This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

IHG has been revamping several different aspects of their program, some positive, some negative. In the past, one of the easiest and quickest ways to accumulate IHG points was via their Accelerate promotion. The long and short of the promotion that you earn bonus points for each targeted requirement you fulfill, earning more for the cumulative number of requirement.

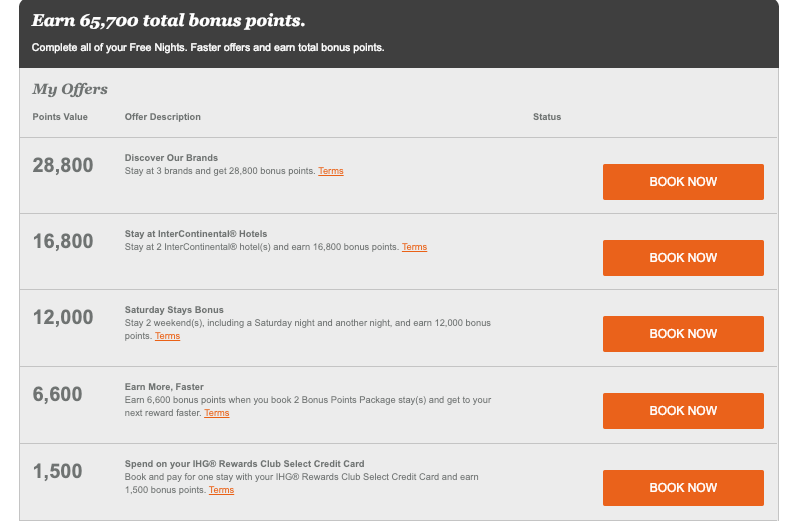

In all honesty, my hopes for this first quarter’s promo were quite low. BUT…happy days – I was proved wrong. I was targeted for a whopping 65,700 total bonus points and if I stack the way I stay, I could tick off all but 12,000 bonus points in 4 stays. Let’s take a look at my offer

Getting 53,700 bonus points in 4 nights.

The first 28,800 bonus occurs when I stay at 3 different brands, so that alone requires 3 of the nights. However, if you drop down to the second requirement, stay at 2 Intercontinental hotels, that adds on the 4th night requirement. I’d avoid the 2 weekend stays, and on one of the 4 nights ( 2 at Intercontinental, 2 at other brands ) I book two bonus packages and pay with my IHG Rewards Club Select Card ( currently unavailable and replaced with the IHG Premier )

It would look like this then

- Stay 1: Intercontinental Pay with IHG Rewards Select ( Pick up 1,500 )

- Stay 2: Intercontinental ( pick up 16,800 )

- Stay 3: Holiday Inn ( Bonus Package )

- Stay 4: Crowne Plaza ( Bonus Package ) Pick up 28,800 for 3 different brands, 6,600 for 2 bonus package stays

- Total: 53,700 bonus points

What could I do with 53,700 Points

At some point this year I want to get the IHG Premier card ( read that article, but the benefits are killer and one is a 4th night free). I just visited Budapest and the Intercontinental is in a fantastic location and runs 30k points per night. Since I’m Ambassador and renewed with an offer to receive 10% back on Intercontinental Stays, and my legacy IHG Rewards Select card gives 10% back as well, I could stay two nights at the Intercontinental Budapest for just 54k points. Unreal value and it’d be wonderful to visit Budapest again in the summertime, rent bikes, and enjoy the city in a different way.

There are plenty of other uses as well, this is just the first to pop into my head as I just stayed in Budapest and the hotel is in a wonderful location, and with just a lobby visit, quite nice as well. The Danube view rooms must have stunning views.

You can check out your offer and register here:

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.