This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Stack Prestige with Hilton’s Hawaii Promo for Buy 3 Get 2 free

Hilton is currently running a promotion that offers a 5th night free when booking one of their participating Hawaiian properties under the “Another Day in Paradise” rate. If you’re in the market to take a trip this could be a great time to make use of a great stacking opportunity. Stack Prestige with the Hilton Hawaii Promo for Buy 3 get 2 free, and you’d be saving a ton of money.

Citi Prestige’s 4th night free

The thing to remember here is that it gives you the chronological 4th night free. Whatever the cost of that 4th night, it’s gives you a statement credit in that amount. Hilton removes 20% of the pro-rated amount for the entire bill. Citi will then show you a credit in the amount of that 4th night. By the terms laid out at the end of the post, it dictates that it’s not specifically the 5th night, but rather 20% the entire bill, it still gives you 2 nights free, but a pro-rated.

Stack Prestige with Hilton’s Hawaii Promo for Buy 3 Get 2 free

When you call into Citi to make the reservation just instruct the rep to find the “Another Day in Paradise” rate that will book you a buy 4 and get a 5th free rate. At check out you will pay the bill as though you were paying for 5 nights with a discount, and a few weeks later your Citi statement will show a credit for the 4th night. Essentially, you’ll end up buying 3 nights and getting 2 for free.

Can you book more than 5 nights?

You can book up to 8 nights with the Hilton Promotion, but only the 5th night is free. However, Citi Prestige does not give you mutliple “4th night free” refunds. So if you booked 8 nights, you wouldn’t get 3 nights free, you’d get the 4th and 5th night free and pay for the rest. If you changed properties after 5 nights, the clock resets, and you’d then again buy 3 and get 2 free. Kind of silly that Citi promotes changing properties, but it is what it is. I would suggest checking out a couple of different properties if you’re wanting to take a longer trip and enjoy the stacking opportunities this deal presents.

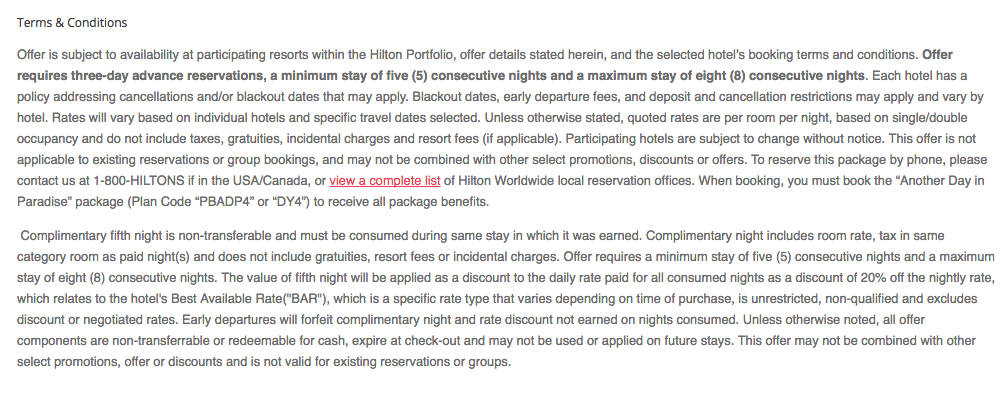

Official Terms

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.