This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

I’ve been a big proponent of American Airlines Business Extra program whereby AA loyalists can earn Business Extra points alongside Aadvantage miles. It’s a super easy double dip for small businesses. Today, I received an email explaining some amendments being done to the program that will certainly hurt businesses that have fewer than 3 employees.

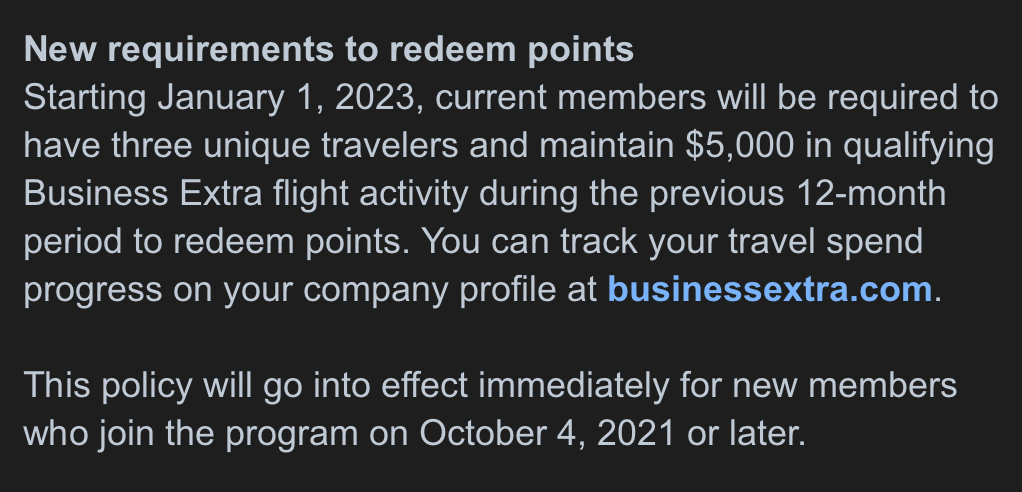

New Requirements starting 1/1/23 – no point redemptions for businesses with fewer than 3 unique fliers and $5k qualifying spend

*This also goes into effect if you enroll in the program after 10/4/21.

Clearly AA has run a cost/benefit analysis and realized that businesses that don’t spend much and have fewer than 3 employees are bigger takers than givers. I understand it, but at the same time, this has to hurt for a lot fo consultant based businesses that rack up a ton of miles and spend, but would only have one employee under their business extra account. I don’t see any terms that stipulate the extra two people have to rack up any activity, so perhaps you could add non-flying employees to the account, but this is certainly a hit.

Business Extra has been an outstanding way to upgrade domestic flights, especially on those transcontinental flights offering lie flat seats, for just 650 Business Extra points. I’ve done this many a time but, without adding unique fliers to my account, will sadly be ineligible going forward.

