This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

I applied for the 50k in mid August. The 60k debuted. I got verbal confirmation of a match…

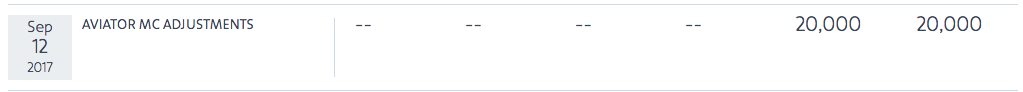

I was still waiting to see if there would be some sort of hiccup when the miles actually got credited. Would they credit as a 60k bonus, or would the 50k credit, then an adjustment of 10k? Well, after getting verbal confirmation on August 30th, that I would be matched and a report had been filed requesting the extra 10k bonus, I received bonus miles in my account.

The miles credited as an adjustment…not for 10k, but 20k…

Here’s the interesting aspect of this. I received two duplicate letters from Barclay that acknowledged the approval for the increased 60k bonus. Both said an additional 10k would be adjusted. It could be that I was doubly approved. Or it could be that the total bonus will equal 60k and because there was a match involved the accounting is a little wonky. Either way, the adjustment has been made, but the sign up bonus hasn’t been credited yet. I suspect it’s because I hadn’t paid my annual fee on September 12th, but had made the first purchase.

If you signed up for the 50k offer and matched to the 60k you should keep an eye out for an Aviator MC Adjustment.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.