This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

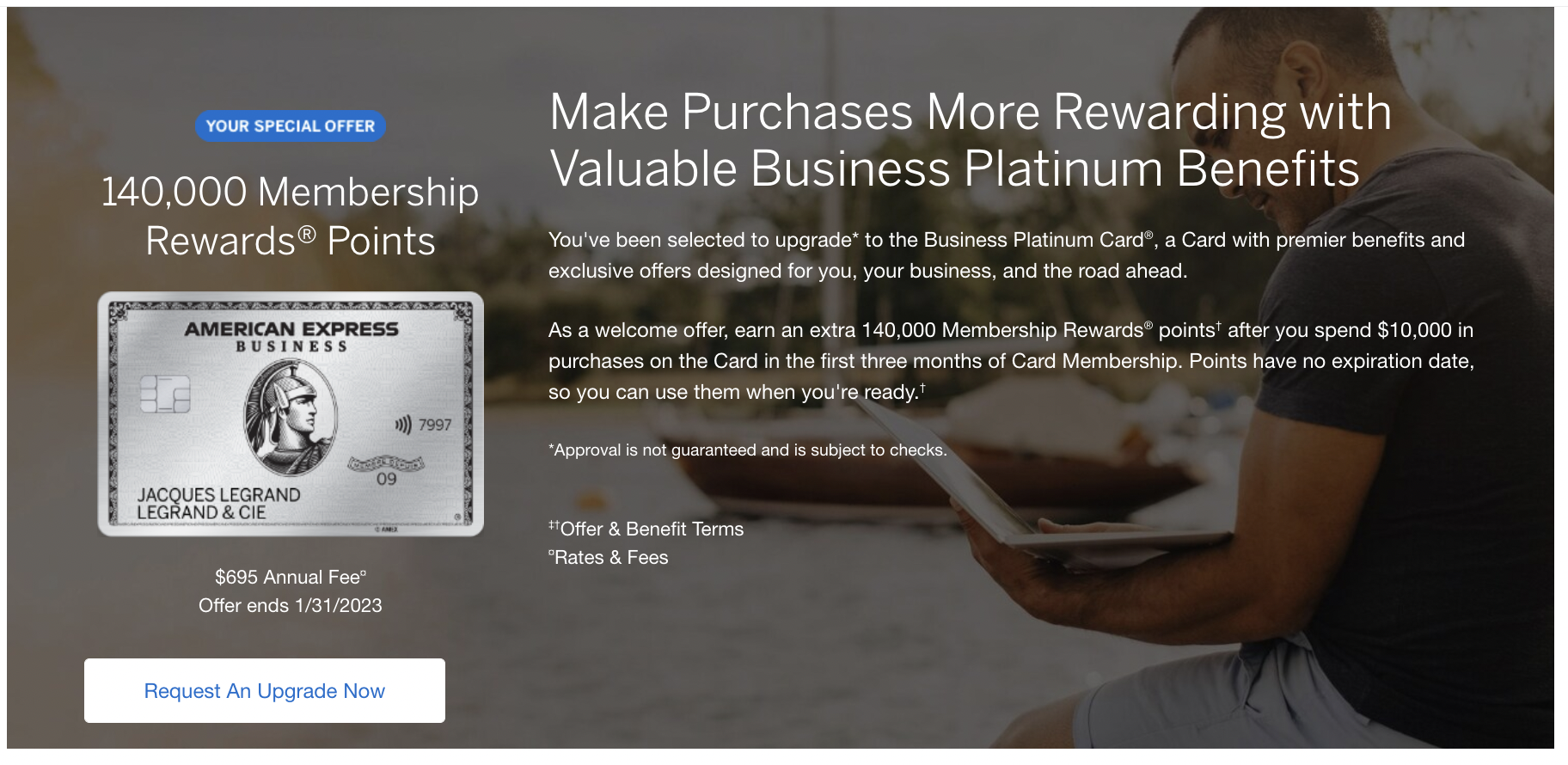

140k Amex Biz Platinum Upgrade Offer

Big hattip to Running with Miles for providing the latest iteration of an Amex Business Platinum upgrade. Pretty straight forward, if you have a card that qualifies for an upgrade you can click the link below to see if you qualify for this offer. I have 3 Amex Business Platinums right now and 3 Amex Business Golds and was not included in this go around. Lemme know if you are!

Check to see if you’re eligible for the upgrade offer

A few things to know about upgrade offers

- Ordinarily this requires no credit pull since it’s upgrading an existing account

- These are targeted so you may/may not qualify

- The offer below looks like it’s valid until 1/31/23

- 140k after $10k spend in 3 months

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.