This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

United released a joint statement today from Oscar Munoz and Scott Kirby essentially saying that, due to Covid, they were thankful for the congressional bail-out, but the reality is they’re going to fire a ton of people come October and need more money. Over the last decade, United used 96% of its free cash flow, or $12.5B, to purchase shares back instead of creating a warchest to weather a recession. In the statement below, United basically points to a 90% reduction in operations, and only 30% of their costs being associated with payroll. What does that mean in laments terms…in order for us to get some free cash we have to pay you until we don’t, then we’ll go back to the government and ask for more money because otherwise we won’t be able to continue operations.

Personally, I think this is flat out ridiculous. Last week I watched an interview with Chamath Palihapitiya who eviscerated airline governance and recommended a financial enema to profligate airlines. It was a capitalism 101 power course, and I loved every second – I still see the look on Scott Wapner’s face in my dreams. Sure, I’m a travel blogger, and I want every airline employee to keep a job, but my goodness, just listen to Chamath break down structured bankruptcy and the power it would potentially give back to employees and resurrect more soundly structured airlines. And if the government was going to bail anything out…how about letting airlines fail and then step in an bail out the employee pensions, etc?

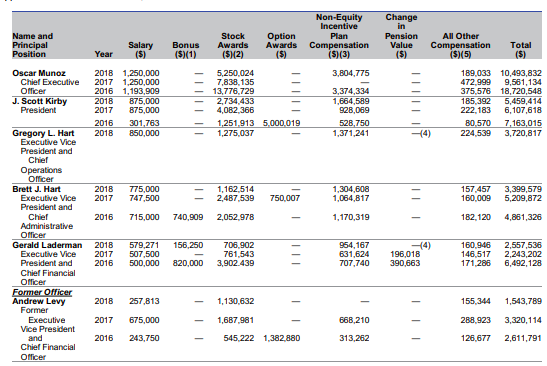

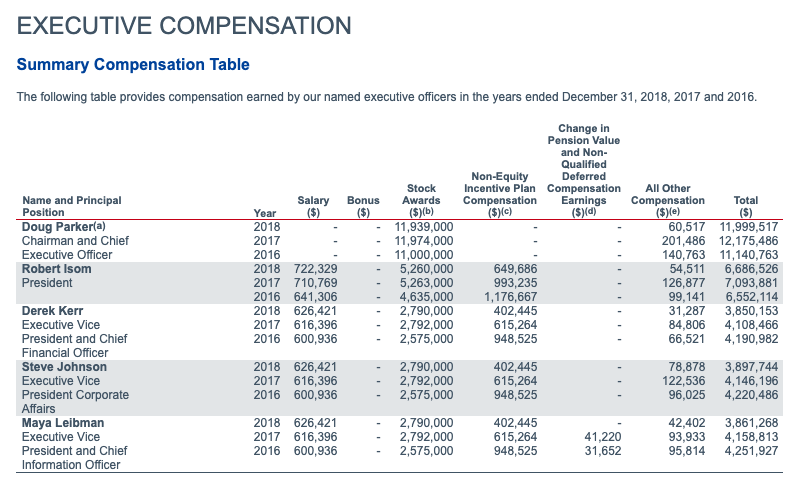

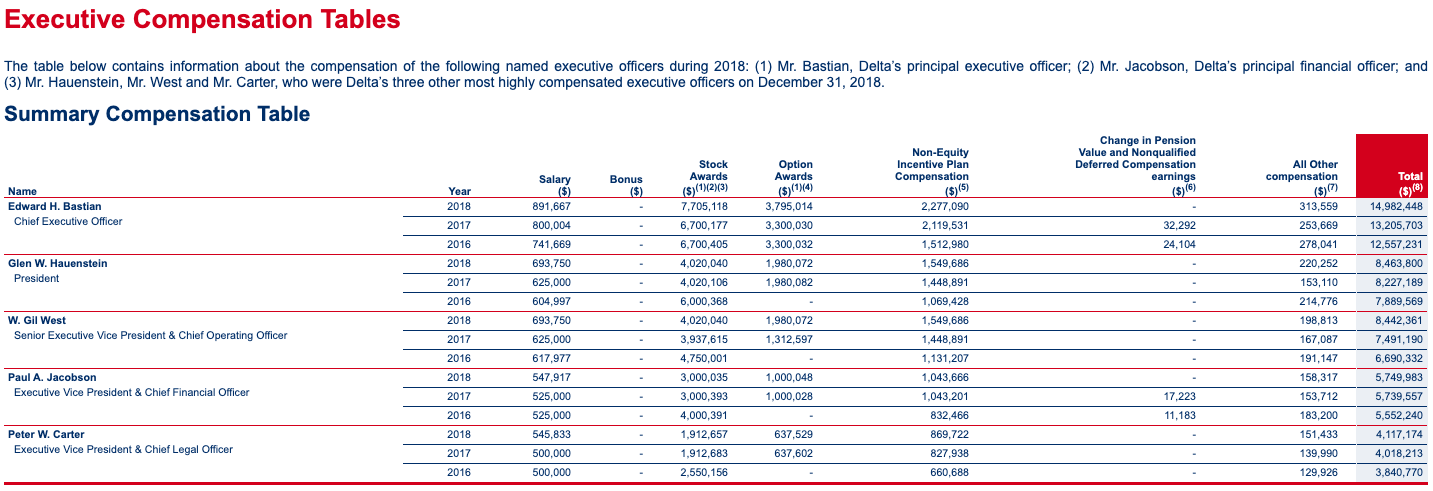

Let’s be honest…customer experience has been gutted as have loyalty programs while C-suite execs have gotten filthy rich off buybacks. Yeah…they’ve announced token base salary reductions ( a few hundred grand ), but let’s look at the DEF-14A statements to see full compensation. Oscar Munoz has earned on average over $12M a year, Doug Parker $12M a year, Ed Bastian $13M a year.

Government ownership via Warrant

