This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Add 15k points to your Marriott Free Night Certificates

Marriott now allows you to add 15k points to your free night certificates. While this is a great new perk, IHG allows you to do the same thing to their 40k free night certificates without any cap ( meaning you could use a 40k cert and throw 60k on top of it to stay at the Six Senses Maldives like I did for my honeymoon ).

Marriott currently has 3 Free Night Certificates it regularly offers

- 35k found on the Boundless and Bonvoy Business

- 40k Annual Choice when you hit 75 elite nights

- 50k issued on the Amex Bonvoy Brilliant

- This is also issued as a promotional welcome offer periodically ( we did this 2 years ago on the Boundless for 5, 50k nights )

- 85k issued typically as promotional welcome offers on cards

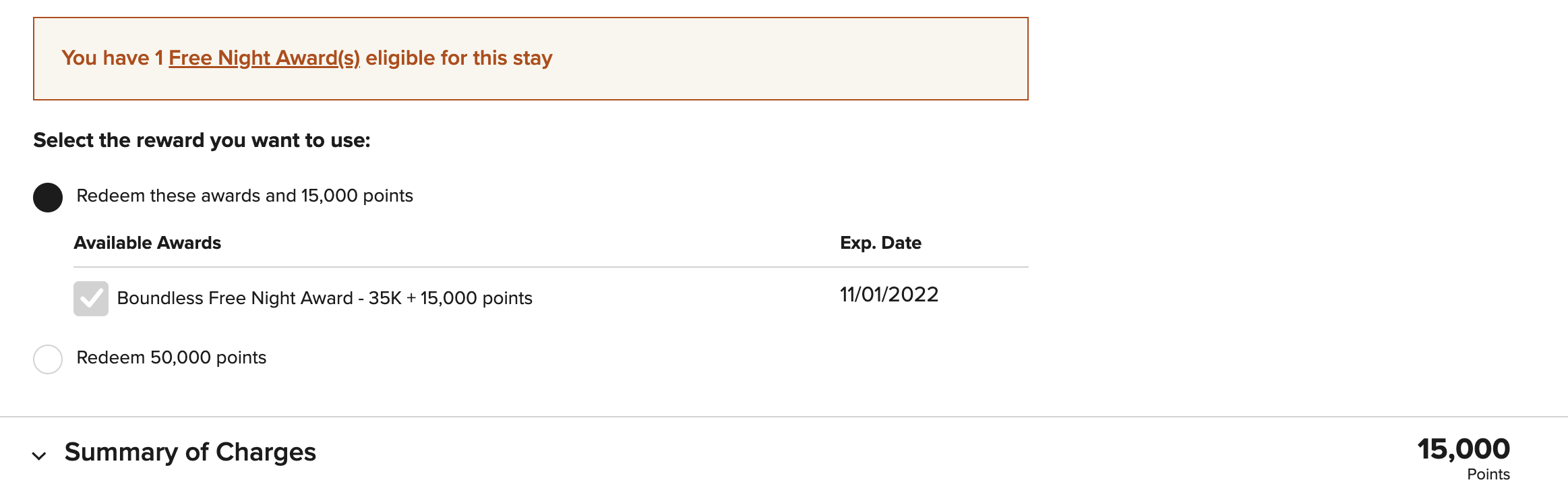

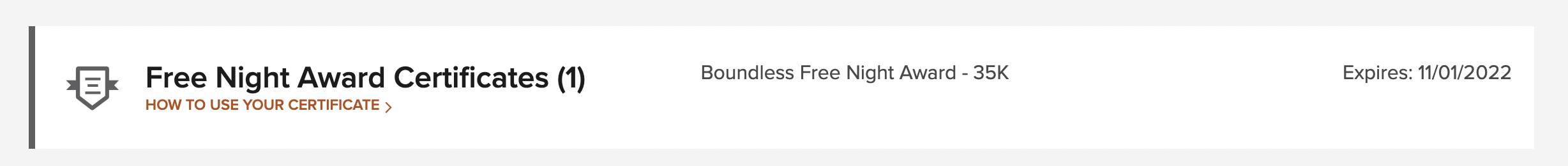

They will populate your account and look like this:

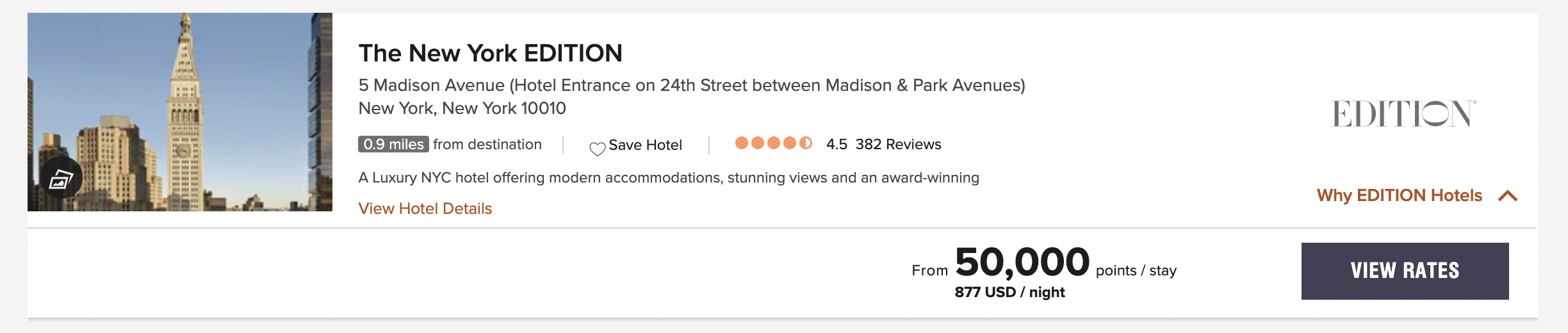

I recently stayed at the New York Edition for 50k points

Unfortunately, when I stayed we couldn’t use our free night certificate since it was static at 35k and you couldn’t add points to it. With that said, it’s a gorgeous property and I’d definitely stay again with the new top up feature.

Now when I go to book I’m given the following option after hitting View Rates and selecting a room.

This certainly makes the free night certificates more valuable after the recent dynamic award pricing model Marriott implemented which saw a ton of properties skyrocket in cost.

Overall

Marriott made their points a lot less valuable when they went fully dynamic and stripped their award chart completely. Unfortunately this is the direction we’re seeing all programs take, but this improves the value of the free night certificates. I’d like to see them follow in the footsteps of IHG and make the amount you can add unlimited, but it’s at least something. With Dynamic pricing you’ll often times see properties price just above the 35k, 50k, or 85k levels meaning the cert is unusable without the ability to top-up.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.