This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

One perk of the American Express Business Platinum card ( and Platinum card) that isn’t heavily promoted, advertised, or blogged about is the International Airline Program available to US cardholders. In the past year, American Express revamped the International Airline Program, enhancing what was a once an overhyped, full-fare, buy1get1 program to one that not only warrants a look, but has proven to not only offer VERY COMPETITIVE rates, it has also proven to be a better deal than transferring to partners on several occasions. Yes, you read that right, it could be BETTER than transferring your Amex points to partner.

Why am I highlighting the Business Platinum vs Personal ( or Centurion )?

Because I’m highlighting using points. Amex Business Platinum gets 1.54 cents vs personal at 1 cent.

The Amex Business Platinum has a unique benefit that the personal Amex Platinum doesn’t have…35% of your points are refunded when you redeem through Amex Travel ( The International Airline Program included )

- You must redeem on your chosen Airline

- Or ANY flight, on a qualifying airline ( listed below ) in a premium cabin

This equates to a roughly 1.54 cent per point rate.

Of course, you have access to this program if you are a Centurion Cardholder as well, and at a redemption rate of 2 cents. I could highlight this, and have come across clients with Black cards, it’s a very, very small portion of cardholders. The value proposition is even greater with them than Biz Plats.

Widget not in any sidebars

Usually point transfers to a partner make the most sense because you get a higher rate of return on your points.

This is usually the case, but not always. Here’s a couple instances where using the International Airline Program made for a competitive discussion.

- I recently had a client wanting to go to South America over New Years. Award space is tight. I ended up finding him and his wife flights on the days he wanted, by BUYING the flights through the airline program vs any attractive redemption options. The pricing equated to roughly 75k a person, each way.

- While this is more than say AA’s Saaver rate of 57.5k – it’s a solid deal to fly at peak season, on the days they wanted, and on top of that…they will earn airline miles.

- I processed another client’s request that involved Air France. I was seeing some roundtrips for 170k points a person using the IAP. 85k isn’t the absolute best deal, but it’s pretty competitive rate during the high volume summer travel months, and well under the 290k a person pricing I was seeing to fly the same routes with a transfer. We ultimately went in a different direction, but the idea is the same: It’s worth the comparison.

It won’t always work out this way, but it’s something you should investigate in your search. Keep these things in mind:

- You need to have the entire balance of points in your account ( pre 35% refund ) to purchase the tickets solely on points

- While you effectively get 1.54 cents per point on redemptions like this, you should look at your total cost and other factors

- Certain airlines like, BA, Air France, Emirates, Lufthansa often have very high fees associated with redemptions

- This is dependent on route and program used to redeem, but as a general statement this is true

- Compare the total cost, not just the point aspect. Even if it costs more points it may be saving you a bunch of taxes and fees. For instance, you may be able to lock down a roundtrip flight on Air France for 150k + $600 by transferring, whereas 170k points may buy the flight outright with the IAP.

- Certain airlines like, BA, Air France, Emirates, Lufthansa often have very high fees associated with redemptions

You need healthy Amex balances

The main thing here is that you will be using solely Amex points. Most of the clients I work with, as well as my own personal travel, utilize currency combinations to shore up partner accounts. A little Chase here, a little Amex there, sprinkle in some Citi for flavor, and voila 😉

However, many people have their business expenses tied to their Amex, or are issued a corporate Amex. In both of these scenarios, and one that I see often with clients, is that they are Amex point rich compared to other currencies. Using a few more Amex to earn airline miles, elite status, or save on taxes and fees may make more sense to them as they accumulate Amex points more quickly and thus feel freer to spend them at a higher velocity.

Here are the airlines included in the program:

- Note – you must originate and return to the US to qualify for the pricing.

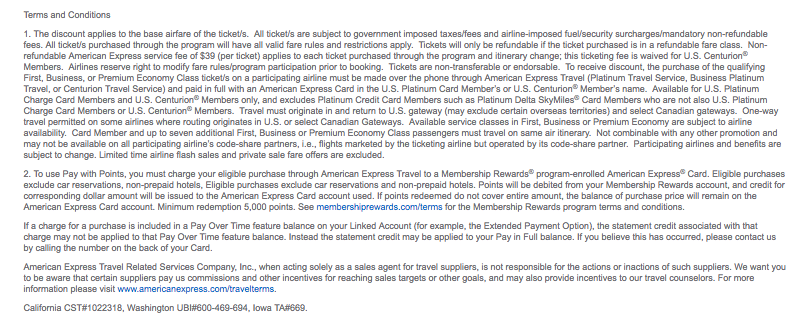

Terms and conditions of the Program:

The broadstrokes

- $39 per person fee

- Must be a US Cardholder

- Must originate and return to the US/Canadian Gateways

- First, Business, Premium Econ

- Includes up to 7 additional passengers

- Pay with Points – full balance must be in account, not the amount post 35% refund

- Minimum 5k points

Widget not in any sidebars

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.