This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Targeted AA Elite Status Offer – Less EQM + EQD

This is a targeted offer and a great way to jump status without having to earn all the normal levels of EQM+EQD. I challenged for AA Platinum status back in 2015 and it paid off big time during 2016. Once you register you have until May 26th to fulfill the requirements for each status. It’s worth noting that you won’t have the status while you are “challenging.” If you currently hold no status with AA, typically fly a competitor, or are scheduled to fly on partners of AA this could be a great way to earn status for the entire year and make qualifying for next year much more comfortable. Check to see if you’re Targeted for this AA Elite Status Offer – Less EQM + EQD.

Here’s the offer and You can check here if you are targeted:

In all honesty, I think the two levels of status to fast track would be Platinum or Executive Platinum. Golds get shoved around too much by higher ranking status levels for upgrades, etc and if you can make Platinum( one world sapphire) you gain access to Business Class lounges when flying internationally, even in coach. Additionally you should be able to status match to other mid-tier competitors like Alaska if you don’t re-qualify for 2018-2019.

Exec Plat is being offered for roughly 1/3 of all the requirements. If you’re scheduled to take a few business trips in premium cabins you could pick up 35k EQM and $4k EQD without much problem. Those SWUs will have you riding in Lie-Flat in no time

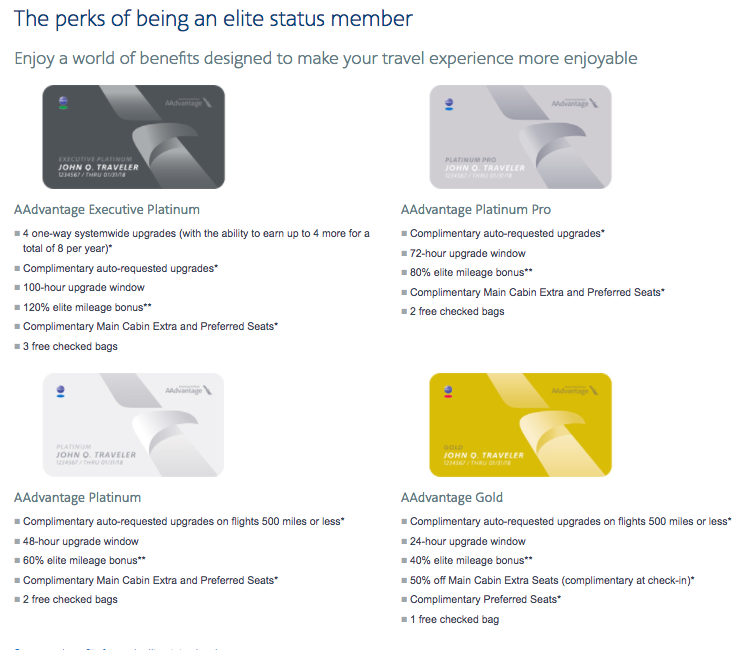

Here’s how American compares the different levels of status:

A Base member earns 5x the fare

- Gold 7x

- Platinum 8x

- Platinum Pro 9x

- Executive Plat 11x

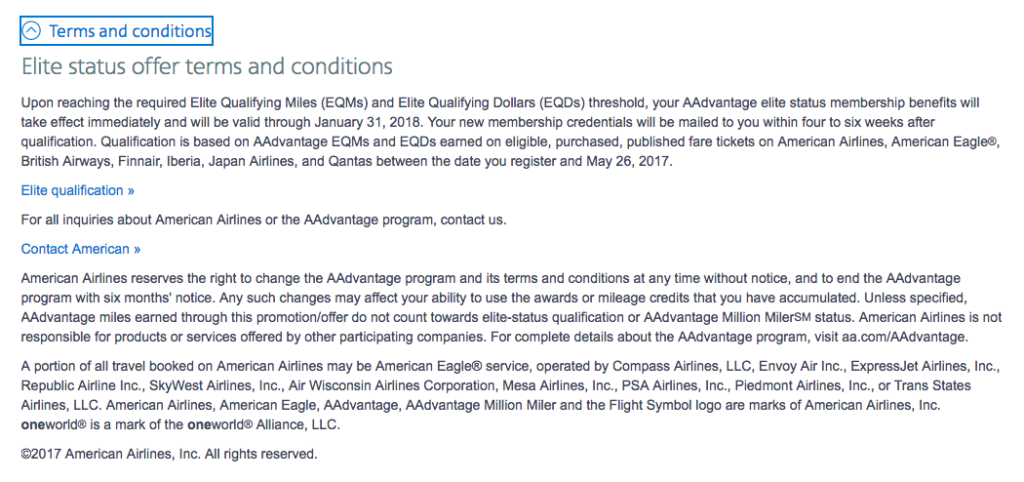

Terms and Conditions:

- Only flights on AA, American Eagle, British Airways, Finnair, Iberia, Japan Airlines, and Qantas qualify

- Must Register and complete requirement by May 26, 2017

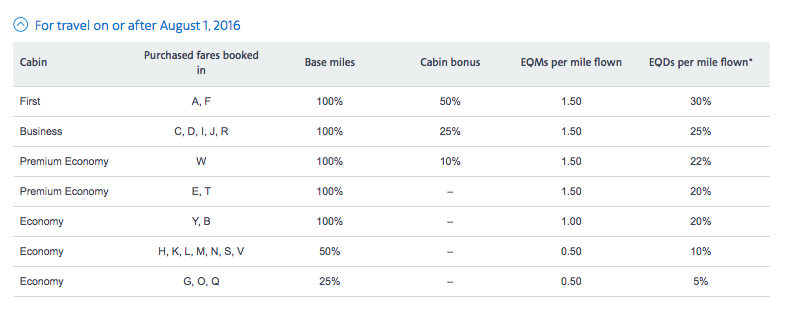

Remember that partner flights that aren’t on AA ticket stock earn EQD based off mileage. You can check that number here.

Here’s British Airways for reference:

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.