This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Get a 100% bonus when you buy 5k+ IHG points until 02/17/17

IHG put this offer out yesterday, 2/14/17, as a sweet little Valentine’s day surprise. You can get a 100% bonus when you buy 5k+ IHG points until 02/17/17. IHG allows you to buy up to 60,000 points per year and this provides a great way to get an additional 60,000. Let’s take a look at the offer and why it may or may not make sense for you. Get a 100% bonus when you buy 5k+ IHG points until 02/17/17.

If you’re interested go here:

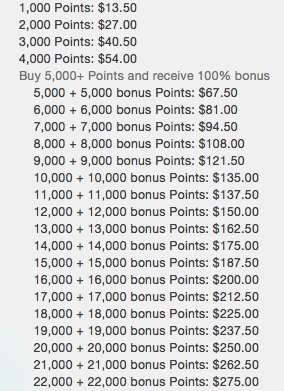

You’ll be prompted to input your IHG information. You’ll then be given the option to buy different quantities of points.

Here is a look at various price points: Best deal is $0.0575 per point

- Buy 5k get 5k = 0.00675

- Buy 20k get 20k = 0.00625

- Buy 60k get 60k = 0.00575

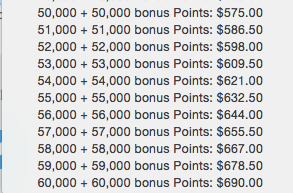

Here are the terms and conditions:

- 60k max

- must purchase by 11:59 EST on 2/17/17

Should you do it?

Like everything…it’s up to you. If you don’t have any points, are short on points, or see that a super expensive hotel could be had for much less through a points purchase, I think this could be a great deal. Another option is to use the points to buy Ambassador at a discount…

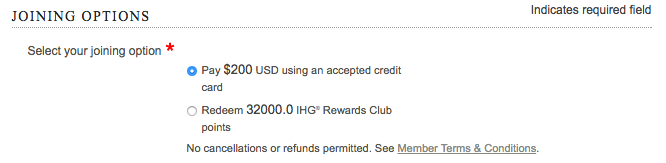

Buy points to purchase IHG Ambassador at a discount

For new members it would cost $184.

- At $0.00575 per point, 32000 points would cost you $184.

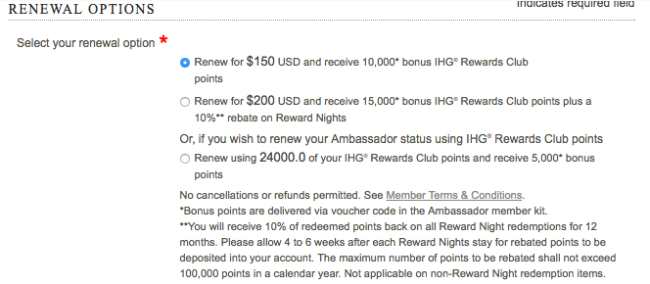

For renewal there were 3 options offered last year and one was an all points offer 24k get 5k back or 19k total out of pocket:

- At $0.00575

- 24000 get 5k back = 19,000 or $109.25

Buy points to get a room at a reduced rate.

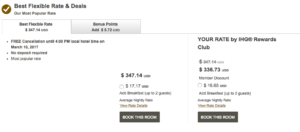

In 2015, we used points to stay at the Intercontinental Johannesburg airport while we were touring for a safari.

It’s a great hotel, adjacent to the airport and can be had for just 30,000 points, 27k if you have the IHG card from Chase which gives you a 10% rebate on award redemptions. With this promotion you could buy points to redeem for a night here for $172.50 or $155.25 with the Chase card. I looked and rates in March are over $300. That’s a great way to stay at a great hotel and save a lot of money.

Think you’ll take advantage of this promotion? Would love to hear your stories!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.