This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

If you fly BA, ignore AA’s transatlantic promotion, and credit to Alaska

When the news broke today of American’s new transatlantic bonus I was excited. Then, as I dug into the numbers, looked at some potential trips I have planned, I realized just how good Alaska’s partner earn rate promotion is for British Airways. If you’re planning on flying Transatlantic on American, FinnAir, or Iberia then this analysis doesn’t really matter and honestly, I’d understand why you would because they offer better products than BA. But, for me, it’s about the deal, the earn rate, and often times BA is the operator of the cheapest fares so it’s worth examining. I’d assert that if you fly BA, ignore AA’s transatlantic promotion, and credit to Alaska.

Obviously…if you’re a steadfast BA or AA loyalist this doesn’t apply. But if you’re looking to score the most miles or interested in switching loyalty – I’d say this is worth digestion.

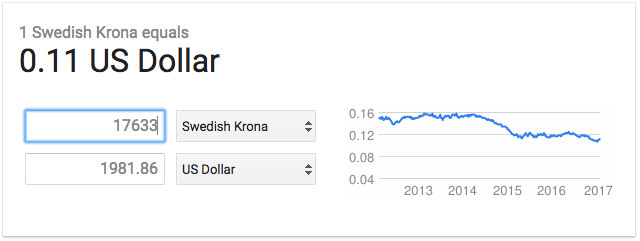

Let’s take a look at this sub $2,000 roundtrip from Stockholm to Los Angeles on British Airways. I found it using the ITA Matrix.

Stockholm is a great place to route in and out of Europe. It’s become a rival of Dublin as the cheap option for business class across the Atlantic. This Stockholm/Los Angeles fare is available throughout the schedule if you can make it work for you…you’ll travel much, much better for, in many cases, just a few hundred bucks more than coach. If you can swing it…do it.

It’s also worth noting that BA has incredible fare sales throughout the year. My parents flew roundtrip from Chicago to Rome for $800 in Club World. That’s amazing value. And yes…I’d have them credit to Alaska now 😉

