We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The partnership ends January 2019

I’ve long had my eye on the American Express Platinum Mercedes Benz card. It comes with great perks, and if you’ve already had a normal Amex Plat, it provided a way to get bonus points a second time. I almost pulled the trigger last year when it was offering a 75k point sign up bonus, but ultimately didn’t pull the trigger because I wanted to lower my 5/24. As luck would have it, my opportunity may be ending sooner than I’d thought. The application page now says that the releationship is ending January 2019, and that the card will be replaced with something else.

Here’s the current offer. I’m going to hold off for now…

Why? There doesn’t seem to be any indication that the card offer is going away any time soon. If that changes, I’ll probably hop on it. But, in the past, with Amex and other issuers, the final weeks of any card iteration often equates to incredible offers…Since this card isn’t really being cancelled, just converted, Amex has the opportunity to attract even more signups by applying the same technique. So, I’ll wait and see what’s up.

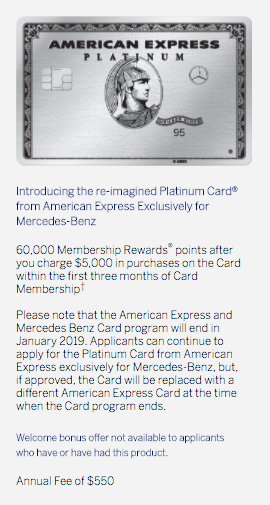

If you click on through to the application page, you will see this:

The language is used on both the basic MB Amex and the Platinum version. So…the relationship is being wound down, not just the Platinum version.

It should also be noted that the welcome bonus isn’t available to those you currently have a Platinum card.

Clearly, the relationship is ending. Is it going somewhere else? Will MB cobrand with another credit card company? What do you think…

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.