We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

A 5/24 Data Point on timing

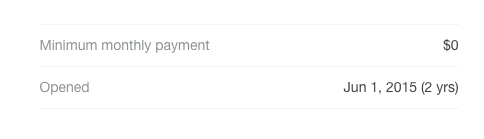

Unfamiliar with 5/24 read this. Otherwise, I’ll just go ahead and get into the story. I recently fell below 5/24, and by recently I mean June 1st. I’d heard through the grapevine that some people being referred by twitter to the Chase Ink Business Preferred were actually receiving 100k bonus points instead of 80k. The Chase Ink Business Preferred is restricted by 5/24 ( DOC has a great list.) Anecdotal evidence showed that the deal was potentially dead on June 1, but it wasn’t definitive, and I was feeling the itch for a new Chase card. Here’s my dilemma: it isn’t really settled when you fall under 5/24. Is it the day or the month that counts? If it was the day then I was good to go. If it was the month…I’d need to wait until July 1st to be assured I wouldn’t be rejected for too many opened cards. Ultimately, I decided the potential of getting 100k points and OBVIOUSLY giving ya’ll a 5/24 data point was worth the hard pull.

After a few phone calls to verify some information… I was approved. I applied the day after I fell under 5/24.

I called in to expedite my card and have yet to receive it physically, but was told over the phone I was approved. Hope this helps anyone who is facing a similar dilemma. Also…it looks like I was approved for the 80k offer – so if you were wondering if a secret 100k offer is being processed via twitter…it’s not looking like it.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.