This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Offers mentioned below may no longer be available

Delta and Amex have “4” co-branded cards

Gold, Platinum, Reserve, and the newly released Blue are offering some intriguing bonuses. It’s very important to sign up for these cards when they are offering all-time or near all-time high bonuses because of their sign up limitations. Remember, American Express limits sign up bonuses to once per lifetime so if you’ve had any of these cards before, you’ll be excluded from earning a repeat bonus. ( Some people have had success is more than 7 years have lapsed, but YMMV). Personally, I’ve carried personal and business gold versions ( at 50k offers, so this is better) so I’m ineligible. However, the Platinum 70k offer is quite enticing.

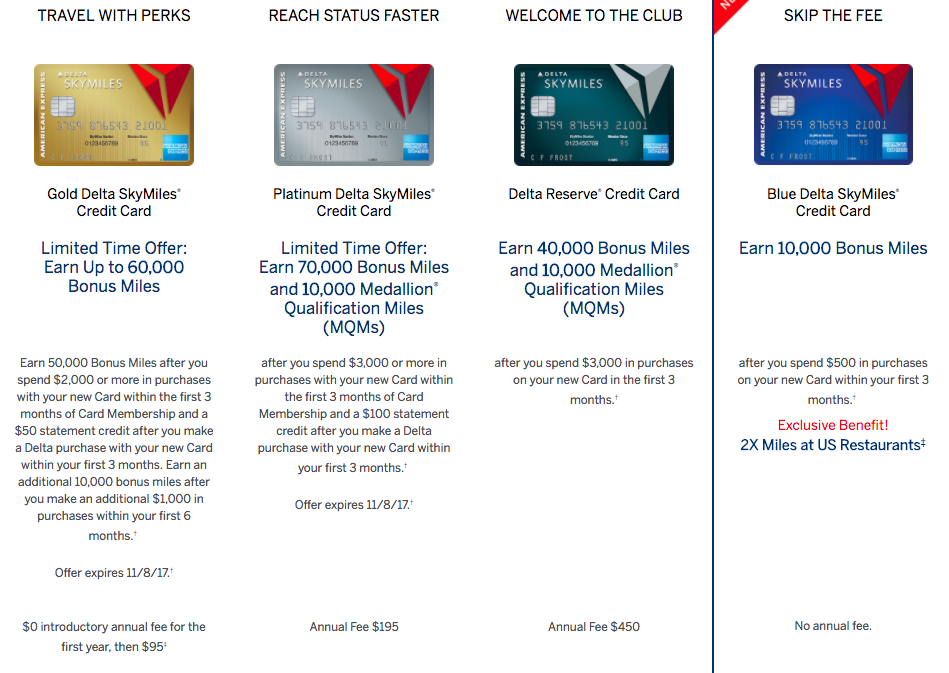

The Personal Versions

The bonus/min spend requirements

- Gold: 50k/$2k + 10k after another $1k in 6 months +$50 statement credit on Delta purchase

- Platinum: 70k/$3k + 10kMQM + $100 Statement credit after Delta purchase

- Reserve: 40k/$3k + 10kMQM

- Blue: 10k/$500

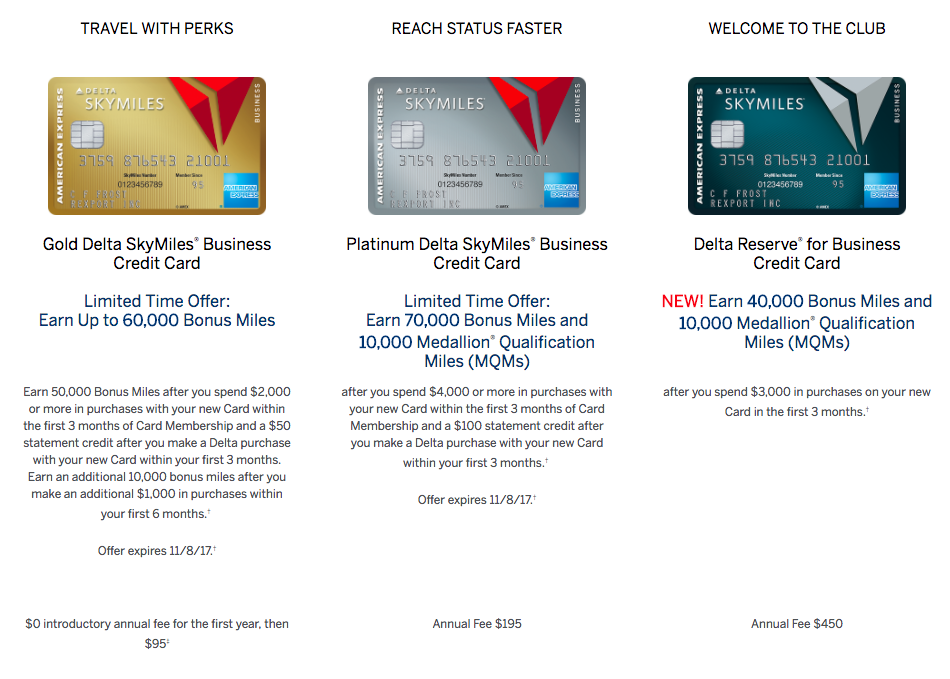

And the Business Versions:

Bonus and Min Spend

- Gold: 50k/$2k + 10k after $1k in 6 months + $50 statement credit after Delta purchase

- Platinum: 70k/$4k +10k MQM + $100 statement credit after Delta purchase

- Reserve: 40k/$3k + 10k MQM

A couple of thoughts on why I may go after the Platinum business version

Delta doesn’t publish an award chart. This allows Delta to confuse people on pricing and also devalue without notice, which they do. It’s happened a few times now, and it will most certainly happen again. Cardmembers get a wavier on meeting the spend requirement for status. Yesterday they announced that the MQM waiver for Diamond status was upped to $250k from $25k spend. For other tiers it was kept the same. Unreal. This waiver doesn’t apply to me as I haven’t and probably won’t vie for Delta status, but it continues to forecast the direction the program is headed.

70k Delta points is, I believe, the highest the Platinum version has ever offered. So it’s a good time to strike, and the business versions of the card don’t hurt your 5/24 status. Who knows what those 70k miles will be worth next year, so I’m thinking I might as well snatch up the offer before further devaluations occur and burn them on a lie-flat flight somewhere cool.

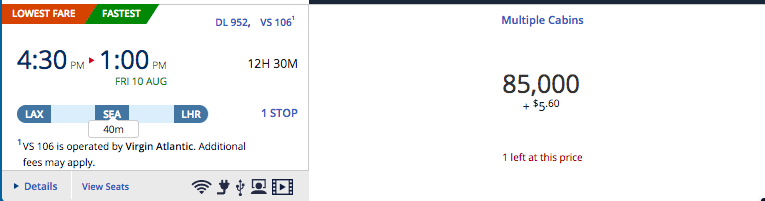

70k would fly me on Delta metal to Europe and 85k would put me on Virgin Upper. Crazy…2 years ago it was just 62.5 to fly Upper using Delta miles.

*Delta is a transfer partner of Amex so you can always shore up your account if need be…

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.