This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Earlier today, Richard Kerr – he does a great job over at TPG – broke the news that Hyatt was planning to devalue their incredible Points + Cash. According to a trusted source – the new program will take the current Points + Cash rates and alter the “cash ” portion from a fixed amount to fluctuate based on room rate – it’ll equal 50% of the standard published rate.

Seriously? Less than 2 weeks notice, in the midst of re-qualification? If this was taking effect next year sometime – so be it. The cash + points aspect of WOH is incredible and highly favors the consumer over operators. But, Hyatt has had a tough time compelling top tier members to stay, and has faced a lot pushback from loyalists in the transition from Gold Passport to WOH. And they gut mid-year? Last year they had to run a promo whereby any Hyatt credit card holder could get top tier with just 20 nights in the final quarter of 2017.

This seems like another card dealt from that deck.

Kerr also revealed that “specialty suites” would be folded into the upgrade program, allowing members to redeem 9k points per night to book them. Currently, if space is available, members can redeem 6k points per night for standard suites ( globalists also receive 4 suite upgrade certificates – good up to 7 nights ). This could be something of interest for families – booking a Governor suites able to accommodate a family of 4 at the cash rate plus 9k points could serve useful and offset the points + cash deval.

Let’s take a look at a few examples of what the new World of Hyatt Points + Cash could look like…

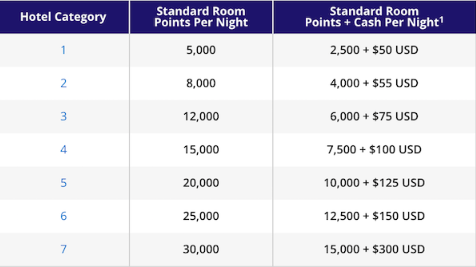

Here’s the current chart:

The new chart would keep the points aspect the same ( 50% of the standard cost in points ) but change the cash portion to equal 50% of the Standard Rate.

Let’s take a look at 3 random hotels over the holidays:

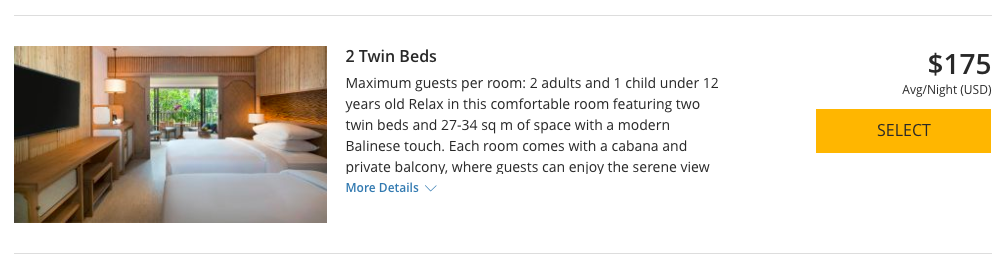

Hyatt Regency Bali – Category 1

I’d written about this earlier in the year, but the Hyatt Regency Bali is reopening January 1st. I booked this hotel with 2500 points + $50 a night. Under the new plan, that hotel would cost me:

2500 + $90

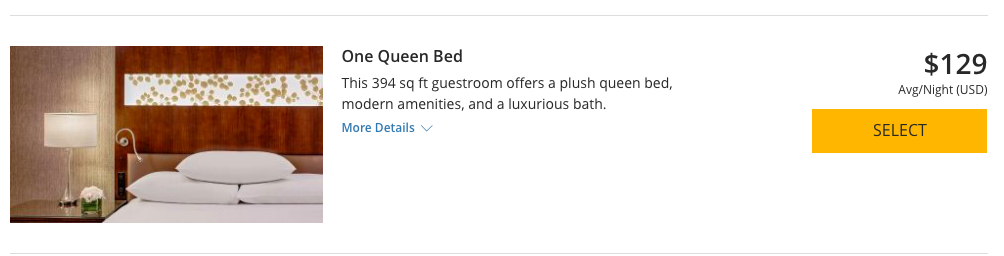

Grand Hyatt Washington D.C. – Category 4 hotel

I’ve stayed at this hotel before utilizing cash and points. Typically this would cost you 7500 + $100 a night. Looking at a random weekend in December… It would actually save money…$65 vs $100. Although I’d never use points to pay for a room so cheap.

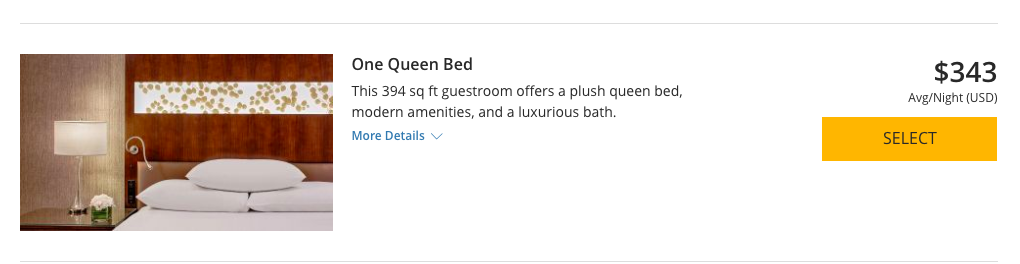

But jump to June…and you’re paying $72 more per night.

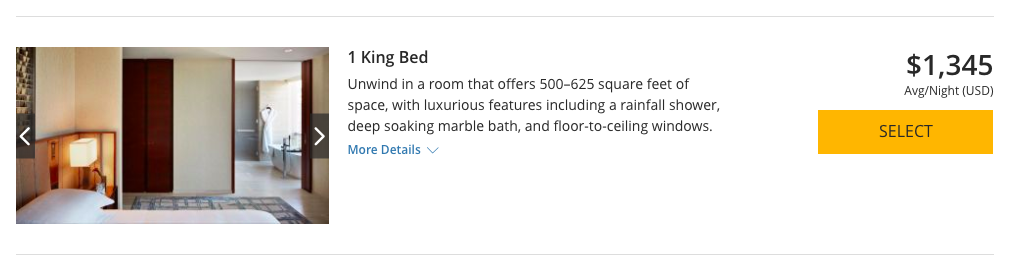

Top Tier – Park Hyatt New York – Category 7

This is one of the most aspirational hotels in Hyatt’s program. Rates are nosebleed year round. Currently, you could reserve a room here for 15k + $300 a night. That seems high, but look at a random day in December. That’s an entry level room starting at $1345 a night. My goodness. Under the new program – such a room would set you back 15k + $673 a night. I’ll pass, thank you very much.

Overall:

Hyatt has been making great progress in tailoring their program with recent acquisitions and partnerships, and they introduced an incredible new credit card – so why would they gut one of the best parts of their program so close to the end of the qualification?

If the timing of this rumor is true, November 1st, I think Hyatt will find itself barking up the same tree with loyalists. Hello Marriott. Hello IHG. Hello Hilton.

I mean…you can acquire top tier status with Hilton ( hello Club level ) by having a single credit card: The Amex Aspire. 150k welcome bonus too

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.