This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The American Express® Business Gold Card has had a bit of a refresh including a new annual fee of $375 which will hit 2/1/24 ( for any applications that day or after ). There are new statement credits, a switcharoo on 4x bonus categories, and if you want to read our full review...go here. Let’s take a quick look at the changes.

You can even get it in Rose Gold now…similar to the personal version.

4x categories have switched around

Amex gives you a list of 4x bonus categories, and from that list, whichever two categories you spend most on within a month, you’ll earn the 4x. The other categories will remain at 1x Membership Rewards per dollar spent. The just revamped the list…here are the changes.

Gone:

- Airline tickets direct with the airline

- Shipping

- Technology and hardware providers

New Categories in italics

- 4x on your choice of purchase at any 2 of the following categories

- U.S. purchases for advertising in select media (online, TV, radio)

- U.S. purchases made directly electronic goods retailers and software & cloud systems providers

- U.S. purchases at gas stations

- U.S. purchases at restaurants, including takeout and delivery

- Transit purchases

- including trains, taxicabs, rideshare services, ferries, tolls, parking, buses, and subways

- Monthly wireless telephone service charges made directly from a wireless telephone service provider in the U.S.

- Capped at $150k total on combined categories

25% points rebate is gone

It used to be that if you booked a flight via Amex Travel and used Membership Rewards to book, you’d get 25% of those points back. That benefit is gone, and makes me wonder if we will see it cut from the Business Platinum as well ( currently 35% rebate ).

Annual fee is going up

Starting 2/1/24 the annual fee on the card will be $375 a year.

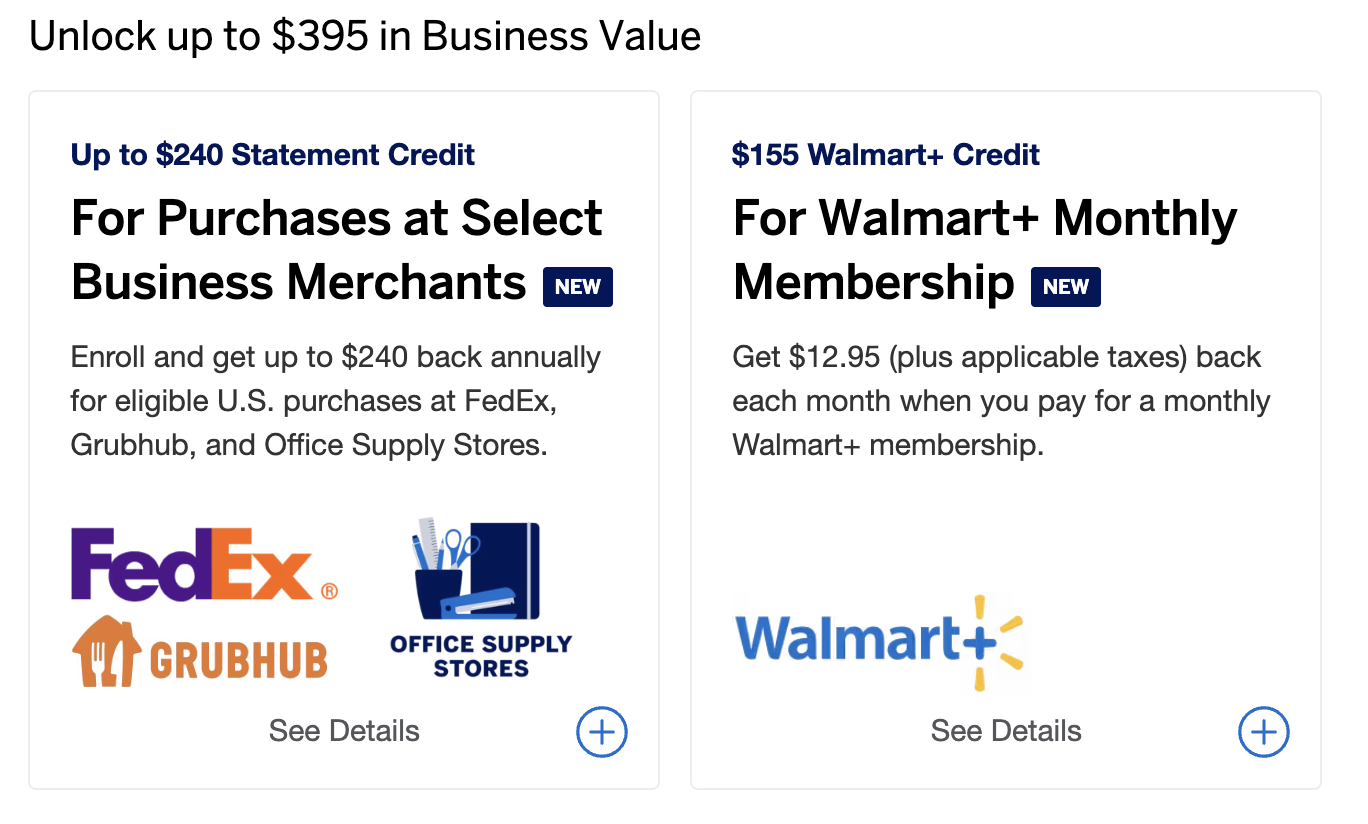

New Statement Credits have been added

These statement credits need to be enrolled, and if you utilize them, can help offset much of the annual fee. Personally, I will be focused on Office Supply and Grubhub

- Earn up to $20 in statement credits monthly after you use the Business Gold Card for eligible U.S. purchases at FedEx, Grubhub, and Office Supply Stores. This can be an annual savings of up to $240. Enrollment required.

- Get $12.95 back in statement credits each month when you pay for a monthly Walmart+ membership (subject to auto-renewal) with your Business Gold Card. $12.95 plus applicable taxes.

Just remember that you need to enroll to get these some of these credits

Just remember that you need to enroll to get these some of these credits

Overall

Overall

The fees on credit cards are continuing to go up across the marketplace and Amex is staying the course by adding in statement credits to help offset the fee. The big question becomes…are they too much of a hassle to utilize to actually erase what is now a very high annual fee. For someone like me, who does this for a living, I’ll spend the time to get my $20 a month credit, for most other people…it’s anyone’s guess.

The idea that you can easily earn 4x, up to $150k a year, on bonus categories, and earn 3x on travel booked in the Amex travel portal is quite attractive, and I’d say it’s must easier to justify paying $375 a year for this card vs $695 for the Business Platinum

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.