This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

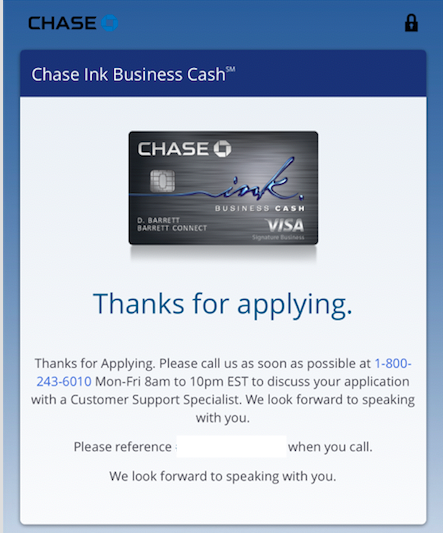

The Chase Ink Cash is offering 50k after $3k spend in 3 months and it carries no annual fee. It’s a no brainer if you’re under 5/24. Luckily, I am under 5/24, and applied as a Sole Proprietor. I didn’t foresee this being a problem at all since I already have a Chase Ink Business Preferred with this business and thought if there was any problem, it would be that I needed to move some credit around. However, I applied and got the following notification:

The Rep said he couldn’t verify that the business was real said he was sending me paperwork to fill out that would require one of the following three items and mail back or fax in:

- Proof of business address

- A bill of some sort or tax filing

- Verification of tax identification number

- Which a sole proprietorship doesn’t have…

- Name of your company

I asked the rep if something on the application was filled out improperly as I already had a card with that business so wasn’t sure why that wasn’t enough for verification. He said the application was fine, but he couldn’t verify, and applications were becoming more stringent. He intimated that a credit card bill wouldn’t suffice for proof… and that he could see it was a Sole Proprietorship and that wasn’t a problem at all.

It didn’t make any sense, but I figured it’d be a good learning lesson.

I waited until Monday and called the Reconsideration Line. 800-453-9719

I explained to the rep the situation and asked for some clarification and help assisting me in verifying the business. He asked me to hold. A few minutes later he came back and said that he worked around the verification block because I already had a card with that Sole Proprietorship. He then processed the application and I was approved.

If you end up in a similar circumstance, I would wait a few days and call back into Reconsideration. My instinct is that the verification was an error, and that the false flag was a processing mistake, rather than some new stringent policy against Sole Proprietorships. A lot of people applying as an SP don’t have bills in the business name, or any paperwork filed to officially register with the State.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.