This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Very tempted by the Club Carlson Business Visa 85k offer

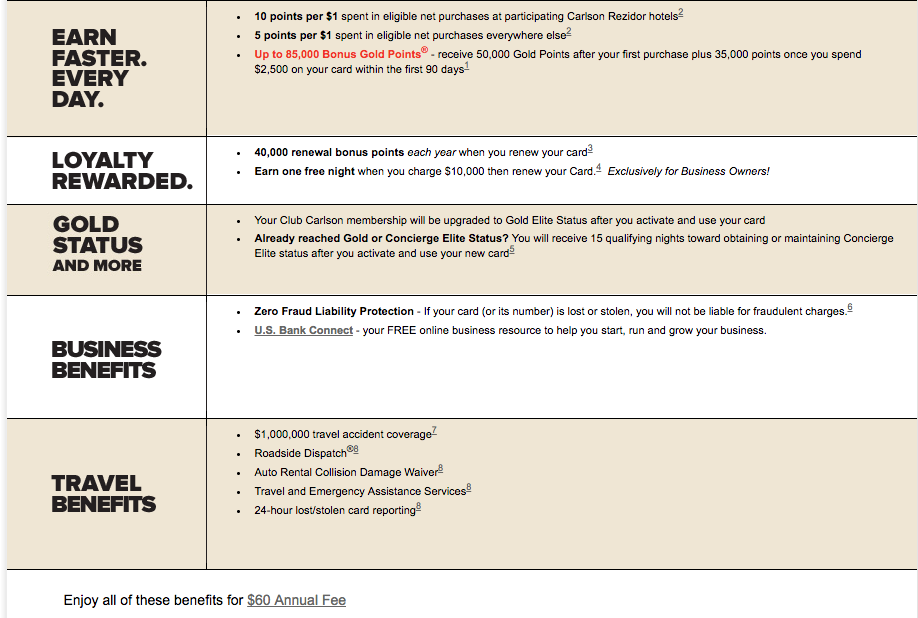

This isn’t a new offer, but I’m always looking to maximize my everyday spend, and new card signups are an outstanding way to do this. I recently posted that I matched to Club Carlson, now the match wasn’t really THAT great as it only gave me their mid-tier status, Gold. This is the same status that is offered by the Club Carlson Premier and the Club Carlson Business Visa. Both of these cards are currently offering an 85k bonus after $2500 spend in 90 days. The offer is tiered, with 50k being earned after first purchase, the rest after you hit $2500 spend after 90 days. I’ve only spent one night at a Radisson Blu, but with more potential stays coming up I’m really peeping the Club Carlson Business Visa the most.

The Club Carlson Business Visa doesn’t affect your 5/24

5/24 is always on my radar. I love Chase cards and want to be able to take advantage of a great offer when it comes around. Yes…I’m still sore that I couldn’t get the 100k Chase Reserve offer. There are also rumors that Chase could introduce a business version of this card, and I’d like to be well positioned to get it.

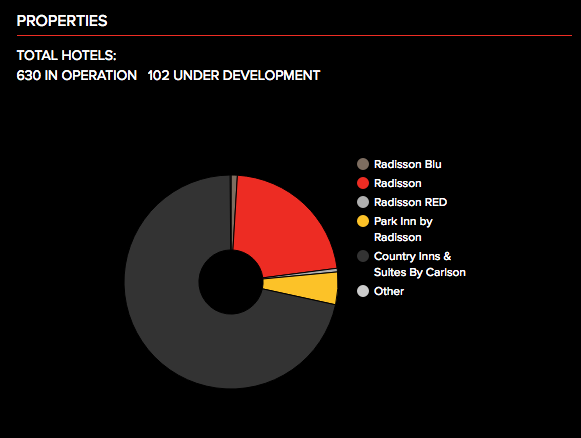

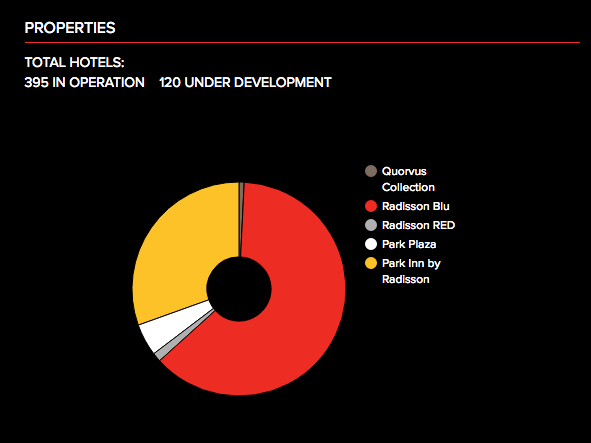

Club Carlson is the rewards program for the Carlson Rezidor hotel group.

Their biggest footprint in the States is the Radisson brand. If you look at Europe, you’ll see a lot more of their top tier, Radisson Blu, chain. These are the hotels I’m most interested in checking out.

I’ve considered getting the Club Carlson Premier card from US Bank, but have never pulled the trigger. Now, with Chase’s 5/24 restrictions…I lean more heavily towards the Business Version now. Why?

- An easy 50k bonus after first purchase

- bonus 35k after $2500 spend

- 40k EVERY YEAR you keep the card

- Free Gold Status

- Low $60 annual fee

The 40k bonus points every year you keep the card is worth $160 in travel. Club Carlson rarely sells points, but when they do it’s at 4/10 of one cent.

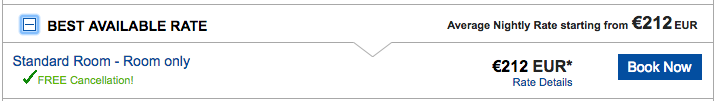

I’d like to check out the Radisson Blu Strand…looks epic.

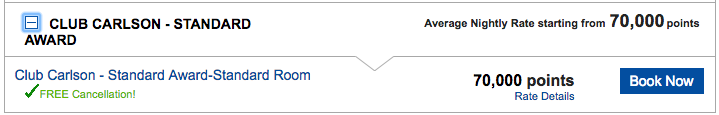

Rates are close to $350 a night…or 70k points.

I’m also considering doing New Years in Helsinki…The Radisson Blu Plaza looks pretty nice!

50k points gets me a room at $250/night spot…

Still on the fence…but I don’t really see a reason not to do it.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.