This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

I’m a buyer at this level.

Currently I use a Ink Business Preferred for Monkey Miles expenses, and concurrently hold an Ink Business Cash for another Business that I own. The great thing is Chase will allow me to get another Ink Cash for my other business. Additionally, as long as I’m under 5/24, and haven’t received a Chase Ink Cash bonus in the last 24 months, I should earn the bonus for this card. It’s worth noting that if you currently hold the card and wish to get a second, you’ll need to do so with either a different EIN, or if you have one with an EIN, use your social as a sole proprietor. Here’s the details on the new public offer for the Chase Ink Cash.

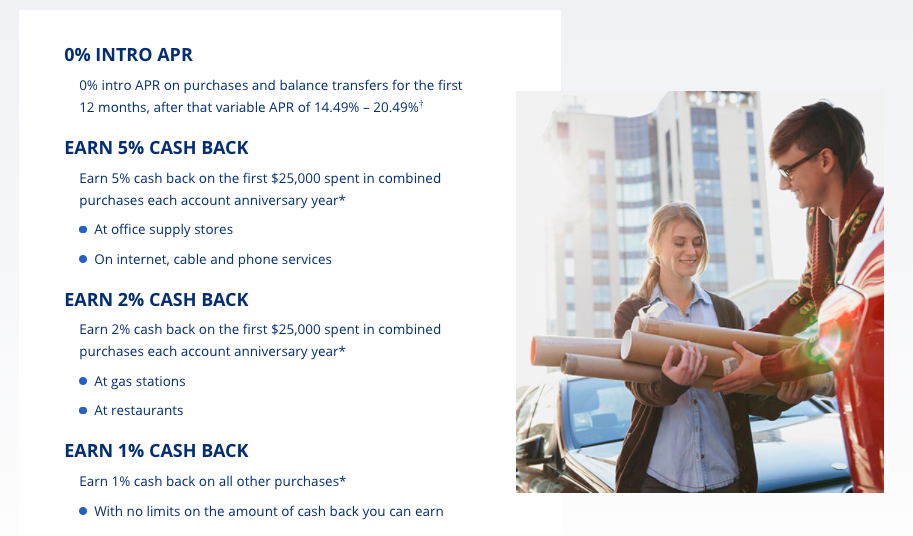

Benefits:

- 5x points up to $25k a year at

- Office supply stores

- Internet, Cable, Phone

- 2x points at

- restaurants

- gas

If you already hold an Ink Business Preferred its worth mentioning that even though you’d only earn 3x points on the bill, it does include free cell phone insurance which I’m willing to sacrifice the 2 extra points per month to get free of charge.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.