We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Earn Bilt Rewards on Lyft rides now

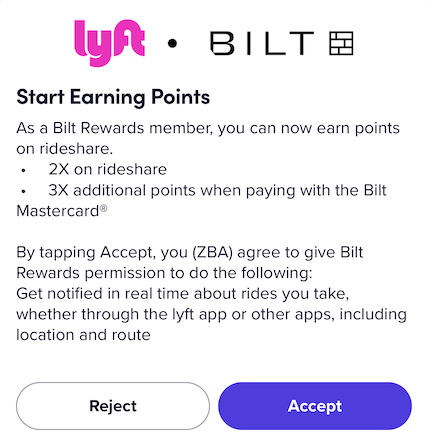

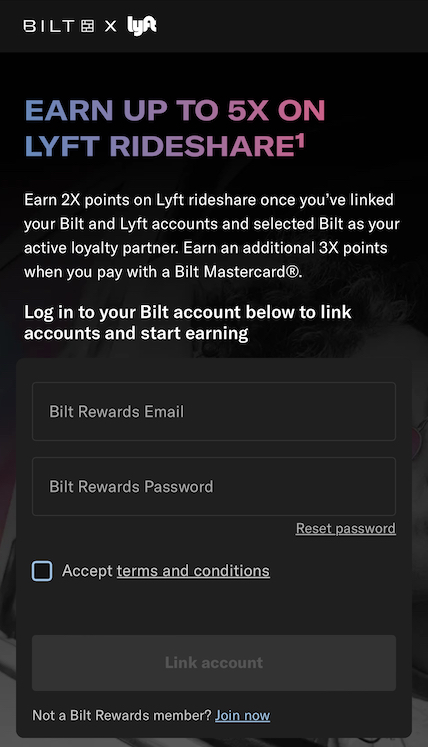

You can now earn Bilt Rewards every time you take a Lyft ride and you don’t even need the Bilt Mastercard® credit card! You just simply link your Lyft account to Bilt Rewards and select as as the point program you’d like to earn points with; however, if you do have the Bilt Rewards credit card you’d earn an additional 3x for a total of 5x.

- 2x for Bilt Rewards Members ( just link your account )

- additional 3x for Bilt Rewards Masterdcard Holders for a total of 5x

Regardless of the credit card you use to pay, I think it makes sense for most people to select Bilt Rewards when riding Lyft is a no brainer compared to earning Delta, Hilton, or Alaskan miles ( although these are very valuable, but it’s a smaller program and less valuable to most people comparably).

Why?

Remember, Bilt Rewards is a partner of Hyatt, United, American and more so you’re effectively earning those points should you wish to convert Bilt Rewards into them. Let’s take a look at this new feature of the program.

How do I link my Lyft account to Bilt Rewards?

In the Lyft app, you’d go to settings and Rewards, and select Bilt Rewards. You’ll prompted to login to your Bilt Rewards account

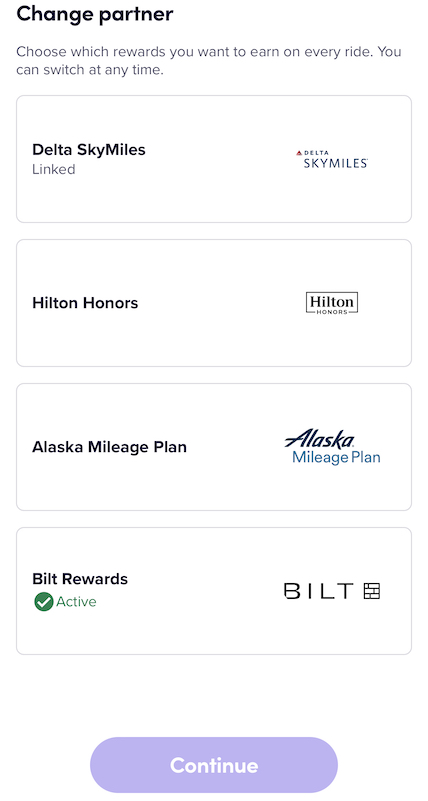

Selecting a Lyft partner to earn Rewards with

You can only select one partner to earn points with + you’d earn credit card points as well – so there are two options to earn rewards…the partner and the credit card you use to pay. Here are the choices

- 1x Delta

- 2x Alaska

- 2x Bilt

- 3x Hilton

Delta and Hilton are worth the least…fewer than a penny a point mostly. Alaska miles are very valuable, but most people don’t have them or earn them, and the roundup from Lyft rides isn’t going to make a difference one way or another on future redemptions. Earning Bilt Rewards where you can tranfser them into programs like Hyatt, American, or United makes a difference if you need an extra 1000 points to hit a redemption.

Credit Cards that offer a bonus

Depending on which card you have, you can earn an additional bonus on your Lyft rides. For instance, if you have the Bilt Rewards Mastercard you could earn 5x total points on your Lyft rides, but if you have the Chase Sapphire Preferred, Ink Business Preferred, or Chase Sapphire Reserve, you could theoretically earn Bilt Rewards and Chase Ultimate Rewards…that is unreal.

- 3x Bilt Rewards Mastercard

- 5x

- 10x

What can I do with Bilt Rewards?

You can redeem them for 1.25c in the Bilt Rewards travel portal, redeem toward rent, a future downpayment on a mortgage, or at Amazon. Personally, I think transferring them to partners is the best use and how I’ve used Bilt Rewards in the past to stay at the Park Hyatt New York or the Thompson New York

What will I do?

I will 100% be crediting all of my Lyft Rides to Bilt Rewards, and when I’m taking Lyft for business I”ll pay with my Chase Ink Business Preferred, and then personally I’ll use my Bilt Rewards Mastercard since I no longer have a Chase Sapphire Preferred or Chase Sapphire Reserve ( dropped that several years ago).

If you have a Chase Sapphire Reserve, earning 10x is a no brainer and I’d say pay with that card. The difference between 5x and 3x ( CSP vs Bilt Rewards Mastercard ) comes down to which point currency you have less of and value more. The ability to transfer to American alongside Hyatt and United may make it more worthwhile to you to pay with the Bilt Rewardes Mastercard and earn 3x vs paying with the Chase Sapphire Preferred and earnining 5x.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.