This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

How quickly do Rakuten points transfer to

American Express?

In 2019, Rakuten and Amex teamed up and gave members the option: earn cashback or Amex Membership Rewards on your purchases. I’ve prioritized Rakuten over every other cashback portal since that occurred. Why? I value Amex points at over 2 cents a pop – meaning if Saks is offering 10% cashback or 10x Amex points I’m going to take the Amex points since I peg them between 1.5 and 2 cents per point = 15 to 20% back. If you’re unfamiliar, you can Learn more about the Rakuten and Amex relationship by reading this article. After you’ve earned those Amex points…how quickly will you see them populate your account? Let’s take a look!

You can earn a bonus by using our Rakuten link.

Note…Rakuten just finished a $30 promo so keep an eye out for higher offers.

When does Rakuten transfer points to your Amex account?

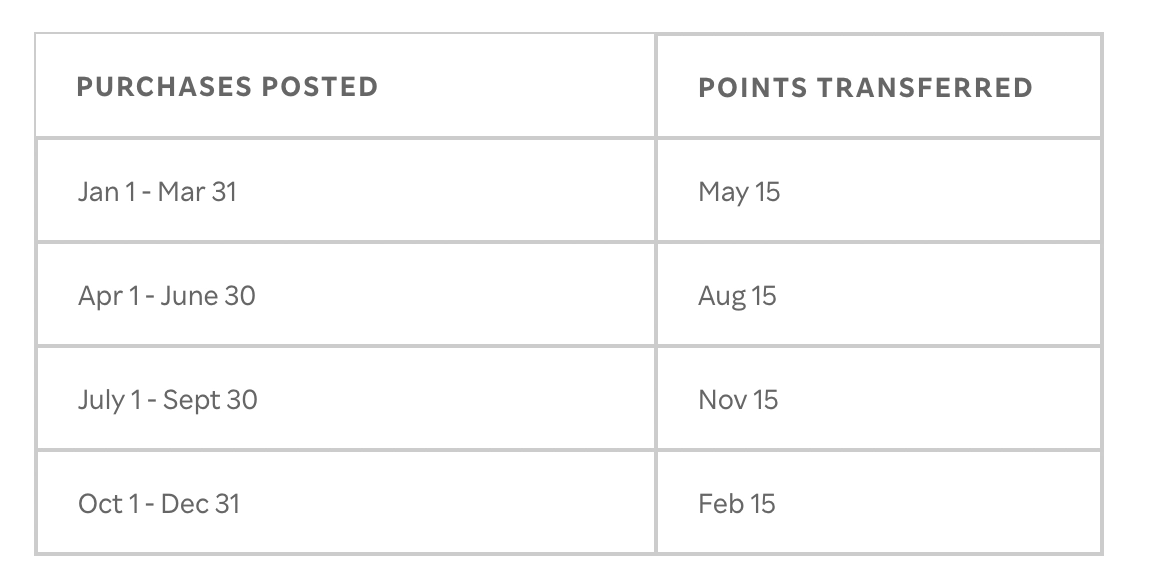

Long and short of it….you accumulate points over a 3 month period, and then 6 weeks after the close of that period, on the 15th of month, you’ll be credited.

In the past, I’ve had it credit to my account on the same day, but in 2023 and 2024 they have been hitting anywhere from 2 to 4 days after they leave my Rakuten account.

2023:

1st Quarter

2nd Quarter

2nd Quarter

Why I choose Amex Membership Rewards over Rakuten Cashback.

Personally, I value Amex points at nearly 2 cents, which means whatever the published cashback rate is, I’m earning double that number purely by choosing Membership Rewards.

- Rakuten offers 10% cashback which means I earn 10x American Express points

- $100 purchase would earn 1000 Membership rewards which I value at roughly $20, or an effect 20% off.

Not everyone is going to agree with my valuation, but in the past, I’ve used my points to transfer to partners and redeem at values far higher than 2 cents. Worst case, I can redeem at 1.55c on premium travel because of my Amex Business Platinum.

One example…transferring Amex to Aeroplan and redeeming 100k points for Lufthansa First Class

Recap

Rakuten points populate the same day as they’re scheduled to transfer. For our future travel purposes, earning Amex points is extremely advantageous, but certainly weigh the pros and cons, and make a decision that best suits your needs. Cashbackmonitor is a great resource to use if you’re purely interested in getting the highest cashback rate.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.