United, along with AA, Southwest, JetBlue, Alaska, and Delta are all potentially participating in a Warren Buffet style warrant deal that could ultimately result in the US government owning a part of the airlines. Remember the days when US Airlines bemoaned Gulf carriers taking slots at hub airports? Here’s some food for thought…if the US Government doesn’t universally own the same amount of warrants in each company, couldn’t one argue that an airline with higher ownership is going to get favorable deals either on future bailouts, or when gates/routes open up for competition and need approval that those currying the most favor will win?

What else could we do? ummm Capitalism?

Let them fail. Right back to the video – structured bankruptcy giving more ownership to employees, even protect pension plans with a federal bailout, get more loans on valuable routes, and penalize the so called savviest of investors who were equity holders…primarily amorphous funds who have gotten an insane safety net anyways. Or…companies could issue more equity, bonds, but certainly not embolden the current teams that buoyed stock prices to make it through lean times.

What we have currently done is feed the beast. Nominal executive salary reductions is for press only…give me a break. Equity and options will be issued at these reduced rates in probably greater volume that we have seen before, meaning the very people who lead these companies into precarious situations will walk away even richer than before.

Come October…aren’t we going to have to do this all over again. Does anyone actually think air travel is going to be anywhere near the level it was in January? Sure, we’ve delayed furloughs, kept more people on salary, but the can has just been kicked down the road.

It’s a sad day for the airline employees, and for an industry that I love. Bad behavior, failure to plan, and ego has been rewarded.

Here’s the whole presser:

To our United Family:

We hope all is well with you and your family. Two weeks ago, we hosted a virtual townhall and it was a valuable opportunity for us to connect with you all. And we’ve been really pleased with the response, more than 50,000 of you tuned in live or watched the broadcast on demand.

