This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Tis the season to be jolly and take advantage of absolutely mega deals hitting shopping portals and online retailers across the board. As I’m sure you’re well aware of… American Express Platinum cardholders get a $50 Saks Fifth Avenue statement credit every 6 months. I haven’t used mine yet, and typically wait until after Christmas, but this deal was just too good to pass up. Let’s walk through how I’m going to earn 20x points, use my Amex Platinum statement credit, and have more credit for post Christmas shopping.

American Express Platinum ( Learn more ) $100 annual credit

Every year you get $100 annually if you hold an Amex Platinum. This is a phenomenal time to make use of that credit.

Rakuten 16x deal at Saks – new members also get a $40 after spending $40

Rakuten has increased its earn rate to a whopping 16% back or 16x points. Remember you can opt in to earning Amex points en lieu of cashback. That’s my personal choice

If you don’t have a Saks Account you’ll get another 10% off your purchase – this is linked to your email address

As I mentioned, if you use my referral you’ll receive a $40 or 4k Amex points after spending $40

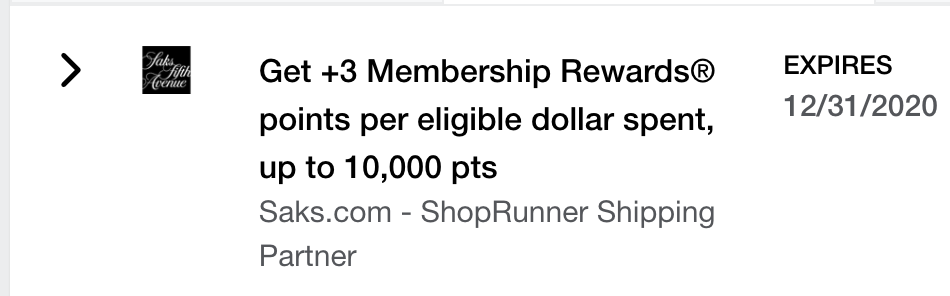

Amex Offers 3x points at Saks

My Amex Platinum was targeted for an additional 3x points, totaling 4x on purchases up to $10k until 12/31/2020

Saks $75 gift card after $150 purchase

Overall

You could conceivably buy $200 worth of stuff and get the following

- 10% off $200, or $20 on your purchase price as a new member

- 20x points on the $180 purchase ( you wouldn’t earn on the 10% off ) or 3600 amex points

- $50 statement credit with Amex Platinum

- $75 gift card on your $180 purchase

- If you’re a new Rakuten member get $40 or 4k points.

That means for $130 out of pocket ( or $90 with Rakuten new member bonus ), you’d end up with $275 worth of Saks products and 7600 Amex Points which I’d say are worth over $150 which means you netted out way more than you spent.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.