This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

3 months of status, plus a fee free challenge

If you’re unfamiliar with FoundersCard it’s a membership program whereby members get access to a bevy of benefits. Among them…Caesars Diamond status, 10% off British Airways Roundtrips, Cathay Pacific Silver Status, 3 months of JetSmarter, the list goes on and on. I inquired last year about joining. The biggest reason I was interested, at the time, was using Caesars Diamond status stay 4 nights at the Atlantis in the Bahamas and pay only the resort fee. You can read Out and Out’s review of that perk here. Ultimately I’ve held off, and have debated the decision ever since. Typically FoundersCard charges $495 + $95 initiation fee. You can often score much better deals than this: I’ve been offered 2 years with a waived initiation and a pro-rated $295 a year if I’d pay for 2 years in advance. A very solid deal IMO. What perked my interest again was a recent email I received introducing another benefit: AA Platinum Challenge.

Typically AA Platinum Challenges cost $200 + $300 if you want the status during the challenge. FoundersCard is offering it fee free.

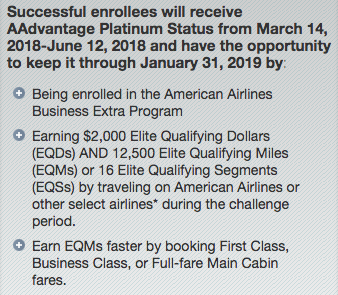

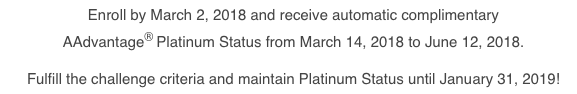

Enroll by March 2nd and get 3 months of free Platinum Status with the opportunity to extend.

If you want to extend. You’ll need to earn 12,500 EQM and $2k EQD.

- Eligible Airlines

- AA

- British Airlines

- Finn Air

- Iberia

- Japan Airlines

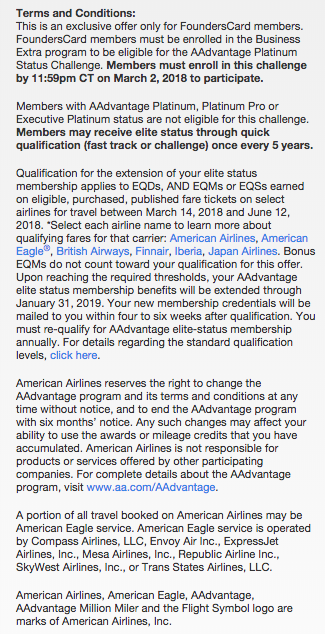

Full Terms and Conditions.

- One key component of this offer is you must be enrolled in business extra. I’ve written about how lucrative business extra is in the past, and if you’re interested I’d read this post.

This increases the appeal of FoundersCard significantly. I’ll have to make a decision soon 🙂

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.