This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

A few days ago American Airlines unveiled their new loyalty program which now revolves around their new currency called Aadvantage Loyalty Points. This isn’t a semantic change, it’s a reinvention of the entire concept of airline loyalty. Rumors had been circulating that American was changing their award system and most in the blogging world thought it would be another devaluation. No one saw this coming.

American revamped what it means to be loyal to their program. No longer is it about how you fly, but rather how you spend. Sure, there have been spending requirements associated with status leading up to this announcement, but this move is a tacit admission that American is in the miles business, not the flying business. Yes, they fly planes, but they make nearly all of their profit on miles. In one fell swoop American has given reason to actually spend on their credit cards. With Loyalty Points, you won’t even need to fly a single flight to earn Executive Platinum status ( however, you will need 30 segments to get System Wide Upgrades, Admiral’s Club Day Passes, etc ). You can simply spend your way to status on a credit card.

Long story, short. If you’re a flier who spends a lot of money with American Airlines – things just got better for you. If you’re the casual flier who picked up Gold or Platinum on discount seats…things got worse. I’d even argue that for the casual American flier, you’d be better off crediting your flights to Alaska than American.

Let’s a look at the new American Airlines Aadvantage Loyalty Points program

When do Loyalty Points take effect?

Beginning January 1st, 2022 the program will completely shift.

There are no more EQM, EQD, EQS

All of those are gone. In fact, as I mentioned up above, there are no flying requirements to achieving status, only earning Loyalty Points. The only time a flying requirement comes into the conversation is at the Platinum Pro and beyond level regarding Loyalty Choice awards which we’ll talk about later in this article.

How do you earn American Airlines Aadvantage Loyalty Points?

You can earn Loyalty Points 3 ways

- Flying on American Airlines

- 5x per $1 you spend

- 7x Gold

- 8x Platinum

- 9x Platinum Pro

- 11x Executive Platinum

- 5x per $1 you spend

- Flying on a partner

- You can read how many you’d earn here

- The miles you earn would count towards Loyalty Points the same as before, including Elite status bonuses

- You can read how many you’d earn here

- American Airlines credit cards

- Sign up Bonuses don’t earn Loyalty Points

- 1 mile per USD spent on eligible US and Internationally issued credit cards

- eshopping portals, dining portals, SimplyMiles

- just the base miles…no bonus spend is counted

- Case in Point – Stand up to Cancer is offering 10x. If you donated $1k you’d earn 10,000 miles to use towards flights, but only 1000 Loyalty Points.

- just the base miles…no bonus spend is counted

*We still don’t know about Bask Banking and whether those count towards elite status or not. If you’re unfamiliar with Bask, you can earn 1 AA mile for every dollar you keep in their bank account. Theoretically, if this were a qualifying method, just holding $200k in a Bask account would earn you Executive Platinum status. I’d say that’s highly unlikely to qualify.