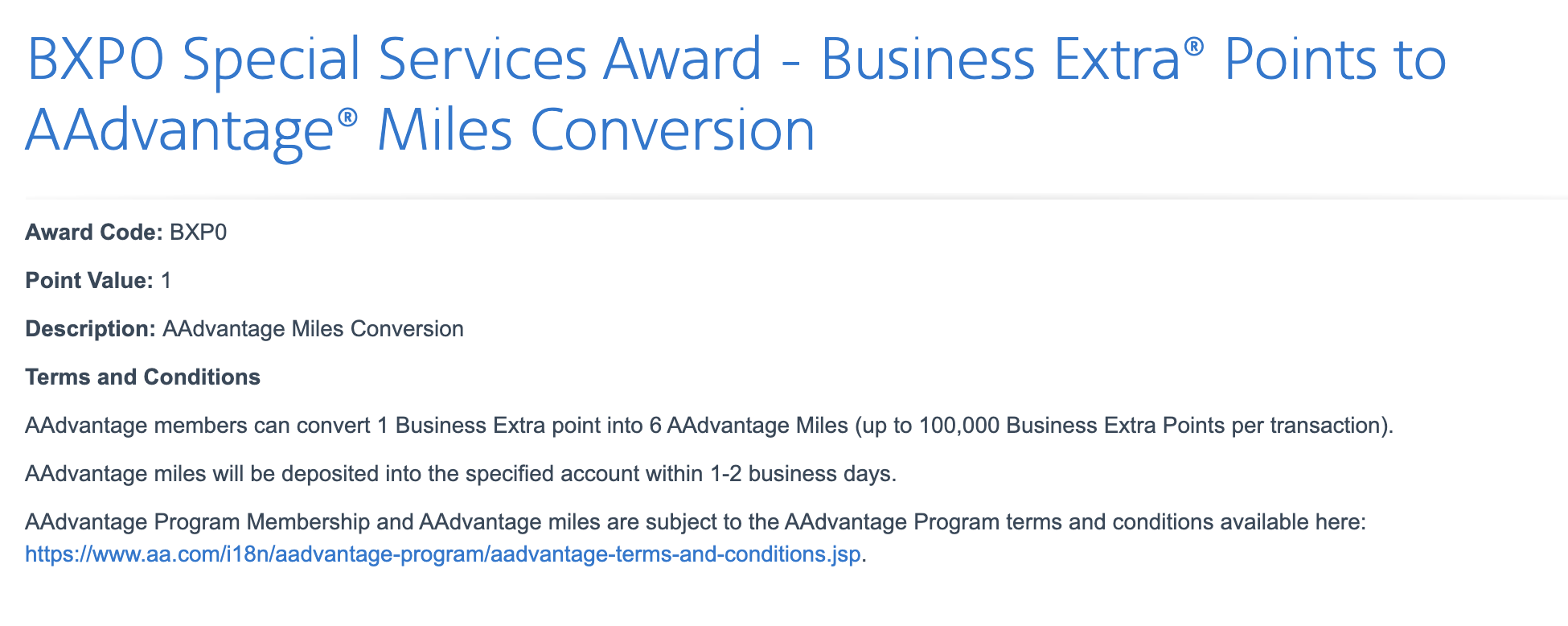

Convert Business Extra into AA miles = 1.2 miles per dollar spend on AA

As a quick refresher you need to spend $5 to earn 1 business extra point. Now you can redeem one business extra point for 6 AA miles

$5k = 1000 Business Extra Miles = 6000 AA miles  Business Extra points can now get you higher status

Business Extra points can now get you higher status

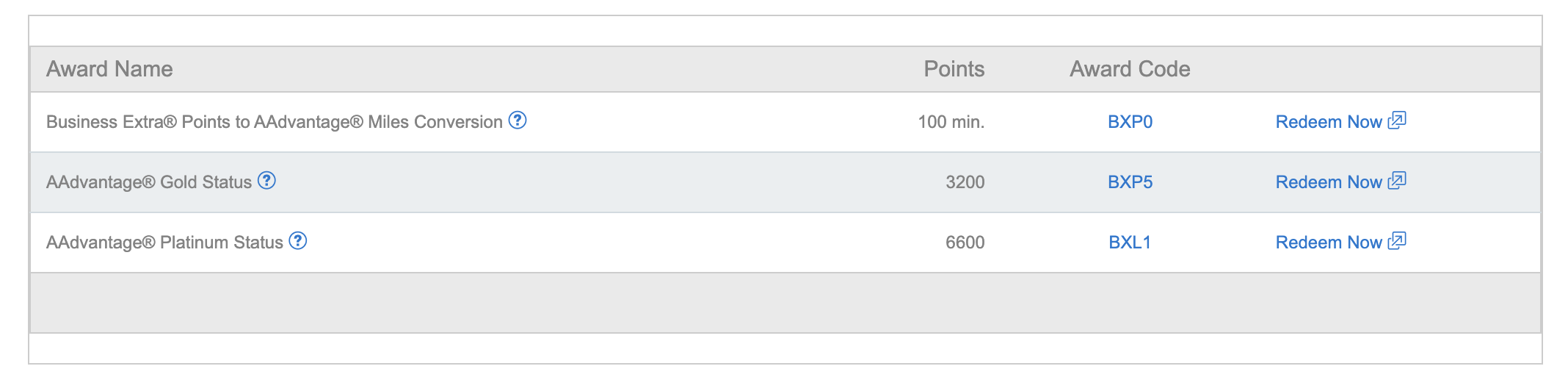

As you can see in the table below…you can offload Business Extra points for AA status

- Gold = 3200

- Platinum = 6600

Overall

Overall

This will be the death of business extra for a lot of small businesses.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.