This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

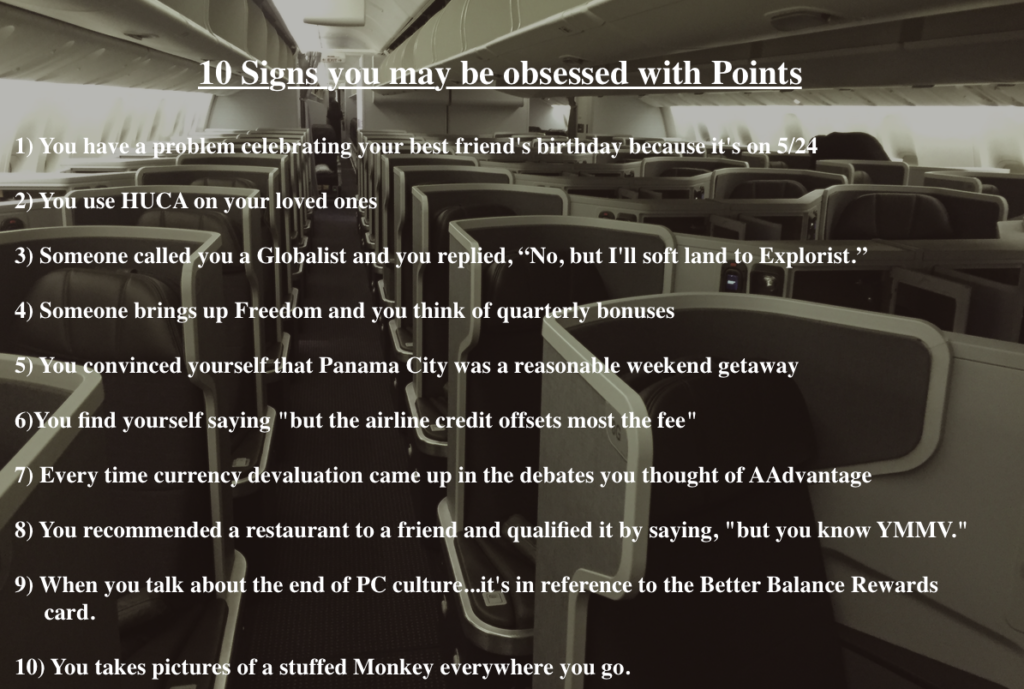

10 Signs you may be obsessed with Points

It happens to all of us. The day comes where you realize you’re obsessed. But when does that happen and how do you know you have a problem? I’ve put together a short list of signs that you may or may not identify with, but I know I certainly do. Here are 10 signs you may be obsessed with Points.

Bonus points if you can name the airline, plane, and cabin in the background =)

And a Clearer Version if you can’t read that 😉

- You have a problem celebrating your best friend’s birthday because it’s on 5/24

- You use HUCA on your loved ones

- Someone called you a Globalist and you replied, “No, but I’ll soft land to Explorist.”

- Somone brings up Freedom and you think of quarterly bonuses

- You convinced yourself that Panama City was a reasonable weekend getaway

- You find yourself saying “but the airline credit offsets most the fee”

- Every time currency devaluation came up in the debates you thought of AAdvantage

- You recommended a restaurant to a friend and qualified it by saying, “but you know YMMV.”

- When you talk about the end of PC culture…it’s in reference to the Better Balance Rewards card.

- You takes pictures of a stuffed Monkey everywhere you go.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.