This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

How do Amex Black Card members make?

You have to admit it…when you see one you have the thought. What kind of money are you pulling in? Well…we have an answer.

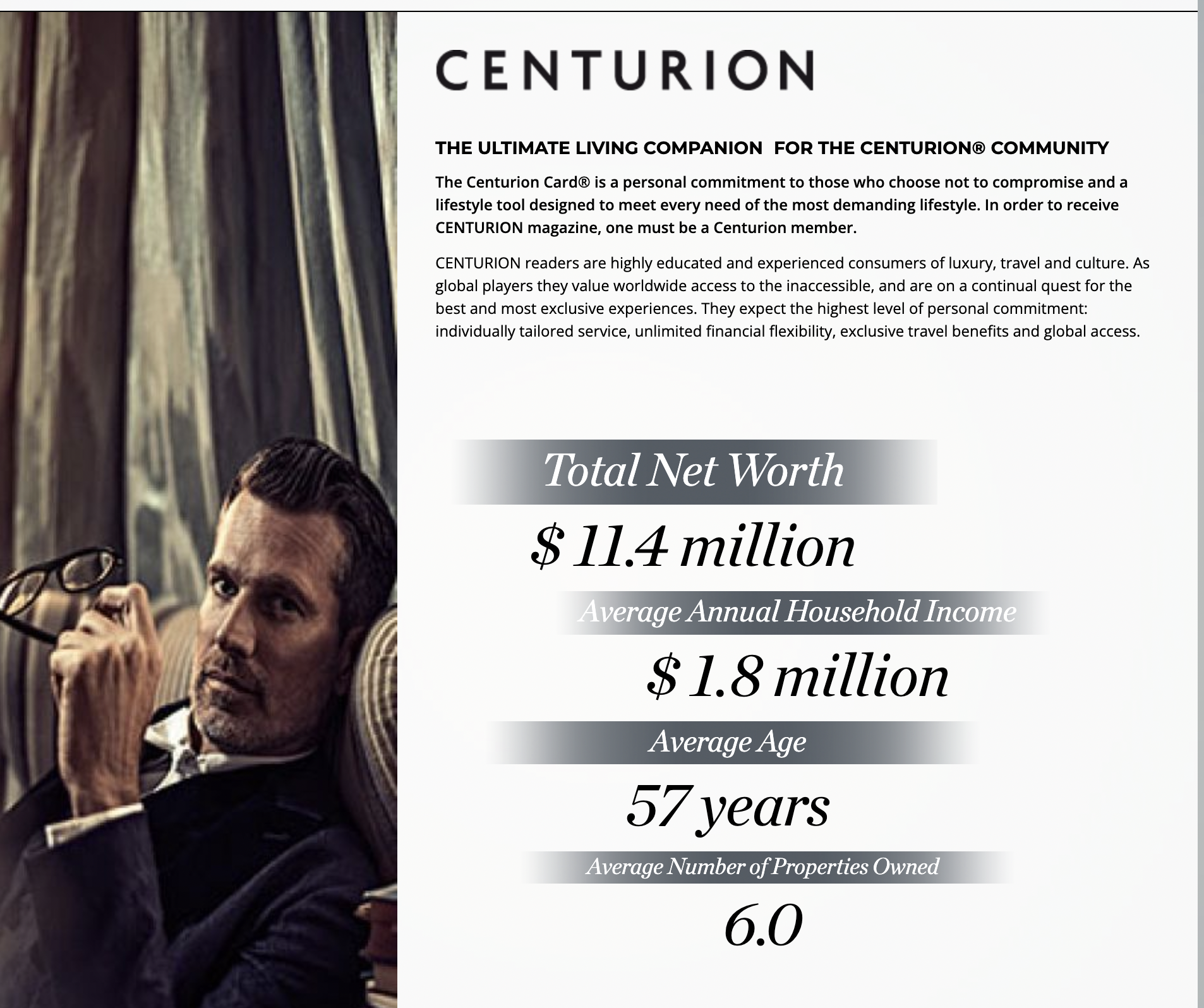

Centurion is the magazine sent to Amex Centurion cardholders, someone correct me if I’m wrong, but I believe both it and Departures are digital now. They ended their publishing agreement with Meredith in 2021 and pivoted to a digital first distribution strategy. They still have a media kit and with so much lore around how much spend is required to get a Black Card ( estimates of $250k to $500k in a year on an Amex card ). You can actually request one now…it used to be invitation only. I thought it was very interesting to see what the average reader of Centurion magazine looks like to marketers.

Presumably, since this magazine is only sent to Amex Centurion cardholders, its what a look at what the average Centurion cardholder looks like as well. The income was about where I thought it would be, but I thought the net worth would have been higher. Don’t forget this card requires an initiation fee of $10k and $5k a year in annual fee. Media Kit Link

- Amex Centurion average household income

- $1.8m

- Amex Centurion average household networth

- $11.4 million

- Amex Centurion average age

- 57

- Amex Centurion average properties owned

- 6.0

A few things to know about Black Cards – American Express Centurion Cards

-

Personal Centurion: 20% points back when used for premium flights or selected airline

- 1.25c per point

-

Business Centurion: 50% points back premium flights or selected airline

- 2c per point

-

IHG Platinum Elite

-

Hilton Honors Diamond

-

Marriott Bonvoy Gold

- Earn 1.5X Membership Rewards points per dollar on purchases over $5,000

- (Up to 1 million additional points per calendar year)

- Delta SkyMiles Platinum Medallion status,

- Hertz Platinum

- Avis President’s Club

Why a Black Card could actually make financial sense to you…

You’d need to be able to out-redeem the Amex Business Platinum + your initiation and annual fee, which is $15000 less the business platinum which is $695 next year. Let’s use $695…so you’d need $14305 in added value. In the first year that would be roughly 3.2 Million in spend at 1x. After that it would be significantly less – roughly 957k. Those would be breakeven and the residual bennies from Hilton Diamond, Delta Plat, etc would outweigh the fees. That really isn’t that much for business spend…

- 3.2 Million Amex points

- $64k in value with Biz Black

- $49,600 with Biz Plat

- 957k Amex Points

- $19,140

- $14,835

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.