This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

For years now you could redeem Alaska Airlines miles on the likes of British Airways, FinnAir, Japan Airlines, American which are all One World, buttttttt they officially joined One World as a full partner earlier this year. This changed things big time.

While it is quite easy to earn Alaska miles when you fly One World partners, but using Alaska miles on One World partners have been are slower to roll out. One of the most highly anticipated has been Qatar Airways and their world class QSuites.

Interestingly enough, Alaska is keeping airline specific charts. Later this year they will roll out One World charts that will allow mixing of partners – currently you can mix a partner and Alaska, but not partners on a single one way. Overall, I think the Qatar Airways rates are quite competitive – let’s take a look.

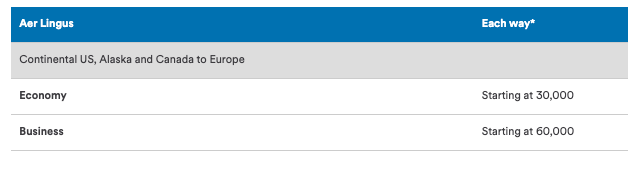

Here are some of the Alaska Airlines Award Charts for Qatar Airways

One thing you’ll see here is *Starting at* Essentially, what this means is Alaska has saver award prices, but also negotiated dynamic pricing as well. I would only redeem at the saver rates…you’ll see how much they vary below, and IT IS INSANE

This saver/dynamic table is something we’ve seen Alaska employ with other airlines as well, and while it certainly makes availability more flexible, the rates are just ridiculous.

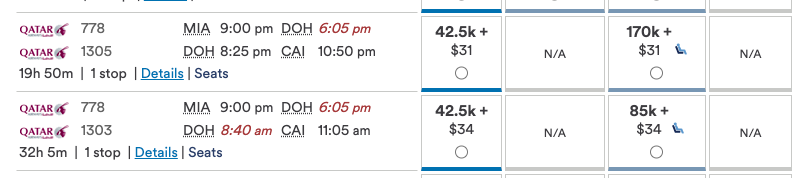

Here’s an example of this pricing on the Miami – Doha – Cairo route

You can see that when there is “saver” space available that the rate would be 85k points; however, Alaska will allow you to use your points on Qatar flights even when saver space isn’t available. That rate would be 170k and could go even higher as the retail price gets more and more expensive.

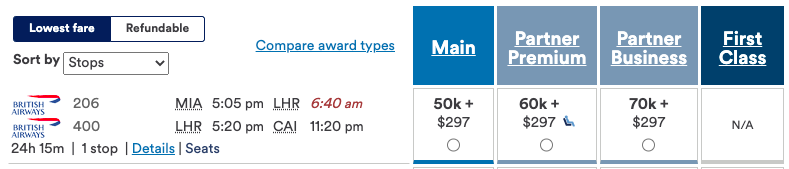

85k isn’t a bad rate for this route, but interestingly Alaska charges just 70k to fly this route on British Airways metal and 82.5k on Emirates. Note the BA Surcharges are quite a bit more, but interestingly on this route just $300 vs the normal $700+.

What do you think?

What do you think?

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.