This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

For years Alaska Airlines has been a favorite program within blogger crowd because of its incredibly priced partner redemption options. For years, they had incredible pricing and stopover rules ( with little to no fees ) when redeeming Emirates that allowed for an incredible number of under 24 hour stops on Emirates first class for roughly 100k miles ( people would start in Australia and connect multiple times back to the USA ).

Since then, I’d argue there have been 3 amazing ways to use Alaska miles to fly some of the best first and business class products in the air: Japan Airlines, Cathay Pacific and Qantas. Last year, Alaska removed their award charts and that was a major signal that they would hit the consumer with hidden devaluations. And…it’s started to happen. H/T Frequent Miler

Clearly, I like to blend in and not draw attention to myself.

The latest Alaska Airlines devaluation is Japan Airlines:

The interesting thing is that when Alaska published an award chart for Japan Airlines it didn’t distinguish between east and west coast redemptions. That has changed…now flying to/from the west coast of the US is cheaper than the Midwest or East Coast.

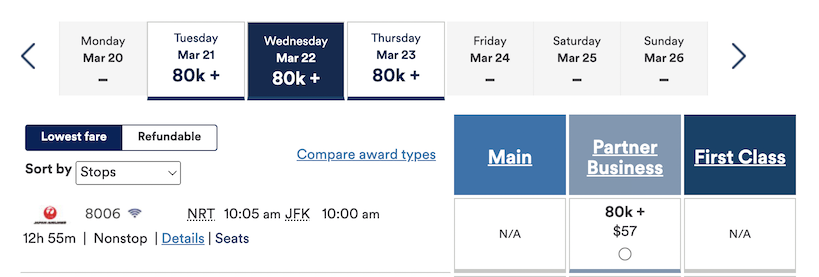

East Coast to Japan

-

- Business Class

- Was 60k now 80k

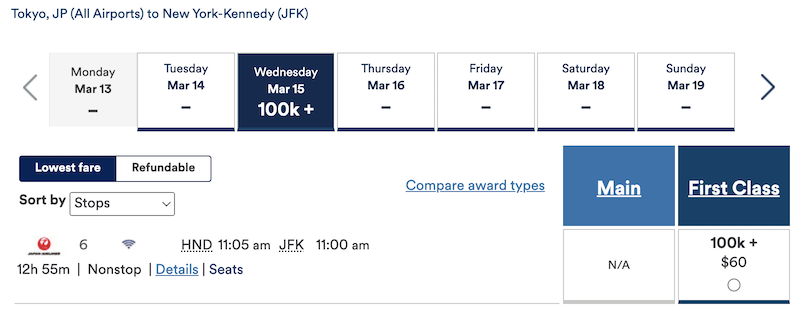

- First Class

- Was 70k now 100k

- Business Class

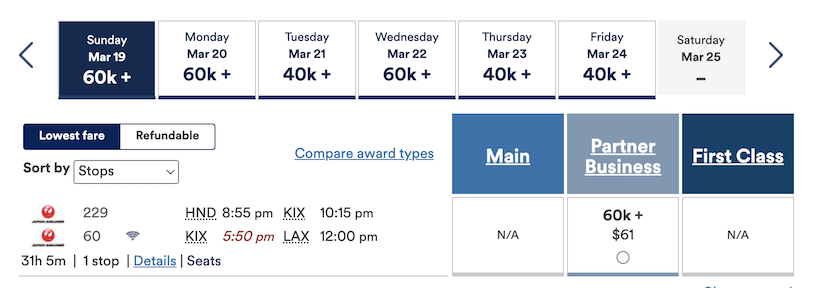

West Coast to Japan

-

- Business Class

- Was 60k, still 60k

- First Class

- Was 70k now 85k

- Business Class

Will Cathay Pacific and Qantas be next?

Two of the other screaming good deals are using miles to Asia on Cathay Pacific and to Australia either on Qantas or Cathay. Look at these prices…they are significantly pried below competition and likely to pop up sooner than later. If you see award availablity on these airlines going to Asia or Australia, book now. They are highly likely to go up sooner than later.

- To Asia

- Cathay Biz is 50k One way

- Cathy First is 70k One way

- Australia – 70k miles to fly First Class from the States to Australia!

- Qantas Biz is 55k

- Qantas First is 70k

- Cathay Biz is 60k

- Cathay First is 80k

Overall

The biggest and most dramatic price increase was Japan Airlines Business Class from the East Coast to Japan going from 60k to 80k or a 33% price increase and first class going from 70k to 100k is over a 50% increase. Japan Airlines became a partner of Alaskas Airlines back in 2016…and they’ve held the redemption rates for 7 years. My complaint isn’t that they’ve raised rates, but the way in which it’s done. According to the inflation calculator, $100 in 2016 now costs $122 in 2023. These increases in redemption rates are higher than inflation, but are they crazy?

Trust is lost when you don’t communicate changes and allow those most loyal to the brand to position themselves. After all, we’ve earned miles by being loyal to flying and using the brand’s credit cards. There are a lot of choices out there, and the consumer knows prices will go up eventually, but when you do it without communicating the details…it erodes trust and when trust is lost, loyalty erodes quickly.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.