This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

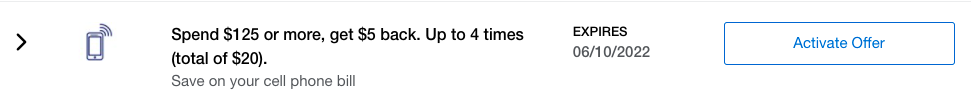

We saw this offer pop up in the summer of 2021 and it’s back. Check your Amex Offers to see if you the following mobile phone offer: spend $125 get $5 off. This can be on combined purchases and runs until 6/10/22 so make sure you pay your bill before the expiry date in June

My Amex Platinum was targeted which could be good for many people since it comes with free Cell Phone insurance. but what would have been even better is if you get it targeted on a Business Platinum since it gets a $10 a month mobile phone credit. That’d be a great stack.

I have 3 Amex Biz Plats and none were targeted – if you get it, lemme know!

I spend more than $2000+ a year on annual fees across 10 Amex cars and lemme tell you, every little bit helps. In fact, I’d say that utilizing Amex Offers and the credits each individual card carries puts me net positive each year.

Here are the 7 American Express Cards that I keep and links to their current offers and why we have them in our wallet and recommend your consideration.

- American Express Platinum

- American Express Gold

- 3 American Express Business Platinum

- 3 American Express Business Gold

- 2 American Express Blue Business Plus

Spend $125 get $5 back on your mobile phone bill

It’s not the biggest % back, but every little bit helps and it doesn’t look to be pegged to any provider.

- Spend $125 get $5

- Up to 4x

- Can be on combined purchases

- Excludes VoIP, hardware, equipment, bundled home/cable

- Ends 06/10/22

Terms and conditions

Terms and conditions

Enrollment limited. Must first add offer to Card and then use same Card to redeem. Only U.S.-issued American Express® Cards are eligible. Limit 1 enrolled Card per Card Member across all American Express offer channels. Your enrollment of an eligible American Express Card for this offer extends only to that Card. Offer valid only for payments for wireless telephone service charges made directly with US wireless telephone service providers via online, mobile app, or by phone. Purchases made with third parties, authorized retailers or resellers are excluded. Excludes purchases for VoIP, hardware, equipment, and bundled home/cable services. Offer is non-transferable. Limit of 4 statement credits (total of $20 back) per Card Member. You may not receive the statement credit if we receive inaccurate information or are otherwise unable to identify your purchase as qualifying for the offer. For example, you may not receive the statement credit if (a) the merchant uses a third-party to sell their products or services; or (b) the merchant uses a third-party to process or submit your transaction to us (e.g., using mobile or wireless card readers); or (c) you choose to make a purchase using a third-party payment account or make a purchase using a mobile or digital wallet. Merchants are assigned codes based on what they primarily sell. Your transaction also will not qualify if the merchant’s code is not eligible. Purchases may fall outside of the offer period in some cases due to a delay in merchants submitting transactions to us or if the purchase date differs from the date you made the transaction (for example, the purchase date for online orders may be the shipping date). Statement credit will appear on your billing statement within 90 days after 6/10/2022, provided that American Express receives information from the merchant about your qualifying purchase. Note that American Express may not receive information about your qualifying purchase from merchant until all items/services from your qualifying purchase have been shipped/provided by merchant. Statement credit may be reversed if qualifying purchase is returned/cancelled. If American Express does not receive information that identifies your purchase as qualifying for the offer, you will not receive the statement credit. Limit 1 enrolled Card per American Express Card online account. The enrolled Card account must be active, not past due, canceled, or have a returned payment outstanding to receive statement credits. Any benefit earned from this offer is in addition to the rewards (i.e. Membership Rewards or cash back) earned as part of your existing Card benefits, but your ability to earn spend-based rewards for the purchase will be based on the amount after any statement credit or other discount is applied. Amex Offers are dynamic and personalized, so the offers you see may change. For questions regarding your Card Account, please call the number on the back of your Card. By adding an offer to a Card, you agree that American Express may send you communications about the offer. POID: K3AE:0001

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.