This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

One of my favorite benefits of holding an American Express are the targeted Amex Offers. I currently hold two Amex Platinums, one business version and the now retired Mercedes Benz branded version, and together they cost me $1000 a year in annual fees. That’s a hefty amount. While they both carry a bevy of benefits, I’ve found that I extract a ton of value in these targeted offers. While I’m not in the market for a new bed at the moment, I was just speaking to a member of my family who needs one. Voila, I log on to the site and here’s a targeted offer. What are those odds?

I went to Casper.com to price beds, and was pleasantly surprised to see that their entry level Twin bed starts at $350. Queens at $600. If you’ve been mattress shopping lately, you’ll recognize those are great prices. With that being said…nicer models go above $2k, so it wouldn’t be too difficult to hit the $1500 if you were going higher end or buys duvets, pillows, etc.

If you’re thinking you’ve heard of Casper, but don’t know why…it’s probably cause it’s featured in American premium cabins.

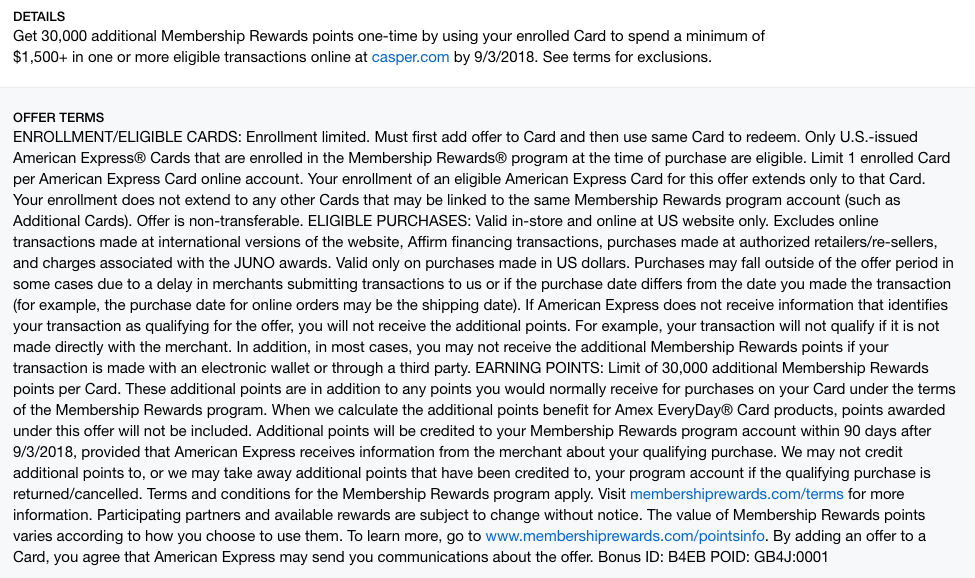

Details of the deal:

- Transactions must be on casper.com

- Done by 9/3/2018

Widget not in any sidebars

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.