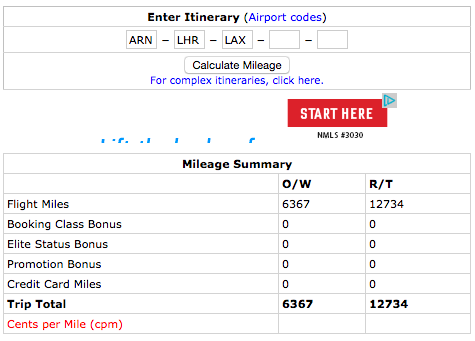

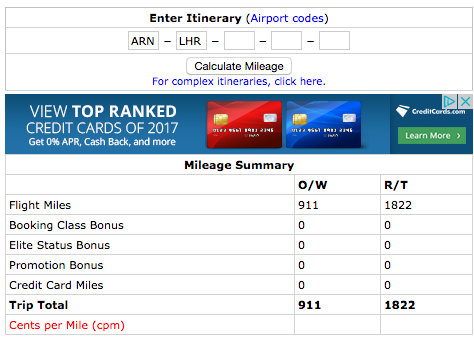

How many miles is it from ARN-LHR-LAX? Roundtrip: 12734

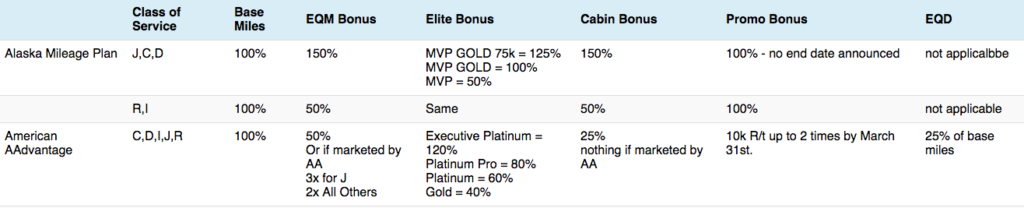

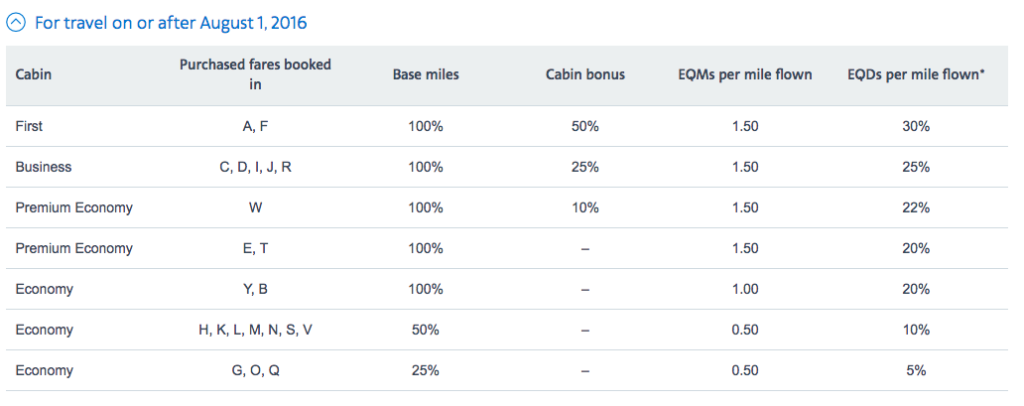

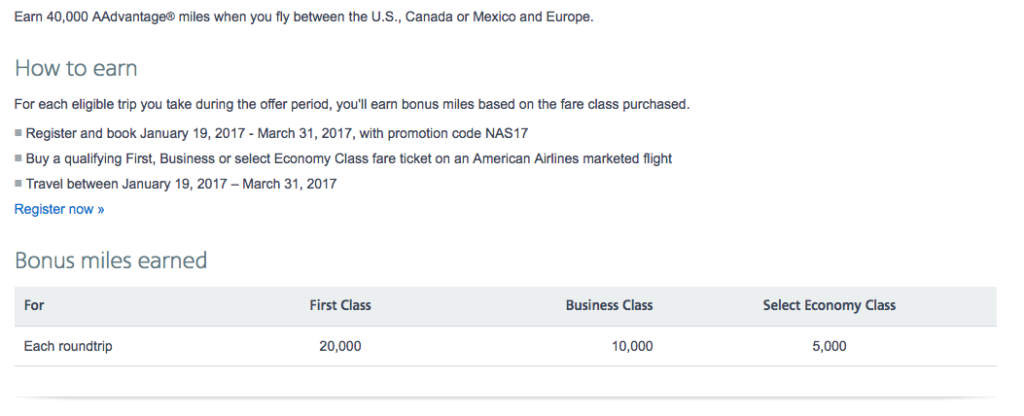

If you were to credit it to American with the new promo…How many miles would you earn?

BA flights that are marketed by AA earn off revenue, to make things easy… Let’s just say the whole fare was qualified revenue. BA flights marketed by AA also earn 2x EQM like AA flights.

Since this is marketed by AA the EQD is based off fare, not mileage.

- Base Fare ($1982) x 11 ( Executive Platinum bonus) = 21802

- Promotional Bonus: 10,000

- EQM = 25,468

- EQD = $1982

Total:

- 31,802 Aadvantage RDM

- 25,468 AA EQM

This reflects a ~25.5% fulfillment of EQM and 16.5% EQD requirement of Exec Plat.

