We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

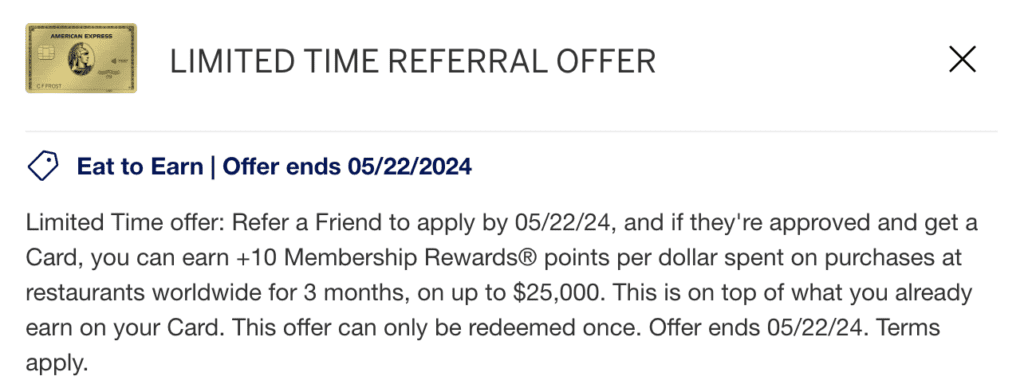

Amex Referrers earn an extra 10x on dining ( max $25k ) through 5/22/2024

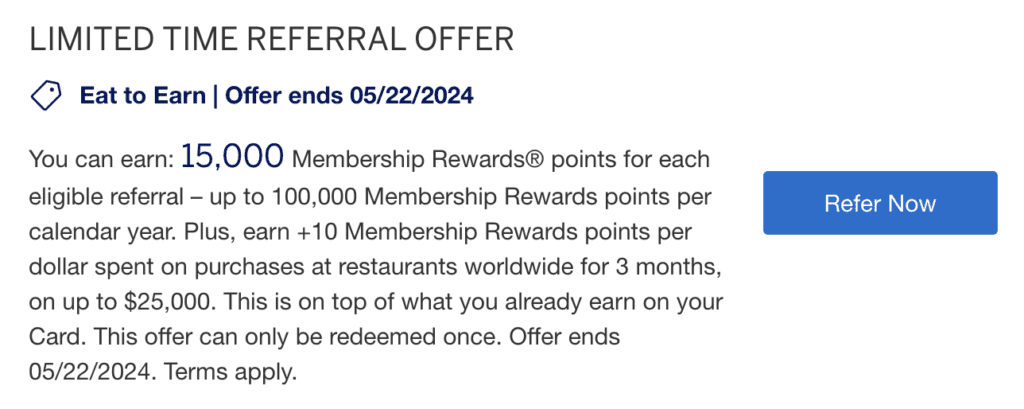

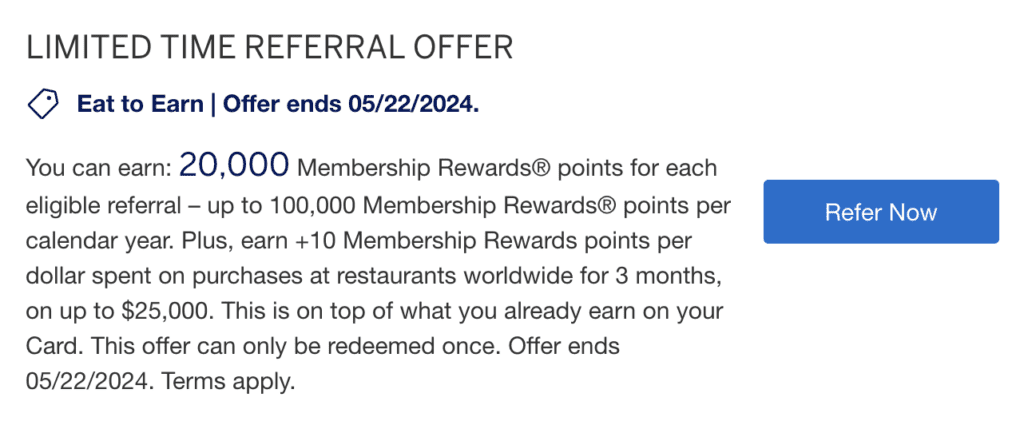

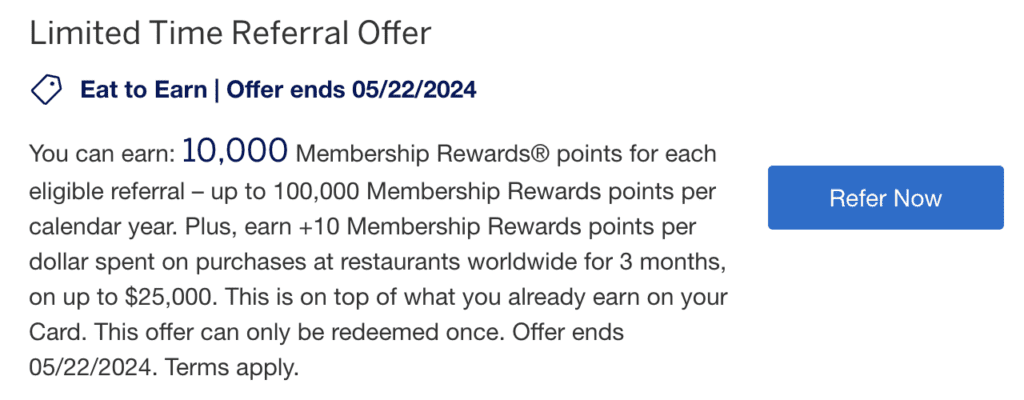

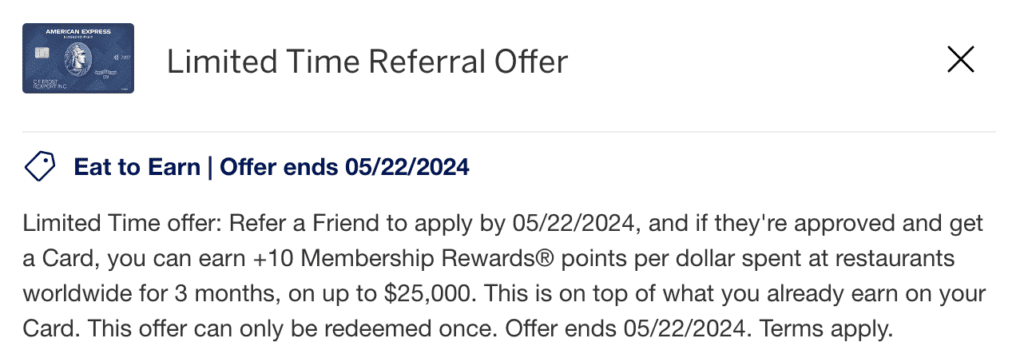

We have seen iterations of this offer in the past with supermarkets, dining, and gas. This round, Amex is incentivizing their cardholders to refer others by giving them a 10x bonus ( Points, Cashback, or Miles ) on supermarket spend for 3 months, capped at $25k. If the card you’re using to populate a referral earns Membership Rewards, you’ll earn an additional 10x Membership Rewards. If earns Marriott Bonvoy, you’ll earn an additional 5x Marriott Bonvoy. If it earns cashback, you’ll get an extra 5%, etc. You will only earn the 10x if the person you refer is approved for the card. Offer runs through 5/22/24

We keep referral pages for you to leave links on

You can leave links on this post, but honestly they won’t get used. The posts that get the most action are listed below:

- The Platinum Card® from American Express

- American Express® Gold Card

- The Business Platinum Card® from American Express

- American Express® Green Card

- American Express® Business Gold Card

- Hilton Honors American Express Aspire Card

- Blue Business® Plus Credit Card

- The American Express Blue Business Cash™ Card

- Amex EveryDay® Preferred

For the cardmember who refers: 10x bonus on US dining for 3 months

You’ll get your referral bonus + 10x bonus points on dining on US restaurants for 3 months, capped at $25k

Amex Gold 20% back offer dining, up to $50:

How to populate Amex Referrals

If you don’t know how to populate a referral offer…read this article.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.