This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

I’ve had both the personal and business version of the Gold Delta Amex, and since canceling those accounts have continued to receive targeted offers for both cards. Every time, until this last one, the offers have been between 50k and 60k WITH the Amex lifetime language included, which obviously excludes me. If you’re unfamiliar with this lifetime language, the long and short of it is you can only receive a welcome bonus once in your lifetime. A few years ago, Amex changed their policy on new cardmember bonuses from once a year to once in a “lifetime.” What that “lifetime” constitutes is still unclear, but some anecdotal evidence suggest 7 years constitutes a lifetime. The removal of the lifetime language on these targeted offers indicates, and corroborates, other online evidence that Amex routinely allows members to bypass the restriction if targeted.

Here’s the offer I received

It links to here

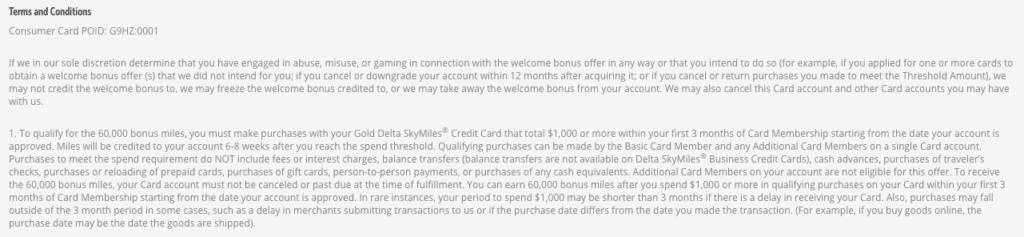

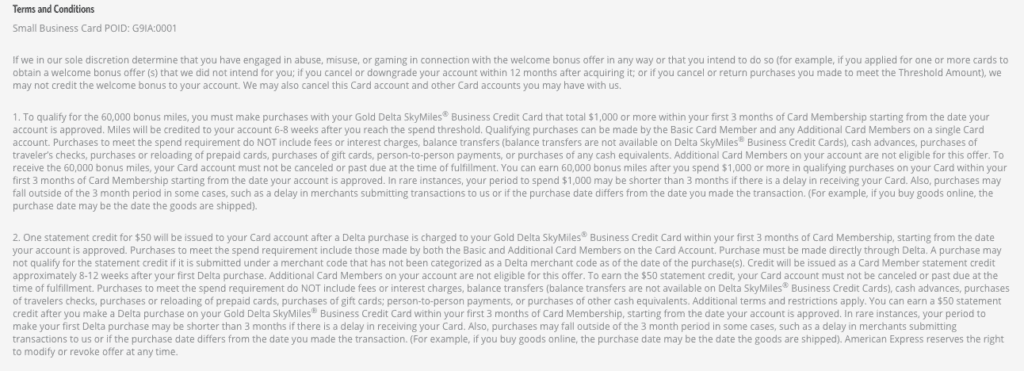

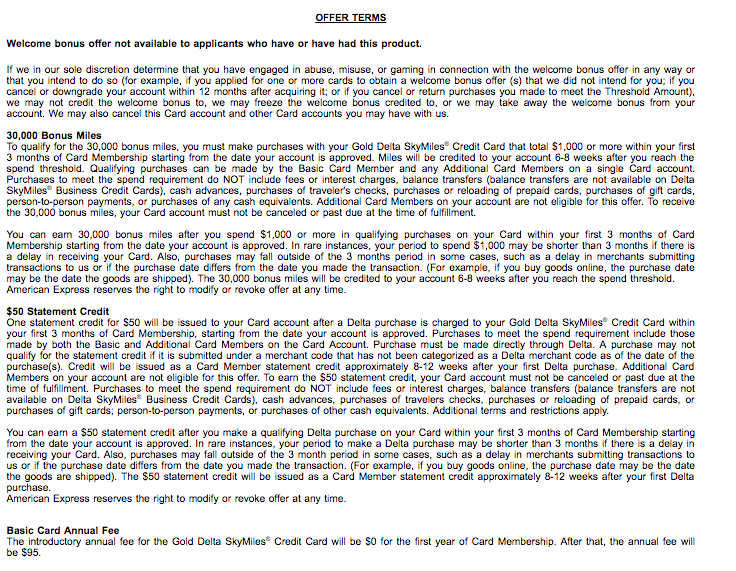

If you take a look at the terms and conditions of my offer you’ll see them start like this:

You can see in both versions of the card, in the space between, Terms and Conditions and number 1 on terms there is no explicit stipulation restricting past cardmembers from applying and receiving the bonus.

Juxtapose this with the 30k public offer where the stipulation is clear.

“welcome bonus offer not available to applicants who have or have had this product.”

Notice in both offers that they have a “gaming” clause

If we in our sole discretion determine that you have engaged in abuse, misuse, or gaming in connection with the welcome bonus offer in any way or that you intend to do so (for example, if you applied for one or more cards to obtain a welcome bonus offer (s) that we did not intend for you; if you cancel or downgrade your account within 12 months after acquiring it; or if you cancel or return purchases you made to meet the Threshold Amount), we may not credit the welcome bonus to, we may freeze the welcome bonus credited to, or we may take away the welcome bonus from your account. We may also cancel this Card account and other Card accounts you may have with us.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.