This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

How long does it take to Transfer Ultimate Rewards to Singapore Air?

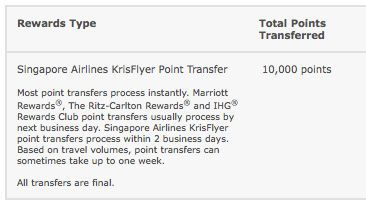

I’m transferring points into Singapore Air to fly EVA business class from Taipei to Ho Chi Minh City. I’m actually splitting the transfer up between Ultimate Rewards, Citi Thank You, and American Express Membership Rewards and thought it’d be interesting to see how long it takes for the points to be transferred. First up…Ultimate Rewards. ICYMI I wrote about how Singapore Air Intra Asia was a relative sweet spot for business class and I’m going to try it out this winter. So how long does it take to transfer ultimate rewards to Singapore Air?

The request is in at 2:30pm on Oct 31st

4 hours

By 6:30 pm the Ultimate Rewards had transferred into my Krisflyer account.

Now it’ll be interesting to see just how long it takes for Amex and Citi

I can tell you one thing…I am unbelievably stoked to see Vietnam and also to check out EVA business class – even if it’s not the full experience, I’m still stoked.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.