This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

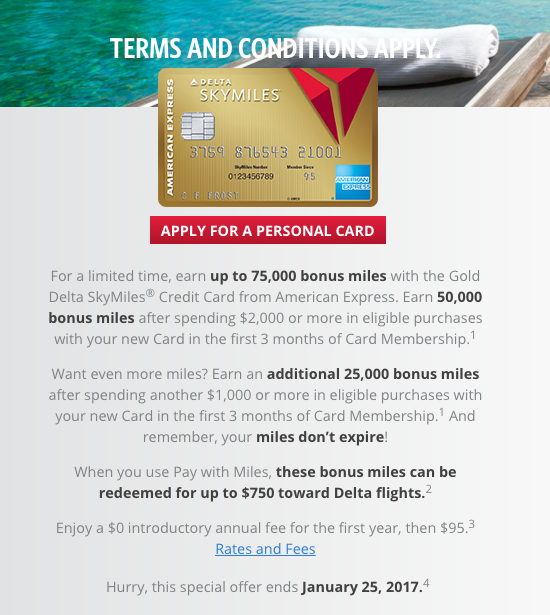

Monster 75k Amex Delta Gold offer after $3k spend

We just went finished a period where Amex presented some of the best public offers we’ve ever seen for the Amex Delta Gold and Amex Delta Platinum. Those were 50k and 70k, respectively. Now, snail mail has delivered a MONSTER 75k Amex Delta Gold offer after just $3k spend. It’s also a tiered offer with two rounds of bonus. The First 50k is award after just $2k spend and the second is an additional 25k after another $1k all within the first 90 days. Keep an eye out in your email and snail mail to see if you’ve been targeted. I’ve also included a link below where you can check.

Basics:

- 50k after $2k spend in 90 days

- 25k more after an additional $1k spend in first 90 days

- annual fee waived for first year

- First bag free for up to 4 people ( capped at $200) on same reservation

- Priority Boarding

- Application must be received by 01/25/2017

You can go here to see if you are targeted

This isn’t available if you’ve ever had or have this product – ugh the once in a lifetime clause.

I’ve had both a Amex Delta Gold and an Amex Delta Gold Business card so I’m not technically allowed to get the sign up bonus. BUMMER. It’s also worth noting that the Amex business cards do not show up on your personal credit report. The PULL will show up, but the new account, and therefore the addition to your 5/24, will not. Worth keeping in mind if you’re targeted for this as it’s a SUPER EASY way to rack up some Delta SkyMiles.

The once in a lifetime clause is something that I personally think should be changed. If you’re interested to know more of my thoughts on that…check out my Why Chase’s 5/24 rule is a huge opportunity for Amex and Amex should respond to Chase with Vigor posts

If you wanna read the terms and conditions…

I’m using Delta SkyMiles to travel on China Air Business Class on my EPIC trip to Southeast Asia

Don’t forget that if you’re short on Delta Miles for a specific trip you can do I as did and Shore up the account with Amex Membership Rewards. I transferred from my Amex account into Delta to Fly on Virgin Atlantic in Upper Class for 62,500 + $5.60.

It’s worth noting that the new price will be 70k if you’re departing after January 1st, 2017

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.