This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

When will my Amex welcome offer show up?

After recently getting another new American Express Business Gold, I now have 10 Amex cards. Let’s just say I’ve had my fair share of minimum spend requirements. In the past, whether it be a welcome offer, referral bonus, or Amex Offer, the bonus points populated within a day of hitting the spend required.

Hurry up! I’m ready to fly in luxury with my points!

Specific to welcome offers, I have received the bonus points prior to the statement closing when I’ve eclipsed the min spend threshold. As an example, if you were to get one of our favorite cards, an Amex Gold (which requires $4k in 3 months minimum spend) in September, and in the middle of October you hit the $4k, you shouldn’t be surprised to see your welcome offer show up in your account before the October statement closes. Then, at the end of the October billing period, the points earned from your October expenses would populate as well.

It keeps on happening.

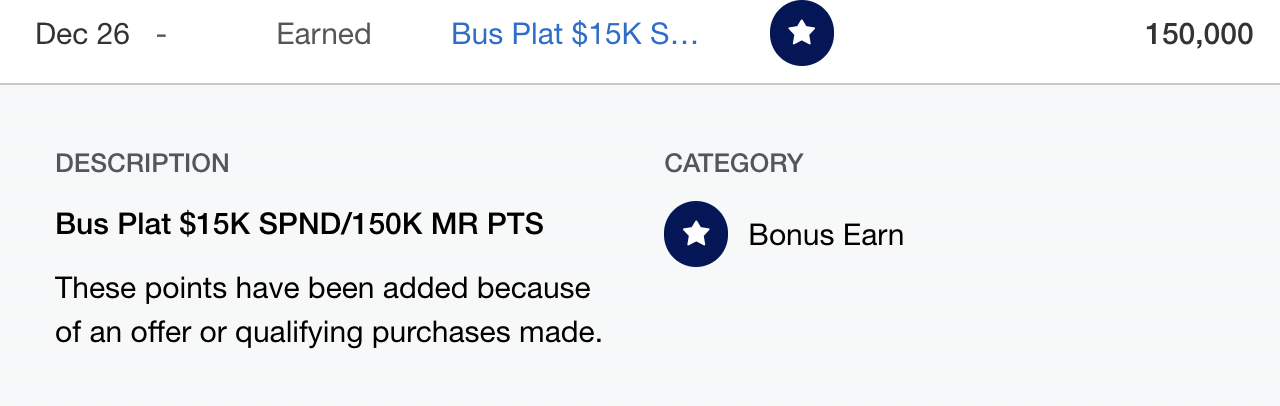

Prior to actually hitting the minimum spend requirement yet for Amex Business Platinum in December I received the welcome bonus.

This is the 3rd time it’s happened and I fully anticipate my newest Amex to repeat that process. I just got it in February and I’ll likely hit the min spend sometime in March or early April, but I’d guess it will credit my account based on the pace of my spend.

Based on prior experience, I’m guessing I’ll be credited when I’m within 10% of hitting the spend requirement as long as the trajectory and pace continues.

Recap

Usually you’ll receive your welcome offer when you cross the threshold of spend, but don’t be surprised if you get the credit in advance if you’re on pace to hit it before the 90 days expire.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.