This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Heads up! This deal ends today.

Yep, this fantastic transfer bonus ends today. I’m debating shifting over 10k or 15k Amex just to have a few more Avios in the account should I want to fly to see my family last minute (LAX – IND is just 10k Avios), or if I’d need a few extra to do a nice upgrade on BA. It’s been quite a few months for the ole Avios program which, in July, went from a 4:5 Amex transfer ratio, to parity, to a great 7:5 limited time bonus ratio: that’s a whopping 75% increase in the amount of Avios you could score transferring from Amex. Tomorrow, the ratio goes back to 1:1, so if you have any upcoming trips and may need some Avios…this is your time.

Personally I think that some of the best redemption options for Avios are positioning flights.

Unfamiliar with positioning flights? Read our Monkey Miles Monday Memo written specifically on the subject. You can also watch our tutorial on how to use Avios to fly on partners…

Avios are also a great use intra-Asia where you can fly Cathay Pacific business class on many routes for just 15k Avios.

Another great use of Avios is upgrading a flight – I’ll show you first class ( in the feature picture) but the concept is the same from cabin to cabin.

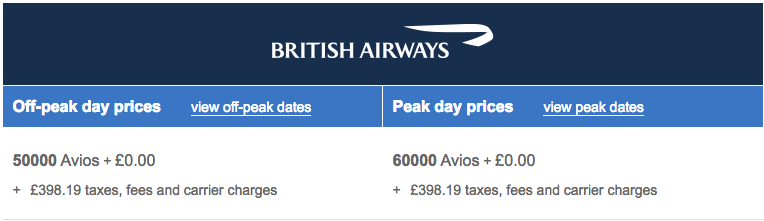

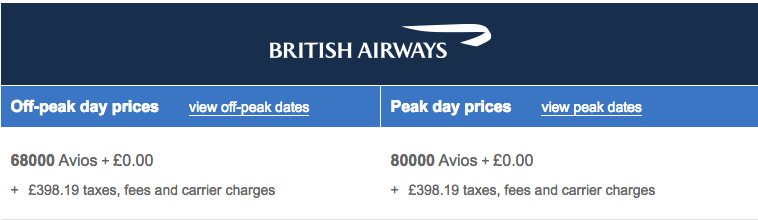

BA releases a considerable amount of award space, and they often release quite a bit of first class space from the east coast to London. What’s the cost to utilize an upgrade? Just the difference in Avios between your cabin of service, and the cabin you’re upgrading to. Let’s take a look at a Business Class to First Class upgrade from JFK to London.

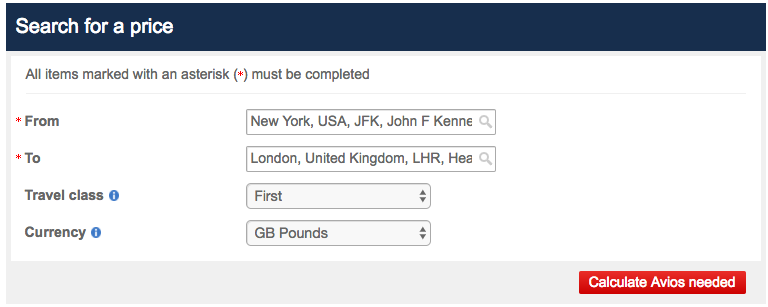

The easiest way to calculate this is by using the Avios Calculator. ( it doesn’t work if you have the USA selected as your home country, so change it to UK. or click this link)

You can search to see how much a Business Class ticket would cost you, and then how much a First Class ticket would cost you. The difference is what you’d pay

In peak times it’s only 20k Avios to upgrade to First Class. Because of the 40% Amex transfer bonus that number drops to just 15k Membership Rewards. Amazing deal.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.