This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

What is AA Business Extra?

Business Extra is marketed for small business owners. So, if you have a small business and fly frequently on American or their codeshare partners then you qualify to earn a different set of points called business extra points. This program is entirely different, requires registration, and earns a separate set of points. Enroll here.

How do I earn?

Once registered, select an Travel Manager. Add employees as Travelers.

American, British Airways, Iberia, and American codeshare partners earn 2 business extra points for every $10 of paid fare. This is a revenue based program that allows the travel manager to earn a collective bank of points earned off all employee travel. You can then redeem those points for specific employee travel in the future.

Example: Husband and Wife restaurant startup consultant group.

The two of you travel across the country extensively and help restaurants get off the ground. Both of you can accrue points under one account led by one Travel Manager. The company travel manager’s account with accrue Business Extra points based off of both employees’ booked fares. Just don’t forget to add your business extra number to flights. Once you have earned enough to redeem, you select a flyer from the traveler’s list and redeem points.

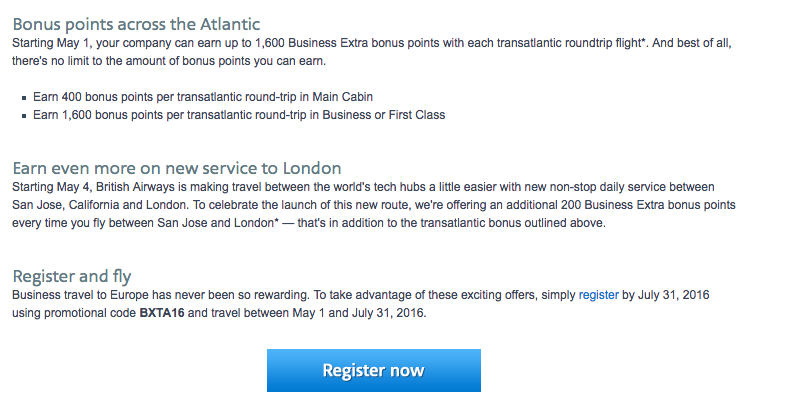

Current Promotion

There is a current promotion that is extremely lucrative. Earn 1600 Business Extra miles for every business class transatlantic flight. That’s huge. You can register here. You do need a Business Extra account prior to registration though. With just one flight you are already half way to a one-way business class upgrade on an international ticket. On top of that, you would be stacking the 2 points per $10 earned on the fare price and you’re also earning Aadvantage miles plus whatever promotions are currently running.

My folks recently flew roundtrip to Italy. They paid $800 out of pocket for a roundtrip business class fare. Unfortunately, they hadn’t registered their small business for this promotion. Had they done so they would have earned the following:

- 9700 Base AAdvantage miles

- 2425 AA class of service bonus

- 9700 AA Platinum bonus

- 25,000 AA Promotional Bonus for transatlantic business class

- 160 Business Extra points

- 1600 Business Extra promotional bonus.

- Total: 46k AA + 1760 Biz Extra.

That’s almost a one way business ticket earned off one roundtrip. They are also half way to a SWU using Biz Extra. Stacking pays.

What are the best redemptions? An Effective SWU

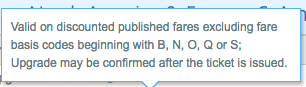

So in the header I mentioned you can earn business extra points for an effective SWU. SWU stands for System Wide Upgrade and they allow you to upgrade by one class of service on a paid ticket. Typically these are only given to top tier Executive Platinum and Concierge Key. But, business extra points provide a unique opportunity to earn an effective SWU. It’s worth noting that unlike SWUs which can be applied on any class of service these are ‘effective SWU’ in the sense that there are some restrictions: They can’t be used on B, N, O, Q, or S fares.

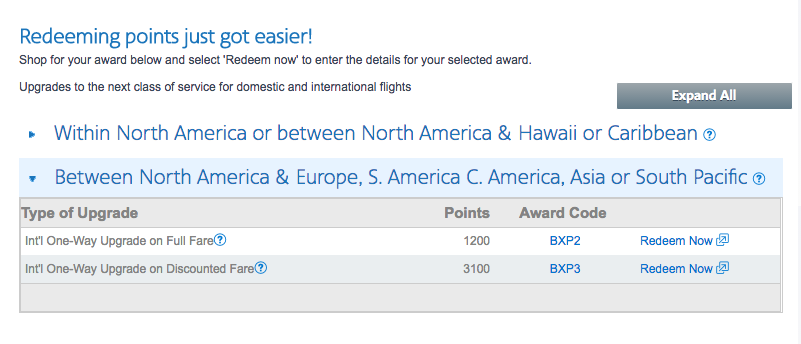

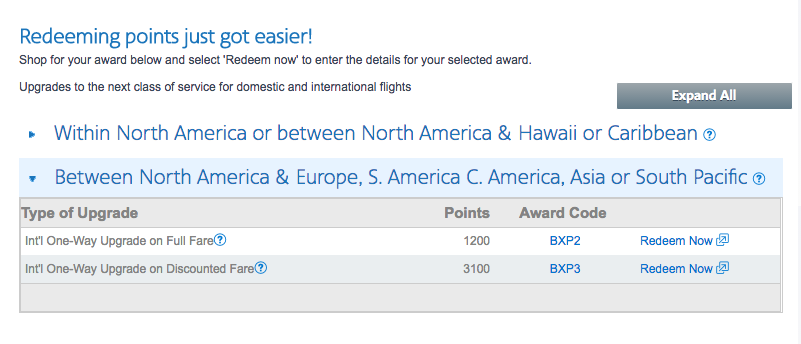

Analyzing the value per point, an upgrade from paid economy to business class on an international flight provides the best value…in my opinion. As you can see, you need 3100 points for a SWU on a discount fare. This is pretty great value, especially when there is a promotion of 1600 points for one roundtrip in business class to Europe.

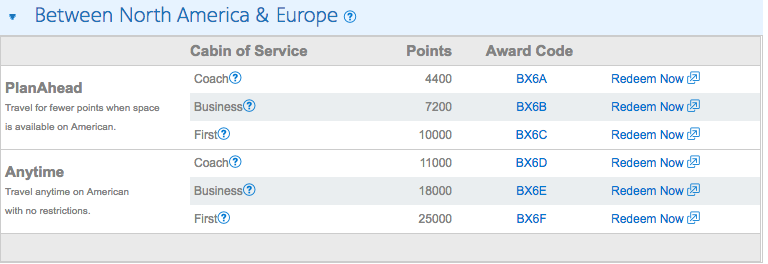

Let’s compare that to some of the other redemption levels

Look, you aren’t going to earn these points rapidly because the point accrual isn’t the fastest. But, they are free points and have great value down the road when you do redeem them. Make use of stackable promotions and fast track your way to business class.

If you’re small business owner, and travel for business, you should definitely be earning Business Extra points.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.