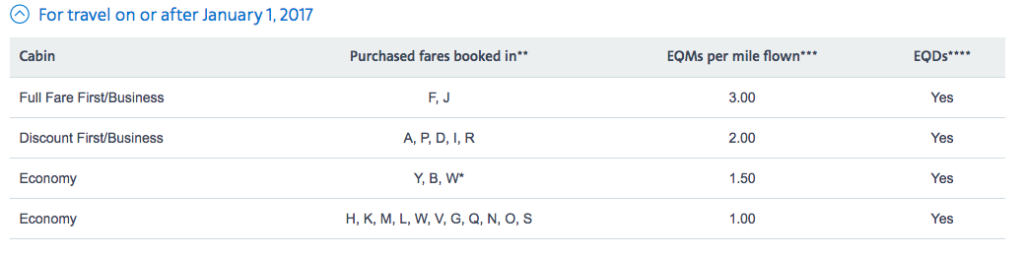

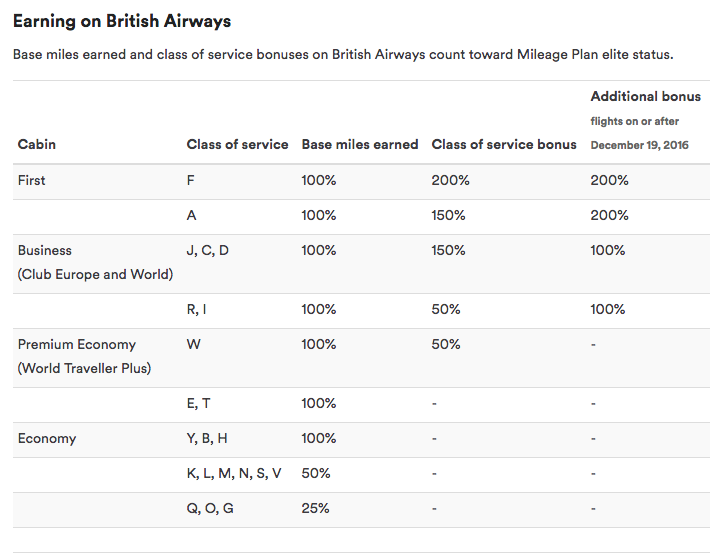

Let’s take a look at Crediting this to Alaska’s MileagePlan.

Here’s Alaska’s earning chart.

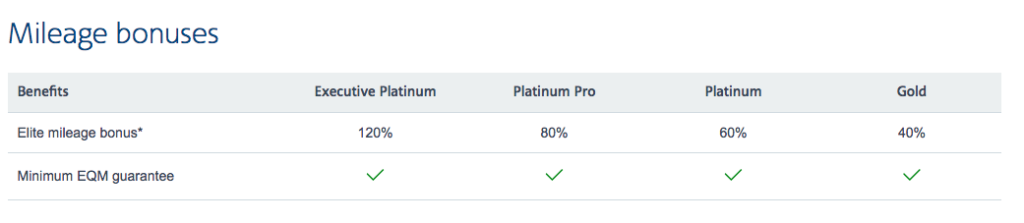

- As you can see…D earns a 150% bonus, I earns a 50% bonus

- MVP GOLD 75k earns 125% bonus

- Additional Bonus of 100%

Because D and I are separate fare buckets and earn different bonuses, I’ll separate them out and calculate independently.

First leg- ARN to LHR would earn this

- 100% Base Miles = 1822

- 150% Class of Service = 2733

- 100% Additional Bonus = 1822

- 125% MVP GOLD 75k Bonus = 2277

That’s 475% bonus on base miles. BYAH to the power of BYAH!

Total for ARN to LHR = 8654

Second Leg LHR-LAX would earn this

- 100% Base Miles = 10912

- 50% Class of Service = 5456

- 100% Additional Bonus = 10912

- 125% MVP GOLD 75k = 13640

That’s a whopping 375% bonus on base miles. YOWZA!

Total LHR-LAX = 40920

Total for Alaska =

- Alaska Mileage Plan RDM = 49574

- Alaska EQM = 15918

Alaska requires 90k EQM for re-qualification when partners are used and this is about 17.7% of that requirement- a little less than what you’re earning with American, but a good step in the right direction

Overall…Alaska 49,574 vs AA 31,802 and 15.9% vs 25.5% EQM

That’s nearly an 18k point gap! It really comes down to what you value more and how much you think you’ll travel. Just because crediting this flight to Alaska earns almost 10 % fewer EQM doesn’t mean it makes more sense to credit to AA if you highly value EQM and status. Alaska doesn’t require any sort of Elite Qualifying Dollar requirement to gain status again, so even if you hit the EQM number you could miss on EQD and qualify for a lower status. Alaska doesn’t have the same revenue requirement. Additionally, Alaska only requires 90k total EQM to gain top tier status vs 100k EQM with American, and Alaska’s 2nd tier MVP Gold, earns 100% bonus while only requiring 50k EQM for status. That’s less time you’d potentially have to spend in the air for some pretty great perks.

Also…If you were to achieve top tier status with Alaska you’d receive a 50k point bonus. Including a pro-rated amount of the 50k in this calculation would add an additional 8850 ( 50k * 17.7%) MileagePlan miles making the total 58,424. That’s almost double!!!

Here’s a table I put together that hopefully helps you make some calculations

What’s the price at which this would make sense to credit to AA? 49,574/11 ~ $4500.

I can’t imagine a fare at that price not booking into J,C,D which means the Alaska bonus for cabin would increase 10,912 miles. So really you’d need an AA flight priced at almost $5500.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.