We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Royal Air Maroc is offering up a last minute status match, but honestly, given the cost of this match, it’s not something I will do, but it depends on your circumstance and how much you value having One World status.

You can go here to match

There is a plethora of ways to match and you should hear within 3 days whether you’re approved or not.

What status do I get?

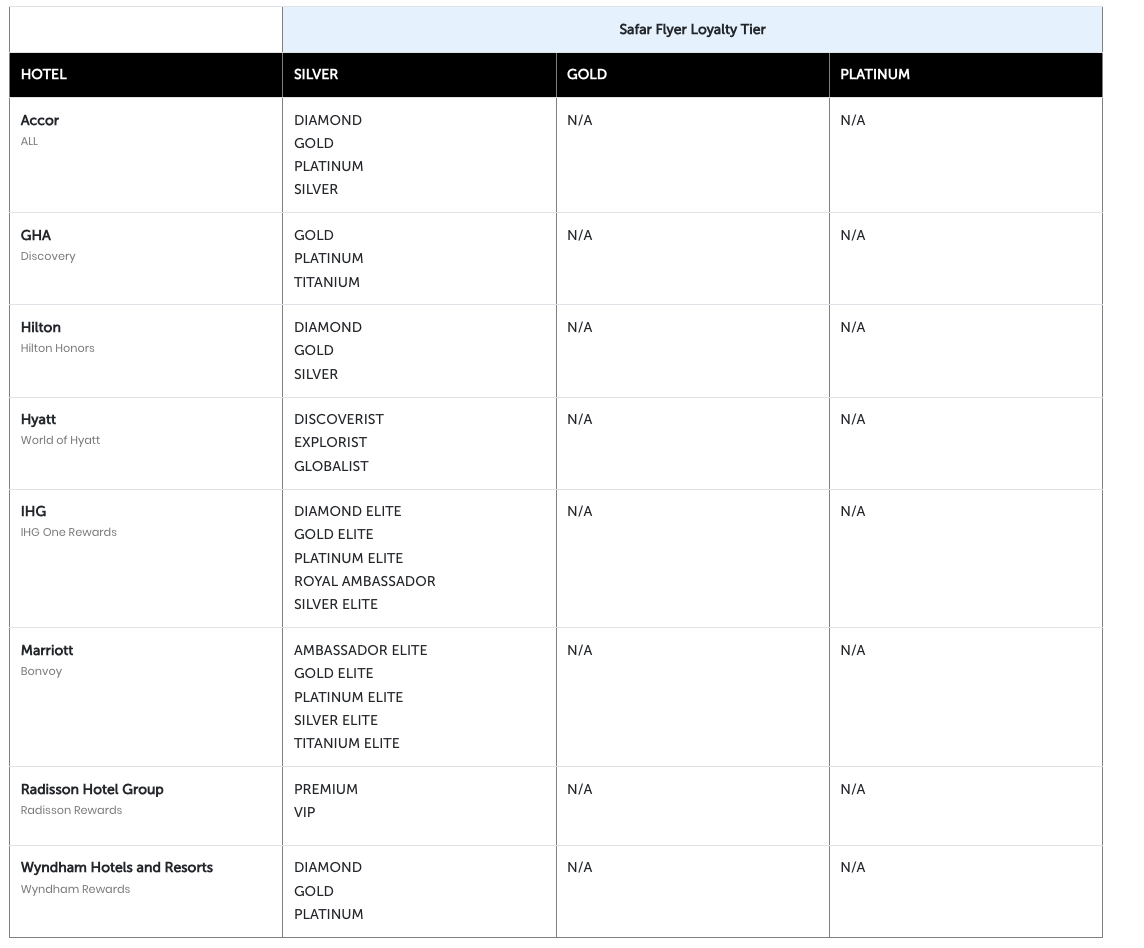

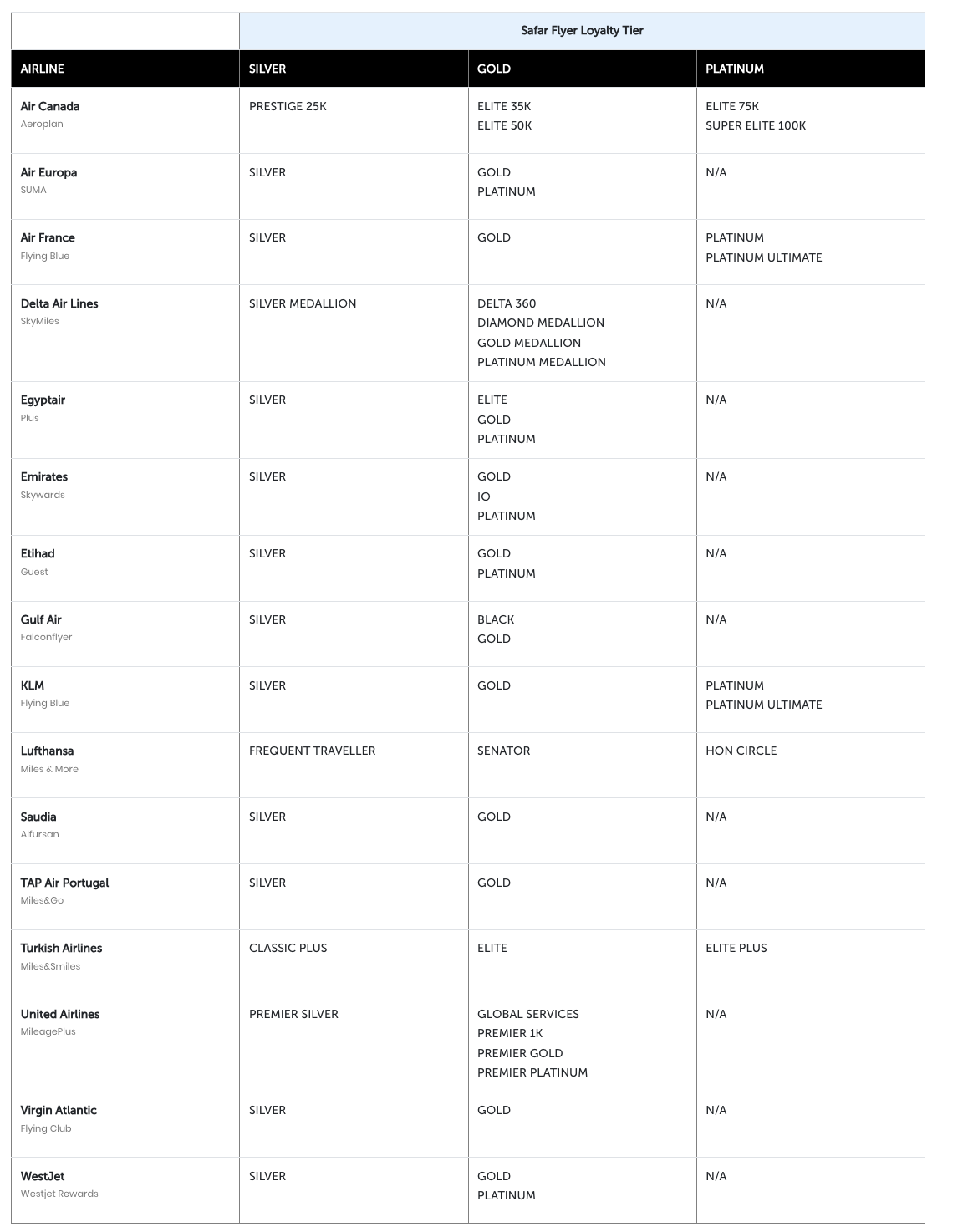

You can look at these tables

- Silver = One World Ruby

- Gold = One World Sapphire

- Platinum = One World Emerald

Things to keep in mind: it can get pricey

The only status, in my opinion, that could be worth it is Gold because that equates to One World Sapphire and lounge access when flying outside of Morocco on a One World carrier. But is it worth $450?! Yikes…I dunno, it’s not much cheaper than an Admirals Club membership.

- (I) Only 1 status match per person will be permitted under this campaign matching to any of the status tiers.

(II) The application fees- $150 for Silver,

- $450 for Gold,

- $1000 for Platinum Lite

- $1500 for Platinum Standard

- (IV) If approved, the status match upgrade is valid until June 30, 2024.

- To extend status beyond this date, you must meet the 6-month Extention Criteria.

How long do you have to match?

Technically until June 30th 2024, but last time it ended in 2 days.

You can extend for 6 months:

You need to one of the two following things:

- (1) By June 30, 2024, flown on an eligible Royal Air Maroc flight and earned at least 1 status mile from that flight and that flight must show in your Safar Flyer account.

- (2) Have at least 1 eligible Royal Air Maroc booking linked to your Safar Flyer membership number on June 30, 2024.

From Royal Air Maroc: “Failure to meet one or more of these conditions will result in your 6-month status match being downgraded to Blue status. There are no refunds under any circumstances should you fail to meet any of the criteria for extending status until Dec 31, 2024.”

Overall

$450 for Gold? $1000 to $1500 for Platinum and valid for just 6 months? Clearly this is a revenue generator for Royal Air Maroc, but it’s far too pricey for my blood given the benefits I’d extract from those status levels.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.