This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Use Bank Direct to earn over 5000 AA miles /month

I often peruse the earn miles page on AA.com. It’s an easy way to check out where AA has partnered for easy bonus point accrual. They often have multiple point per dollar accrual rates for charities, money market accounts, etc. I recently was perusing the business products/financial services subpage and saw that the Bank Direct has some really attractive deals as well.

It’s through this subpage that I found the following deals:

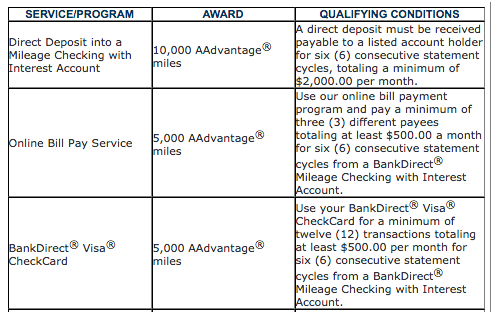

If you expand the offer details a little further you’ll be redirected to the BankDirect website where it details the terms further:

-

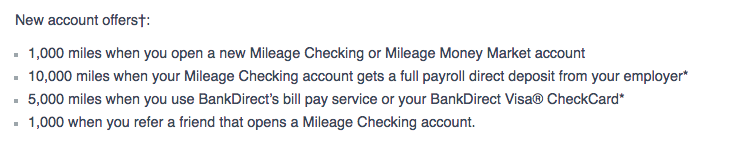

New Account offers:

- Direct deposit requires 2k/mo for 6 straight months

- 10k Miles

- Bill Pay requires online bill payment to 3 different payees totaling $500/mo for 6 consecutive months from a BankDirect mileage checking account

- 5k Miles

- Visa Checkcard requires 12 transactions >$500 per month for 6 straight statements cycles

- 5k Miles

- Direct deposit requires 2k/mo for 6 straight months

The first on the list seems to be a pretty easy and straight forward direct deposit set up situation. If you can make the 2k per month direct deposit then this would be an easy way to accrue 10k miles and you wouldn’t even have to think about it. The 2nd and 3rd option seem far more laborious and wouldn’t be something I would do cause of the time commitment.

-

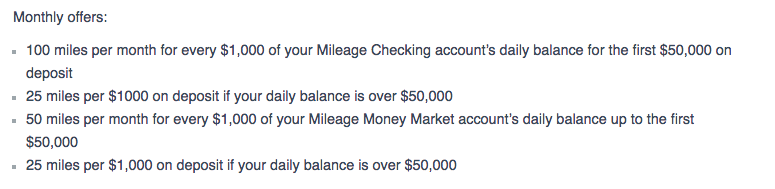

Checking and Money Market deposit deals: 5000AA/month

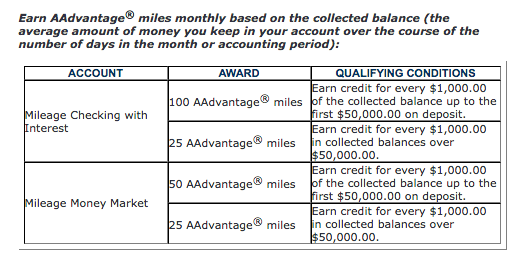

- Mileage Checking with Interest: 100AA per $1000 balance up to $50k balance, 25AA per $1000 over $50k balance

- Mileage Money Market: 50 AA per $1000 balance up to $50k, 25AA per $1000 balance over $50k.

This seems to be a very attractive way to move a checking account balance over to Bank Direct. It’s especially attractive if you have the means to fund this account in addition to your normal checking account.

*update* it’s worth noting and a couple of commenters mentioned this…but there is a $12 a month fee per month. I forgot to add this when I first wrote published…

Hypothetical:

You’re married, in your mid 40s, and make $100k a year or roughly $8000/mo. You have 150k in your checking account, 150K in your Money Market, and you’re a Chase Private Client. You don’t want to lose your Private Client status by dropping below 250k in total assets.

You could transfer 50k into a Bank Direct Mileage Checking with Interest account and set up direct deposit for 6 months.

- You would earn 10k AA new account bonus for the initial deposit and 6 months of direct deposit.

- At 50k balance you would earn 100AA/$1000 or 5000AA/$50000 per month

- Let’s say your $8k per month salary drops to $4k after taxes so you’d earn another 25AA/$1000 or 100AA/month on the balance over $50k.

- Month 1: 100AA

- Month2: 200AA

- Total: 2100 after 6 months

- At the end of 6 months you’d have earned:

- 10kAA sign up bonus

- 32,100 AA Mileage Checking bonus

- Transfer any funds over 50k back to Chase = $4k*6 or 24k

- Leave 50k in account and accrue at 5kAA/month or 60k/year

- One year total points= 10k AA + 2100AA + 60kAA = 72,100AA.

Obviously this hypothetical works in the situation where someone has the means to fund this account separately. But this setup works for anyone and is the most advantageous if you can set up a direct deposit for 2k a month for 6 months and move some assets into their mileage checking account. But even if you just move money into the account you will earn 0.10AA per dollar you move over. The setup is the most lucrative for assets under 50k, but still have a decent return on investment for those assets over 50k.

This is how you use BankDirect to earn over 5000k AA miles/month.

You would also be earning 60kAA/year in perpetuity or until they stop the deal. That’s a pretty great rate of return. That’s more than enough to fly business class to Europe or South America on the 777-300ER. I’ve reviewed it three times and have loved it every time.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.