This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

‘Plane’ and simple – the 60k Amex Platinum Delta will get me closer to Virgin Upper Class.

- Whether that be on Virgin Atlantic or Virgin Australia…I don’t really care.

- The 60k Amex Platinum Delta SkyMiles bonus is the highest ever. You can only get a sign up bonus once in your life, so get it while the getting is good.

- I would sign up for the 50k offer in a heartbeat, but I did both personal and biz gold last year. I’m still sitting on the miles.

I flew Virgin Upper class last year on an old 747 from San Francisco to London Heathrow. I LOOOOOOOVED it. It was the old product and the plane had certainly seen better days, but she treated me well. I can’t wait to fly the new product as it look incredible. But regardless of hard product, the soft product is sick: the vibe, the crew, the bar, and more than anything – it’s the simple cool factor. Just check out the Virgin Australia “The Business” business class.

Airlines specialize in their brand:

- Airlines that make you feel pampered

- Airlines that accommodate your need to work

- Airlines that make you feel ignored and neglected

- Airlines that treat you like cattle – sans the prod

Well Virgin specializes in the brand of Cool.

I’d use the Amex Platinum Delta for the 60k bonus and benefits and not for on-going spend and point accrual.

- 60,000 bonus after 2k spend

- $100 statement credit after a Delta purchase

- 10,000 MQM after 2k spend ( that leaves you 15k shy of Silver – pretty great if you’re traveling much Delta at all)

- free bag

- priority boarding

- If you renew the card you’d get a r/t economy companion certificate

It’s worth noting that the $195 annual fee is not waived the first year. But even if you value Delta miles at just a cent – you’re getting $600 worth of flights. If you’re redeeming for business class, you’ll be getting more like 5 to 10 cents a point – making this worth 3k to 6k worth of potential flying. There are many more benefits, but those are the ones that I’m most interested in – if you’d like to see the entire list, click here

Ok, enough with the card benefits – how does it get me on Virgin?

Delta is a member of the SkyTeam Alliance and partners with:

- Aeroflot

- Aerolineas Argentinas

- Aeromexico

- Air Europa

- Air France

- Alitalia

- China Air

- China Eastern

- China Southern

- Czech Air

- Delta Air

- Garuda Indonesia

- Kenya Air

- KLM Royal Dutch

- Korean Air

- Middle East Air

- Saudia

- TAROM

- Vietnam Air

- Xiamen

They are also partners with:

- Virgin Atlantic

- Virgin Australia

- GOL

- Alaska

- Hawaiian

- Great Lakes Airlines

- Westjet

In all honesty, there are several airlines on that list that’d I’d be stoked to fly: Air France has a dope new biz class as does China Eastern and China Air. But, I loved my Virgin experience and specifically would love to give Virgin Australia to go down unda.

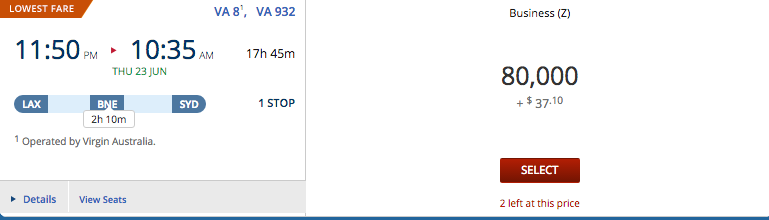

Delta doesn’t publish an award chart anymore. But, as we can see above, it’ll cost 80k for a one-way flight from LAX to SYD in Virgin Australia “The Business.” The great thing about using Delta to fly on Virgin – and I comment on it in my Virgin Atlantic review to San Francisco, is they don’t assess the taxes/fees on London bound flights. However, if you were to fly the same flight but use Virgin Atlantic Flying Club points – you’d fork over several hundred in fees.

Delta is also a transfer partner of American Express Membership Rewards

Since we are basically looking at this card for benefits and the bonus, it’s worth pointing out that American Express is a transfer partner. This means if your balance is a little short, you can shore it up with a transfer. In fact, American Express allows you to have 4 credit cards with them at one time. MMS has reported, anecdotally, they are allowing up to 5 now, but that hasn’t been proven to be a consistent case study. Since this card is a credit card and the American Express Platinum Mercedes Benz is a charge card, if you applied for both, only the Delta card would go against you 4 card maximum.

I’ve been an American Airlines loyalist for the last few years…and that’s coming to an end – at least on face value. My hometown is in Indiana and I fly back and forth quite a bit. For loyalty reasons, I had been avoiding Delta to fly on American, but now with American gutting its program and Delta offering the same route, often times with sub $600 First class, I’ll fly Delta for sure. Anyways, this card gives you some great redemption options, and with the bonus only available once in your lifetime – it’s worth seizing when at all time highs.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.