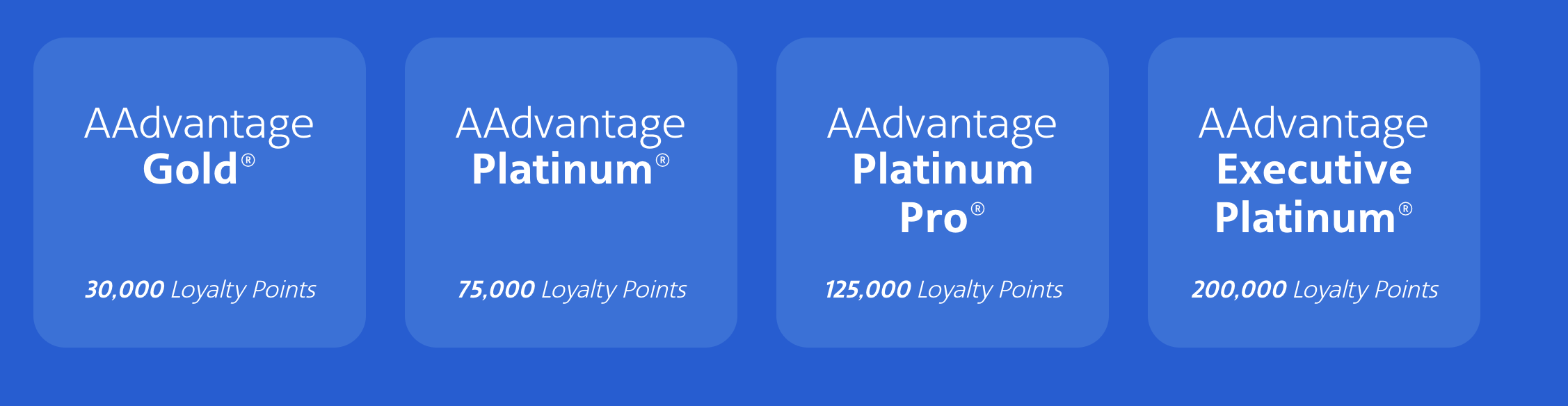

How is status earned with Loyalty Points?

It’s all revenue based. The more you spend in any of the above ways, you’ll get closer to achieving status. This means if you spent $75k on just your Barclay Aviator Red…you’d hit Platinum status.

- 30k Loyalty Points – Aadvantage Gold

- 75k Loyalty Points – Aadvantage Platinum

- 125k Loyalty Points – Aadvantage Platinum Pro

- 200k Loyalty Points – Aadvantage Executive Platinum

How many bonus points do Elites earn?

The biggest takeaway here is that if you are entering 2022 with Status, you have a huge advantage since you earnings are staggered in the following way:

- Flying on American Airlines

- 5x per $1 you spend

- 7x Gold

- 8x Platinum

- 9x Platinum Pro

- 11x Executive Platinum

- 5x per $1 you spend

Let’s take the case of a base member who wants to earn Platinum status vs a Platinum Elite wanting to keep Platinum status.

Let’s take the case of a base member who wants to earn Platinum status vs a Platinum Elite wanting to keep Platinum status.

- You need to earn 75,000 loyalty points

- A base member

- 5x on the first $6k spend to get to Gold status at 30,000 Loyalty Points

- 7x on the next $6428 to hit 75,000 total

- Total Spend is $12428

- A Platinum member retaining status

- 8x on all flying and needs to 75,000

- $9375

- A base member

Clearly, entering into next year with status is advantageous

How is the status qualifying year defined? It’s moving to March 1st to March 31st.

Starting in 2022, the status year is shifting and will counted beginning March 1st and will expire end March 31st of 2023.

- The qualifying year is from 3/1/22 until 2/28/23

- It will expire at the end of March

A one time double up in 2022 – 2 more months to earn 2021 and 2022

For next year only, you’ll be able to earn miles that count towards 2022 and 2023 status in January and February of 2022

Let’s say you end 2021 10k EQM short of Platinum Status

- You’ll actually be able to count the first two months of 2022 towards 2022 AND 2023 status

- You’ll earn EQM, EQD, EQS alongside Loyalty Points

- 2 more months to hit status from 2021

- 2 more months of the new Loyalty Program , so 14 months of spending to hit status for 2022/2023.

- Jan 2022 to end of Feb 2023 vs March 2022 to Feb 2023.

Loyalty Choice Rewards start at 125k Points/ Platinum Pro Status / require 30 flights

You can see below the chart AA put out that correlates some of the benefits enjoyed by Platinum Pro, Executive Platinum status and beyond. The big ones to look at are the System Wide Upgrades which I personally value the most on this list. This also incentivizes people to fly vs just spend their way to status.

How will my upgrades be processed?

- Status is ranked first

- Whomever has higher, gets the upgrade

- Same status?

- Whomever has the most Loyalty Points wins

Is anything happening to mileage redemptions?

Not yet…which is a massive win for everyone. The big fear was that the mileage redemptions would skyrocket and resemble Delta. That hasn’t happened and thank goodness.

Japan Airlines First Class is still just 85k miles.

