves a Hyatt transfer. Alila Big Sur is now redeemable for just 30k Ultimate Rewards and it’s all inclusive – so I’m really thinking this should happen. Rates are nearly $2k a night – what an insane use of Hyatt points.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.