We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Flying Blue Family Accounts

In March, Air France and KLM’s loyalty program, Flying Blue, introduced the Flying Blue Family Account. This permitted a group of 8 people, 2 adults, and up to 6 children ( under 18 ) to share their miles in a family account. It’s pretty simple to use, the head of the account can transfer miles in/out of the other members accounts once linked.

I just took advantage of it on a last minute booking when I realized I had two separate Flying Blue accounts and needed to merge points. Long ago I had a problem with my account and created another one…apparently Chase was linked to one and Amex to the other. I ended up taking advantage of the 25% transfer bonus from Chase for a Flying Blue booking and realized it ended up in a different account from where I had a small balance. This isn’t the intention of the family account, but it’s possible to use it as I did. Let’s walk through how I linked accounts, and then combined points to make a booking.

Family Account rules:

- 2 Adults

- up to 6 children, under 18

- All members must have Flying Blue accounts

Step 1: Finding Flying Blue Family in your account

Super simple, just drop down the Flying Blue tab once you’re in your account and you’ll see the Flying Blue Family listed as an option

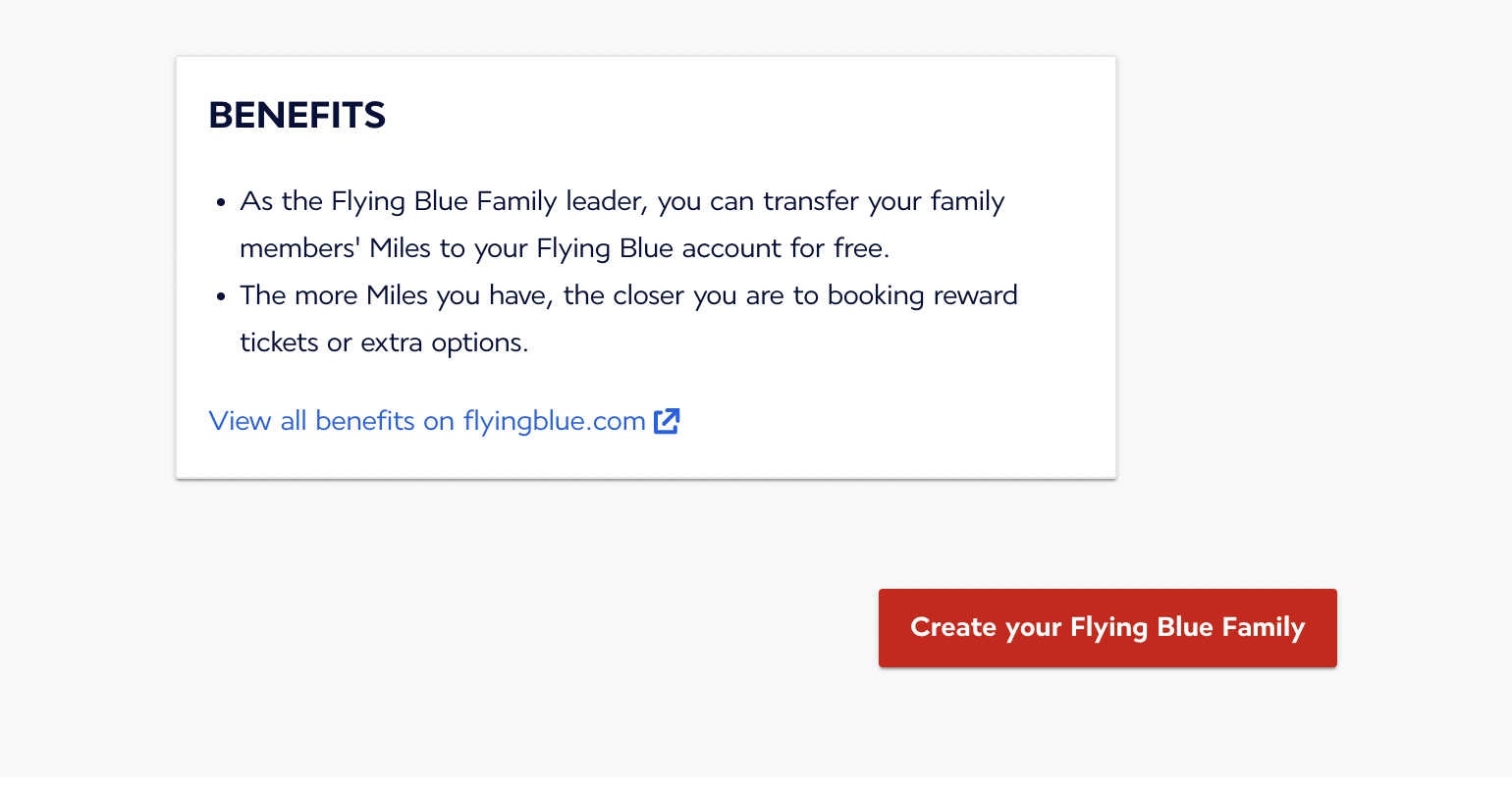

Step Two: Create Flying Blue Family

Step Two: Create Flying Blue Family

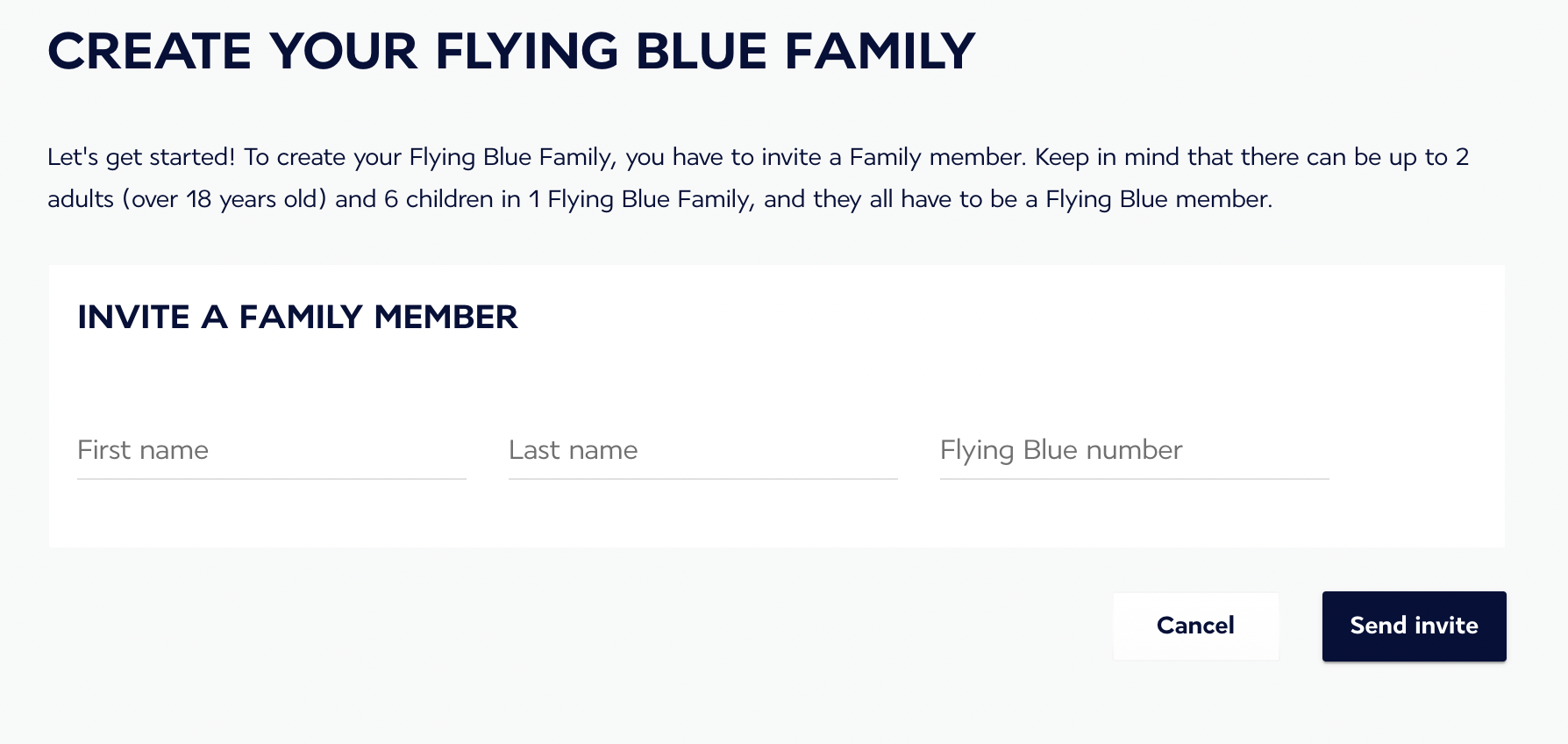

And then send an invite to the other Flying Blue Member

And then send an invite to the other Flying Blue Member

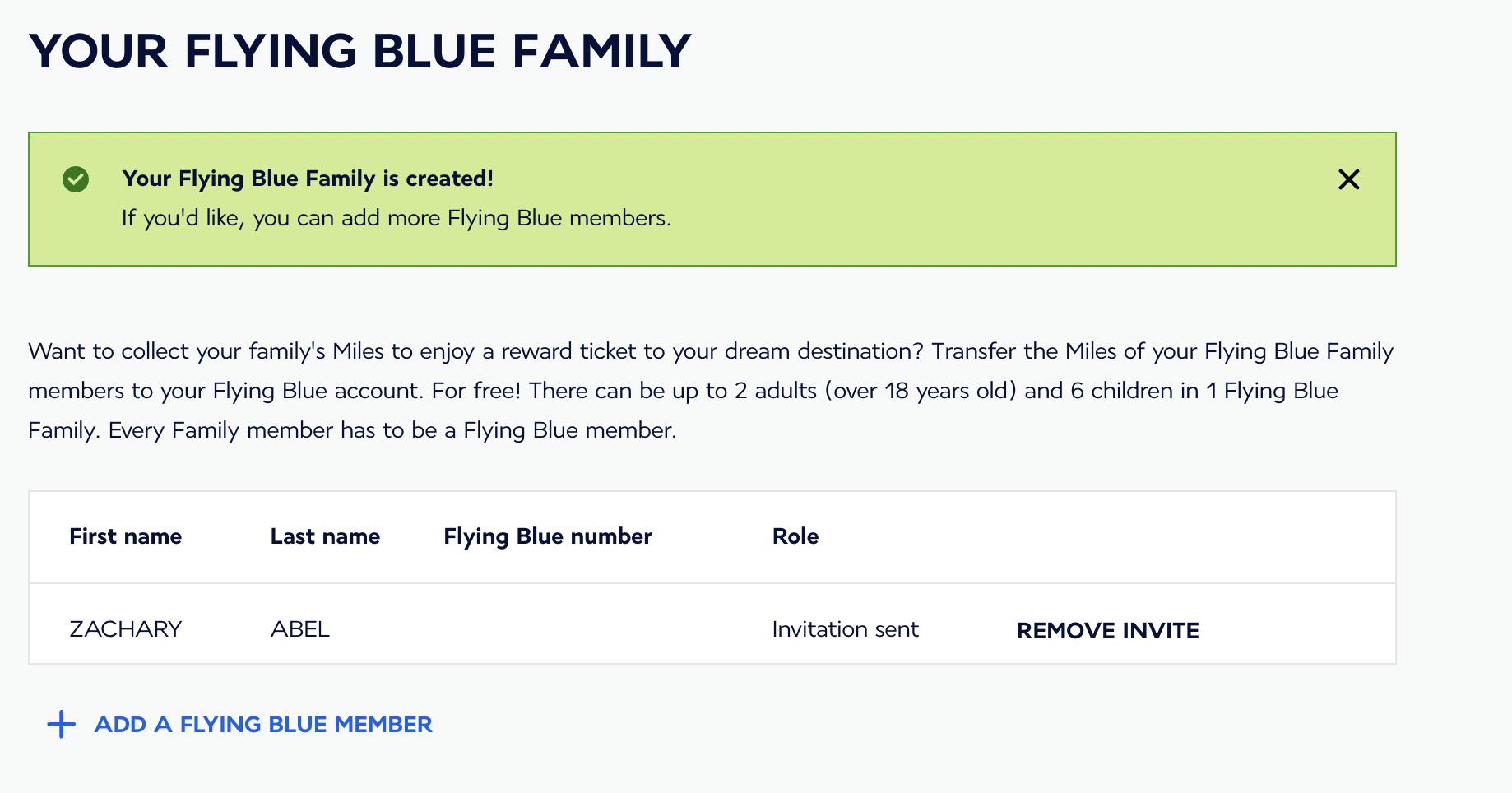

You’ll see the invite has been created

You’ll see the invite has been created

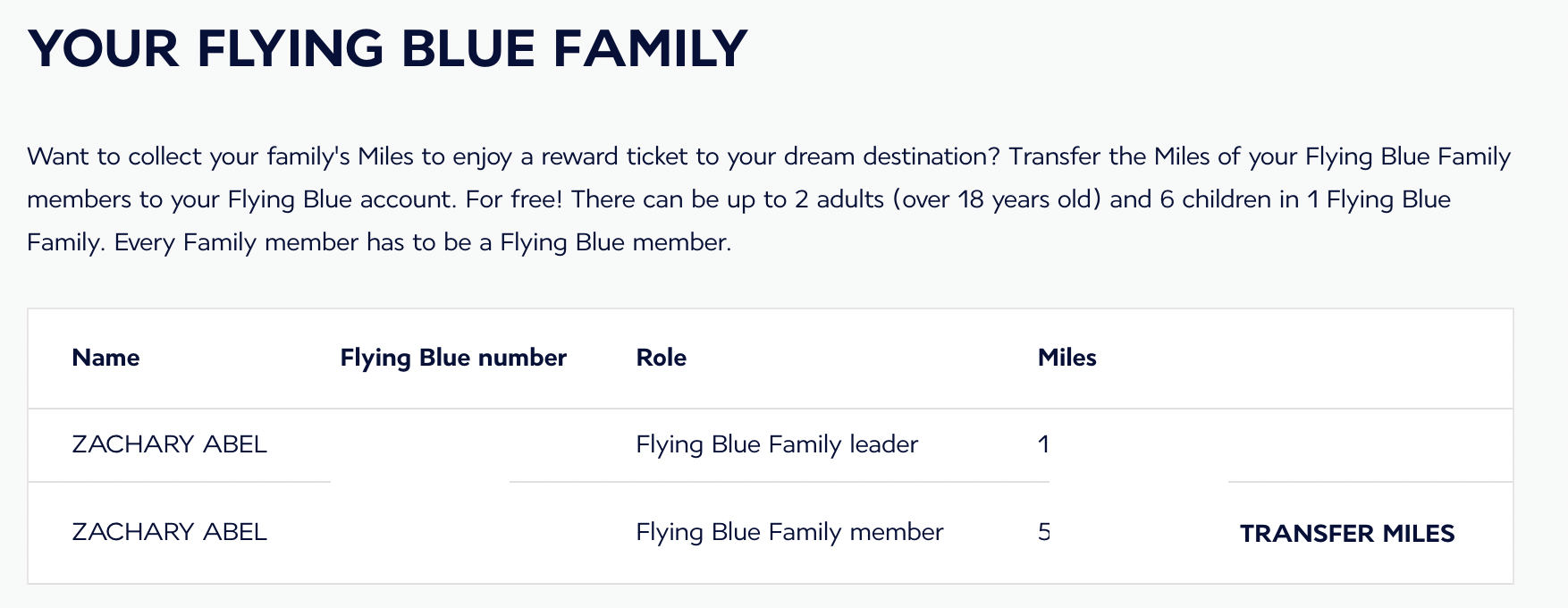

Step 3: How to Transfer miles

Step 3: How to Transfer miles

Super easy…you can see the linked family accounts below and you’d just click transfer miles.

Once you click that button you’ll select the amount you need and voila…it’s transferred.

Once you click that button you’ll select the amount you need and voila…it’s transferred.

Overall

Overall

This is a great way for family and friends to combine points. Currently, I’m not seeing an easy way to remove a family member online ( which I’d like to do so I can add my wife’s account instead of my secondary account ) I’ll update this post when I figure that out!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.