American is rewarding loyalty based on revenue – bad news for the average joe

American is rewarding loyalty based on revenue – bad news for the average joe

This has been a long time coming and we have seen the redefining of American, and other airlines, from who puts their butts in our seats most, to who makes us most profitable. As I said before, American makes almost every dollar of profit on the back of the milage program and not from flying. It seems like a no brainer for them to incentive putting more spend on their credit cards, shopping and dining portals, and rewarding those who pour money into their most profitable segment. One thing that doesn’t really make sense to me is why all of the ancillary fees don’t count like baggage fees, food and drinks, upgrades, 500 mile upgrade certs, or even mileage purchases. I mean hell, they keep a book value on mileage far below their sales so why wouldn’t they count those purchases as Loyalty Points, even give bonuses? I’m paying way more than Citi or Barclay is paying for an AA mile when sold directly to me, why wouldn’t I get incentivized to do so?

I suspect those things will be unpacked as the program is further developed.

When I first started geeking out at points and miles there was a romance aspect to getting rewarded for your time spent flying. Every mile flown equated to me getting closer and closer to status. That’s no longer the case really.

What should I do if I don’t spend much on flying?

I’d look at crediting to Alaska. They’re both One World Partners, have reciprocal benefits, etc. I think there is a the distinct chance that you may end up qualifying for Alaska status via AA flights easier than you would qualify for AA status. The big kicker is you’ll likely not get upgraded nearly as often, but you’d have access to better seats, potential lounge access internationally, and a wonderful award program that is very attractive and accesses wonderful partners.

