We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

AA bonus miles for crossing the Atlantic

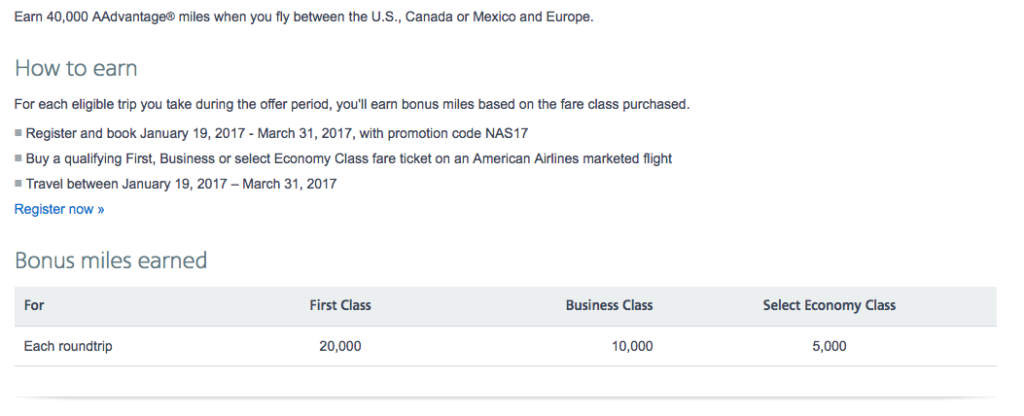

The bonus is back! If you have a trip already planned, but not booked, it may be a good time to check out prices on flights marketed by AA and flown by AA, BA, FinnAir, or Iberia. The maximum you can earn is 40k for 2 roundtrips in First class, and if you just fly once in economy, well, you’ll get a nice little 2500 mile bump. The promotion requires registration and is only valid on flights booked on January 19th and flown by March 31st. Yep…if you booked a flight yesterday – you don’t get the miles. Shortsided, in my mind, for AA to marginalize loyalists who will fly during this period, but booked prior to the announcment – who knows maybe they’ll change this with enough pushback. Either way…you can earn AA bonus miles for crossing the Atlantic.

Go here to register

Travel between January 19th and March 31st, 2017.

- You must register with promotion code NAS17

- Flight must be a qualifying fare

- If you bought a ticket before January 19th…you’re out of luck

- Fly by March 31st

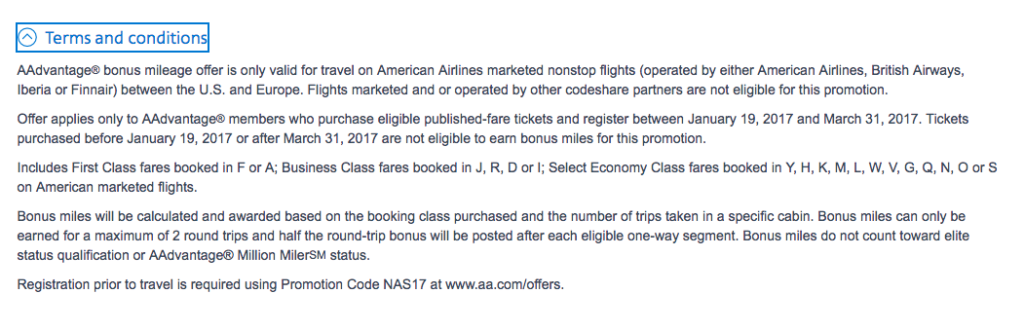

Lay out of terms and conditions

My Take…

I’m going to write more about this, but in the past couple years I’ve been excited about these promotions and have taken advantage of them. However, Alaska is offering INSANE partner earn rates. One of the those partners is BA. So I’m going to run the numbers for a later post, but I don’t think this is really that attractive if you travel is on BA. Unless, of course, you’re going for status, and don’t care about AS miles, but from a pure earning perspective – at first glance, this promotion falls flat compared to Alaska’s.

I read about this on View From The Wing

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.