This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

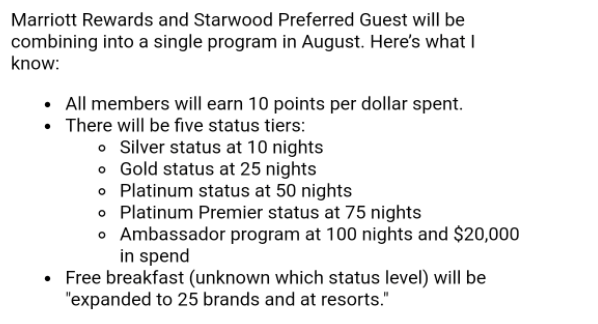

There is a post on flyertalk that has been getting a lot of attention over the past day. The OP has posted a screenshot of a “leaked” 5 tier structure that starts at 10 nights for Silver, and ultimately ends with a top tier Ambassador level at 100 nights and $20k spend. There is also a rumor circulating that SPG airline transfer will cease April 16th. No idea if any of this is true, but the info is out there…

Here’s a look at the speculative chart

Gold is 50 nights right now, but also is quite easy to attain via Amex Plat. Currently, it’s hands down the best mid tier status you can hold due to guaranteed lounge access. At 25 nights…I can’t imagine that is going to stay. If this structure is introduced I’m guessing lounge access moves to Platinum ( hopefully not Platinum Premier, which is also rumored).

Marriott’s current tier structure

SPG’s current tier structure

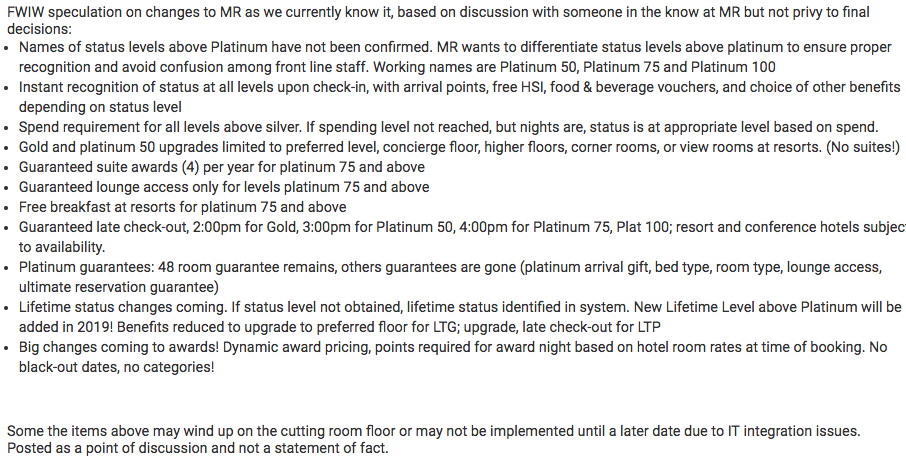

If you want to get super speculative, another post speculated the following changes were being considered at Marriott.

The poster stipulates that many of these proposed changes won’t come to fruition, but my goodness, they are draconion. Read through them…they’ll make you shiver.

Thoughts…

If the first chart is introduced…it doesn’t seem fair that stripped down benefits would go into effect until early 2020 as those who are currently earning status are doing so based upon the benefits they think they’d get upon reaching that goal, i.e. if I hit SPG Platinum then I get guaranteed lounge access and upgrades to suites if available at check in. If you qualify now…that status is good until March of 2020.

I don’t think Marriott Gold can continue in it’s current form purely because of Amex Plat – if you travel much at all, the dollar amount of the club upgrades will negate your annual fee. So something will change there, and judging by this chart, it’ll be a deval of Gold with Platinum taking its place.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.