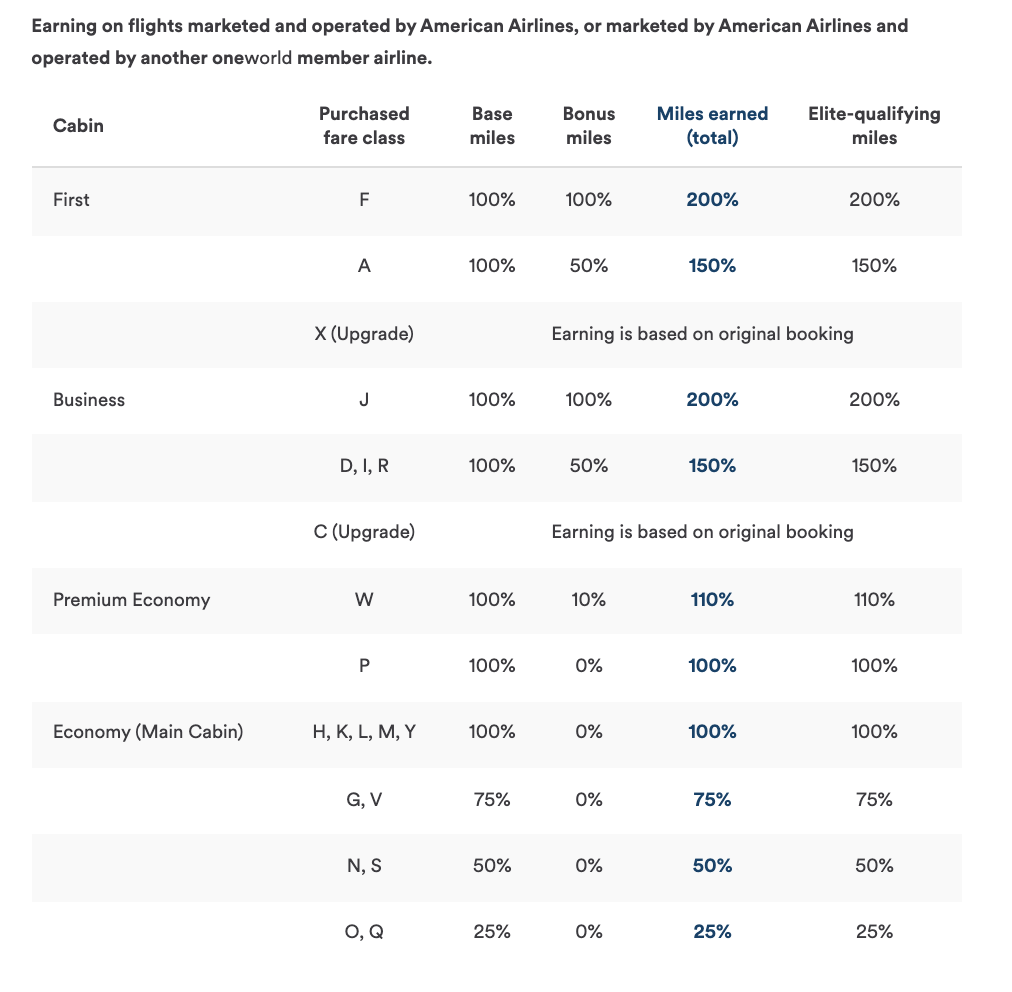

Here’s how many points you’d earn crediting an American Flight to Alaska

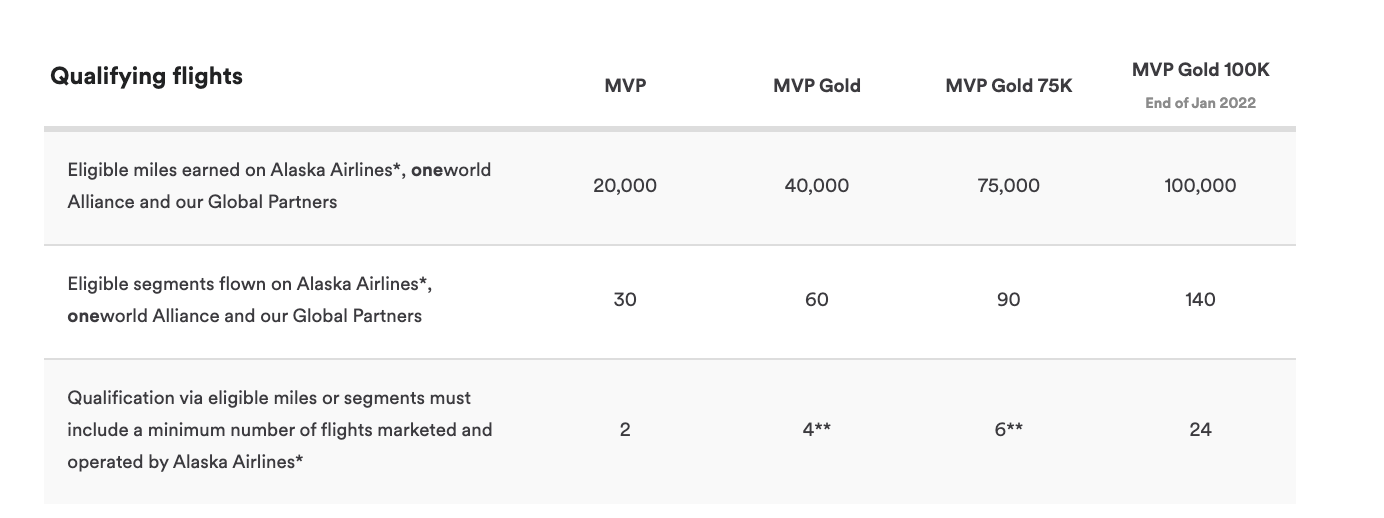

And the pathway to Elite Status – pay attention to the minimum Alaska flights needed. If you never fly Alaska, this isn’t for you.

If you flew 30 AA flights, of roughly 1500 miles a piece, next year that averaged about $300 a ticket you’d earn 45000 Loyalty Points if starting with no status and end the year AA Gold. If those were in Main Cabin Economy ( H,K, L.M, Y ) , and you credited it to Alaska, you’d earn 45000 Elite Miles and end up MVP Gold, or One World Sapphire. You’d need 4 Alaska Flights as well, but you’d be a full level higher, have access to international business class lounges, and even be able to select Main Cabin Extra when flying on American. This is hypothetical and requires finding those fare buckets, but it’s worth considering at the very least.

If you flew 30 AA flights, of roughly 1500 miles a piece, next year that averaged about $300 a ticket you’d earn 45000 Loyalty Points if starting with no status and end the year AA Gold. If those were in Main Cabin Economy ( H,K, L.M, Y ) , and you credited it to Alaska, you’d earn 45000 Elite Miles and end up MVP Gold, or One World Sapphire. You’d need 4 Alaska Flights as well, but you’d be a full level higher, have access to international business class lounges, and even be able to select Main Cabin Extra when flying on American. This is hypothetical and requires finding those fare buckets, but it’s worth considering at the very least.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.