We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The 70k card I wish I could get

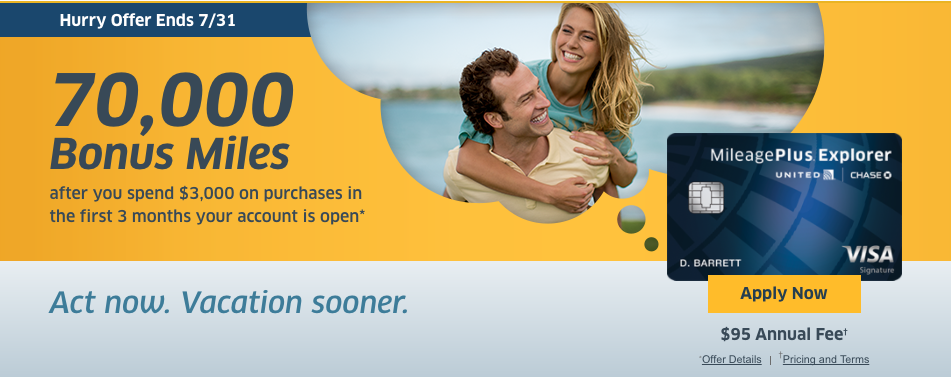

Last year I took the bait and signed up for Chase’s United MileagePlus Explorer when they snail mailed me a 50k offer. Honestly, I was pretty happy, and 50k was about as good as I thought it was going to get. AND THEN THE 70Ks started to roll out. They’ve extended the 70k offer this time around until 7/31. This card is restricted by 5/24 rules, and while I’m under 5/24, it’s only been a year since I was a proud cardholder, and Chase limits sign up bonuses to every 24 months. UGH! However, if I were eligible to get the 70k bonus…I’d be very eager to snatch up this card.

The offer ends on 7/31

You may have to login and out a few times, use incognito, etc. The offer varies for me, but the last time I was checking award avail the 70k popped up, and after I logged in it continued to show 70k.

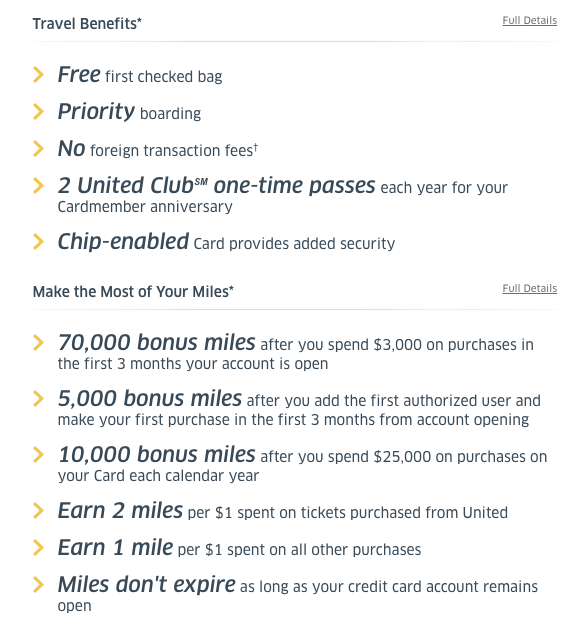

The major benefits

The benefits that interest me the most

- 70k points

- United Club Passes

- 5k bonus for AU

- Extra Award availability

Even if you could, why would you add on to your 5/24 Miles?

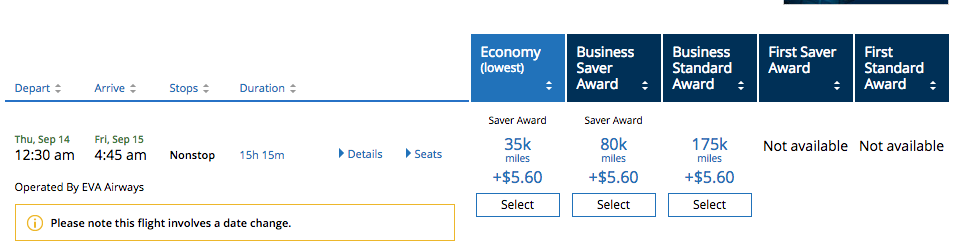

Plain and simple. It preserves my Ultimate Rewards and I highly value flexible currency over fixed. By creating 78k United Miles from a sign up bonus, I save 78k UR for some other redemption. Plus, 80k points will fly you in EVA Royal Laurel Business Class from the US to Asia- and those are points you won’t regret redeeming.

You can check here if you’re targeted

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.