This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

What’s more exclusive than a Black Amex? Multiple Passports.

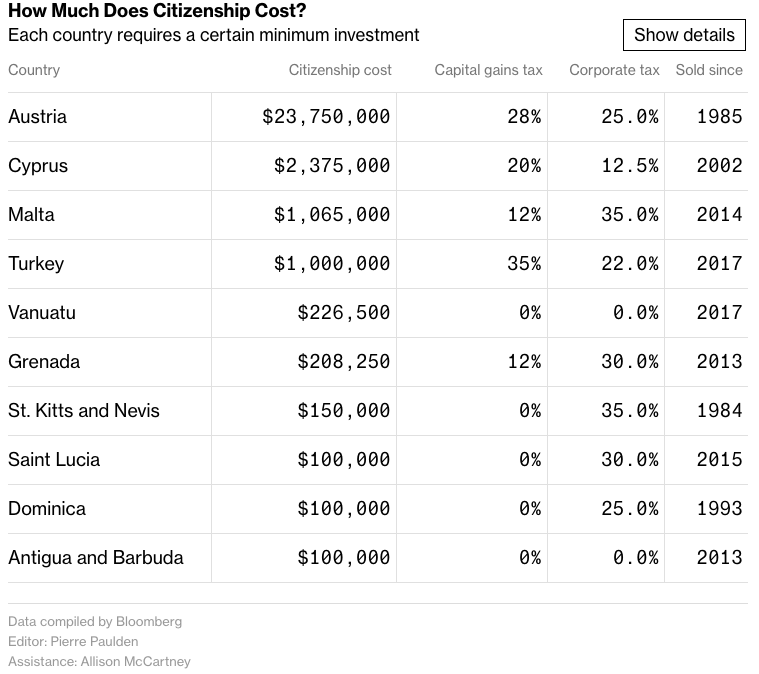

Whether you’re looking for expanded visa free travel, an offshore financial center, a social disruption backup plan, bragging rights, or just aspirations to be a real life Jason Bourne – a 2nd passport has many uses. If you’re in the market, and have the cash, there are 10 countries around the world that will straight up sell you citizenship through what’s called a CIP: Citizenship by Investment Program. The requirements vary from country to country, but essentially you’ll be dropping cash into their country fund, real estate development, or in the case of Turkey: simply purchase a property worth $1M or more.

Worried that you may need to escape your native country due to social unrest? No problem…gas up the superyacht and head to St Lucia for the first time. Yes, you read that right, the first time…you needn’t to have ever visited St Lucia to be a citizen. Oh…what money can buy.

The cheapest option? A cool $100k.

It’s probably no surprise that 8 of the 10 are declared by the IMF to be offshore financial centers, and take note at the tax rates: they.are.low. Look, you’re not EVADING taxes…you’re simply AVOIDING them 😉

Check out this chart that Bloomberg put together that shows the various prices and rates – click the link to see a more in depth breakdown of what’s required.

*feature image courtesy of Hyatt.com ( Park Hyatt St Kitts )

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.