At the townhall, we discussed the impact of your calls and letters to Congress as they debated financial support for the airline industry. Washington heard you loud and clear, passing vital legislation that will provide commercial airlines with a total of $50 billion worth of grants and loans. We are grateful for the bipartisan cooperation displayed by leaders in the Congress and Administration — and appreciative of the critical role that you played. The thousands of letters and messages you sent, capturing the spirit of our United family and what our service means to our customers and communities, made all the difference in the world. We will need that spirit more than ever as we set our sights on the rest of 2020 and beyond.

The challenge that lies ahead for United is bigger than any we have faced in our proud 94-year history. We are committed to being as direct and as transparent as possible with you about the decisions that lay ahead and what impact they will have on our business and on you, the men and women of United Airlines.

Let’s start with the near-term. We now expect United to receive approximately $5 billion from the federal government through the Payroll Support Program under the CARES Act – to be used to protect the paychecks of our United employees. This government support does not cover our total payroll expense, but we’re keeping our promise that there will be no involuntary furloughs or pay rate cuts for U.S. employees before September 30. And, payroll only represents about 30 percent of our total costs. Fixed operating and non-payroll costs like airport rent, supplies and infrastructure are significant and not going away. That’s why we’ve been so aggressive in reducing our schedule, slashing capital expenditures, scaling back our work with vendors and consultants and cutting executive salaries in half.

We’re planning to go even further to reduce costs. This weekend, we’ll load a revamped schedule that will further reduce our capacity to about 10 percent of what had been planned for May at the beginning of this year. We expect to announce similar reductions to the June schedule in the next few weeks. We have now essentially redesigned our network to be down 90 percent while complying with the CARES Act and maintaining connectivity among nearly all our domestic destinations. And these May and June schedule reductions will have direct consequences for our frontline employees in terms of total hours worked. Those work groups can expect to hear more details from their leaders soon.

The more flexibility we have from a payroll perspective, the better. So, all work groups can expect to see a continued emphasis on payroll cost cutting options over the next few weeks including new voluntary leave offerings and voluntary separation programs. For those who are eligible, please consider signing up for voluntary COLA and ANP days. We’re grateful to the more than 20,000 employees who have already signed up. Your sacrifice is both deeply appreciated and important to our company’s future.

These schedule changes reflect the stark reality of our situation – and unfortunately, it’s something that even legislation as large as the CARES Act can’t fix. Travel demand is essentially zero and shows no sign of improving in the near-term. To help you understand how few people are flying in this environment, less than 200,000 people flew with us during the first two weeks of April this year, compared to more than 6 million during the same time in 2019, a 97 percent drop. And we expect to fly fewer people during the entire month of May than we did on a single day in May 2019.

The historically severe economic impact of this crisis means even when travel demand starts to inch back, it likely will not bounce back quickly. We believe that the health concerns about COVID-19 are likely to linger which means even when social distancing measures are relaxed, and businesses and schools start to reopen, life won’t necessarily return to normal. For example, not all states and cities are expected to re-open at the same time. Some international travel restrictions will remain in place. Meeting planners and tour operators will do their best to accommodate people looking to avoid large crowds. So, while we have not yet finalized changes to our schedule for July and August, we expect demand to remain suppressed for the remainder of 2020 and likely into next year.

So, let us end where we began, the government funding we expect to receive soon is helpful in the near-term because we can protect our employees in the U.S. from involuntary furloughs and pay rate cuts through the end of September. But the challenging economic outlook means we have some tough decisions ahead as we plan for our airline, and our overall workforce, to be smaller than it is today, starting as early as October 1.

Throughout this crisis, we have been candid and upfront with you. And today is no different. We appreciate the partnership and open dialogue we have with all of you as we confront this extraordinary situation that has had an unprecedented impact on our families and our company. We promise to continue to stay in close touch – and will continue to be as transparent as possible – in the weeks and months ahead.

Stay safe. Stay healthy. And please continue to take good care of our customers and each other. It’s because of you that we remain proud to be United Together.

Oscar and Scott

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.