We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

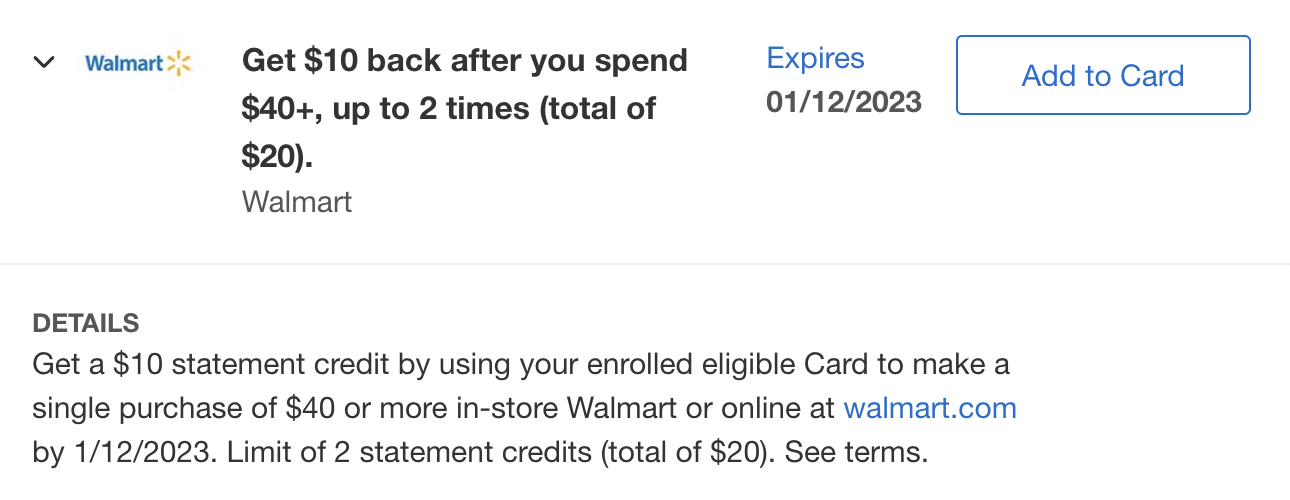

Amex Offers: Spend $40 get $10 back at Walmart

I mean who doesn’t spend money at WalMart? This is well timed for Christmas and the holiday season and is good online, in store, in the app, but needs to be in the US. When you spend $40 or more with your enrolled Amex, you’ll get $10 back as a statement credit. You can do it 2 times as well.

Remember Amex Platinum has a WalMart credit that includes Paramount+ now, so if you’re using WalMart+ this wouldn’t offset any of the cost of membership, but I would think any purchases made on WalMart.com would count even via a membership.

Why we love Amex Offers

I find throughout the year the savings that can be had by adding Amex Offers to your targeted cards can outweigh your annual fee without taking any other benefits into consideration. Maybe not the entirety of the $2000+ that I pay in Amex Annual fees from my 8 cards, but every bit helps.

Here are the 9 American Express Cards that I keep and links to their current offers and why we have them in our wallet and recommend your consideration.

- American Express Platinum

- American Express Gold

- 3 American Express Business Platinum

- 2 American Express Business Gold

- American Express Blue Business

- American Express Blue Business Plus

The Deal:

- Spend $40 get $10 back

- Offer valid in-store, online at US website Walmart.com or via the Walmart mobile app.

- Excludes :

- bulk gift cards & e-gift cards, in-store purchases, layaway purchases, insurance services, auto services, pharmacy transactions, protection plans, and recurring subscription services (for example, Walmart+ memberships, Beauty Box and Baby Box

- Enrollment required

- Ends 01/12/23

- Limit two times

Terms and Conditions:

Enrollment limited. Must first add offer to Card and then use same Card to redeem. Only U.S.-issued American Express® Cards are eligible. Limit 1 enrolled Card per Card Member across all American Express offer channels. Your enrollment of an eligible American Express Card for this offer extends only to that Card. Offer valid in-store, online at US website Walmart.com or via the Walmart mobile app. Not valid on purchases shipped outside of the US. See merchant website for shipping policy. Some merchants may not ship to all areas. Excludes purchases from third party or affiliate websites linked with/from walmart.com or grocery.walmart.com (such as, but not limited to, Walmart Contacts, Walmart Checks, Walmart Photo Services, Walmart Stationary, and Walmart Moneygram). Excludes bulk gift cards & e-gift cards, in-store purchases, layaway purchases, insurance services, auto services, pharmacy transactions, protection plans, and recurring subscription services (for example, Walmart+ memberships, Beauty Box and Baby Box). Offer is non-transferable. Valid only on purchases made in US dollars. Limit of 2 statement credits (total of $20 back) per Card Member. You may not receive the statement credit if we receive inaccurate information or are otherwise unable to identify your purchase as qualifying for the offer. For example, you may not receive the statement credit if (a) the merchant uses a third-party to sell their products or services; or (b) the merchant uses a third-party to process or submit your transaction to us (e.g., using mobile or wireless card readers); or (c) you choose to make a purchase using a third-party payment account or make a purchase using a mobile or digital wallet. Purchases may fall outside of the offer period in some cases due to a delay in merchants submitting transactions to us or if the purchase date differs from the date you made the transaction (for example, the purchase date for online orders may be the shipping date). Statement credit will appear on your billing statement within 90 days after 1/12/2023, provided that American Express receives information from the merchant about your qualifying purchase. Note that American Express may not receive information about your qualifying purchase from merchant until all items/services from your qualifying purchase have been shipped/provided by merchant. Statement credit may be reversed if qualifying purchase is returned/cancelled. If American Express does not receive information that identifies your purchase as qualifying for the offer, you will not receive the statement credit. Limit 1 enrolled Card per American Express Card online account. The enrolled Card account must be active, not past due, canceled, or have a returned payment outstanding to receive statement credits. Any benefit earned from this offer is in addition to the rewards (i.e. Membership Rewards or cash back) earned as part of your existing Card benefits, but your ability to earn spend-based rewards for the purchase will be based on the amount after any statement credit or other discount is applied. Amex Offers are available for varying and limited periods of time and are dynamic and personalized. If you navigate away from the Amex Offers page, you may see different offers when you return. For questions regarding your Card Account, please call the number on the back of your Card. By adding an offer to a Card, you agree that American Express may send you communications about the offer. POID: K4SB:0001

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.