This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

HELLS YES We’re Requesting a metal Citi Prestige card

The new benefits are out and METAL is one of them. I know, I know, everyone is giving a big fat yawn to the metal card. NOT MILES. Miles wants a metal card right now. Why? There is no metal in our wallet and we feel desperately inferior to all the other big bad point bloggers out there. Our wallet has nary a personal Platinum or a Reserve, or any other metal card that is currently out there. So what did we do?! We logged straight into our account and went about requesting a metal Citi Prestige card!!!

WE CAN NOT WAIT TO CLACKETY CLACKETY CLACKETY CLACK OUR METAL CARD ON THE TABLE

I think Tron, from the Chappelle Show, best describes our feeling right now. It’s like we won a hot hand of dice!

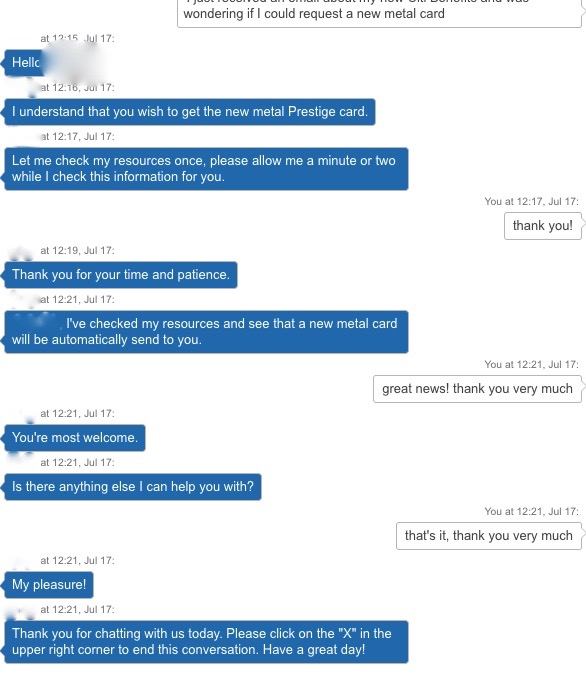

Here’s our convo with the Citi Rep

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.