We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

How to earn points hand over fist shopping online

Are you struggling to earn points to make those dream vacays possible? This simple method will help you stack loads of points.

Loyalty programs have their own online shopping portals that will code your order to earn points in their program. It’s a super easy way to earn tons of bonus points for items you’d purchase anyways. All you have to do is log into the shopping portal and then click a link to be redirected to retailer’s normal site.

Another cool aspect is you’ll be earning points on your credit card as well as points/miles via the shopping portal.

Etihad just announced they’re bringing back the apartment on their London to Abu Dhabi route. Pretty awesome redemption for 62.5k American miles or 65k Aeroplan miles. Using shopping portals help you earn those points more quickly.

Here’s a list of Shopping Portals

This is a pretty extensive list of airline and hotel portals with a couple cashback portals included. Personally, I don’t really use cashback portals unless the discrepancy is massive since I’d rather earn points/miles to use for aspirational travel redemptions.

Airlines:

- Aeromexico

- Air Canada Aeroplan

- Air France Flying Blue

- Alaska Airlines

- ANA

- American Airlines

- British Airways

- Cathay Pacific

- Delta

- Etihad

- Finnair

- Hawaiian

- Japan Airlines

- JetBlue

- KLM

- Lufthansa

- Qantas

- Singapore Airlines

- South African Airwaysf

- Southwest

- United

- Virgin Atlantic

- Virgin Australia

Hotels

Cashback

Other

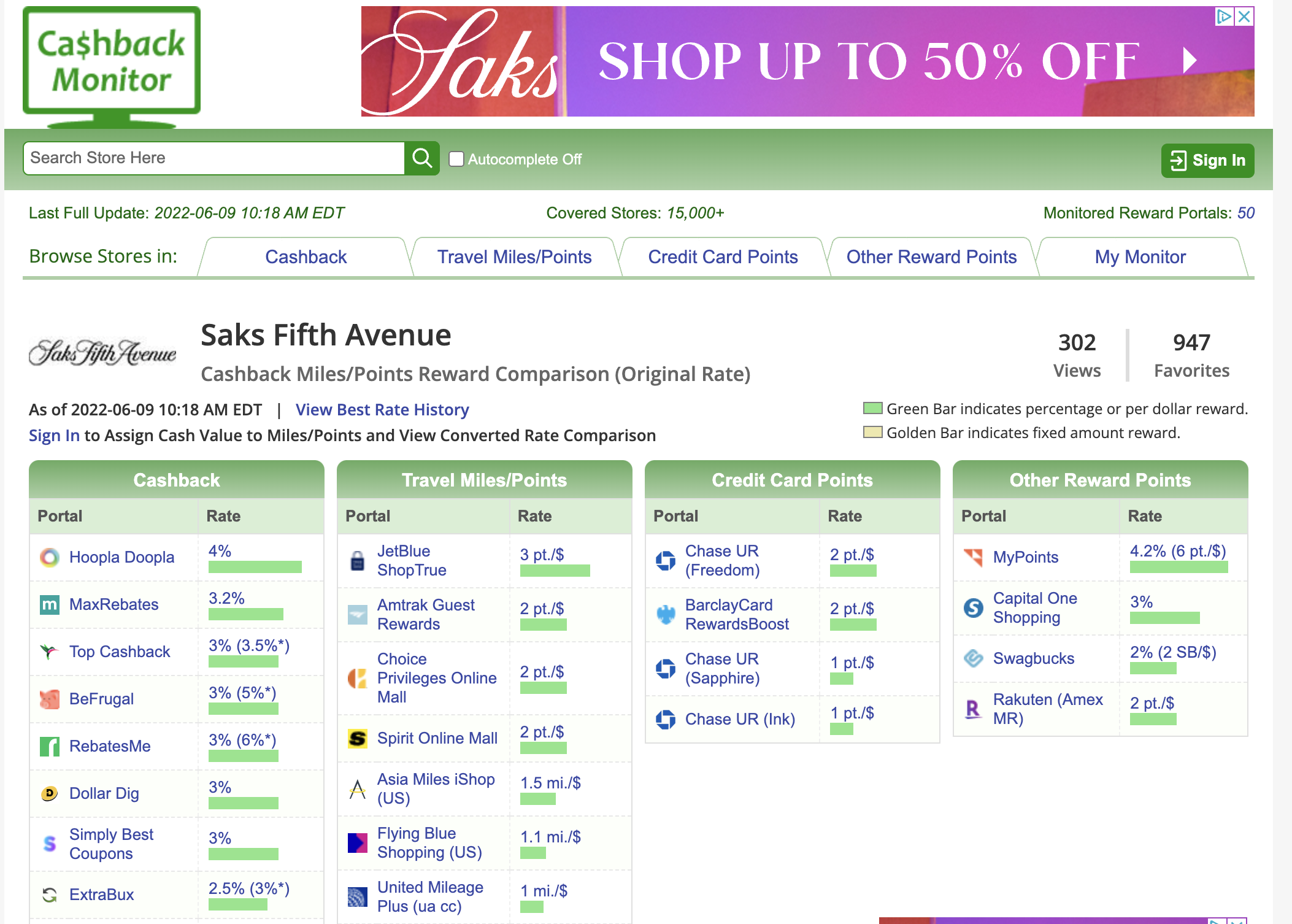

How do you know which one is best?

My favorite way to see which portal is offering the biggest bonus is CashBackMonitor

Rakuten to earn Amex points

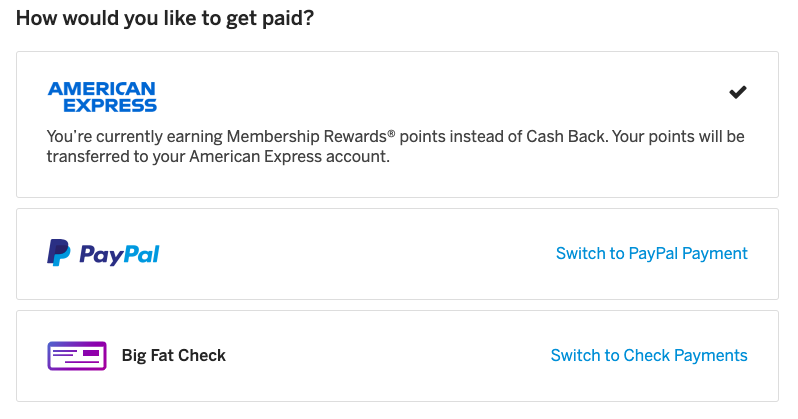

If you have an American Express that earns Membership Rewards then you can opt to earn those instead of Cashback via the Rakuten shopping portal. How does it work? Once you’ve selected that you’d prefer to earn Amex points vs cashback, you’ll start earning points on every purchase. If you see 15% cashback, they will pay you 15x points.

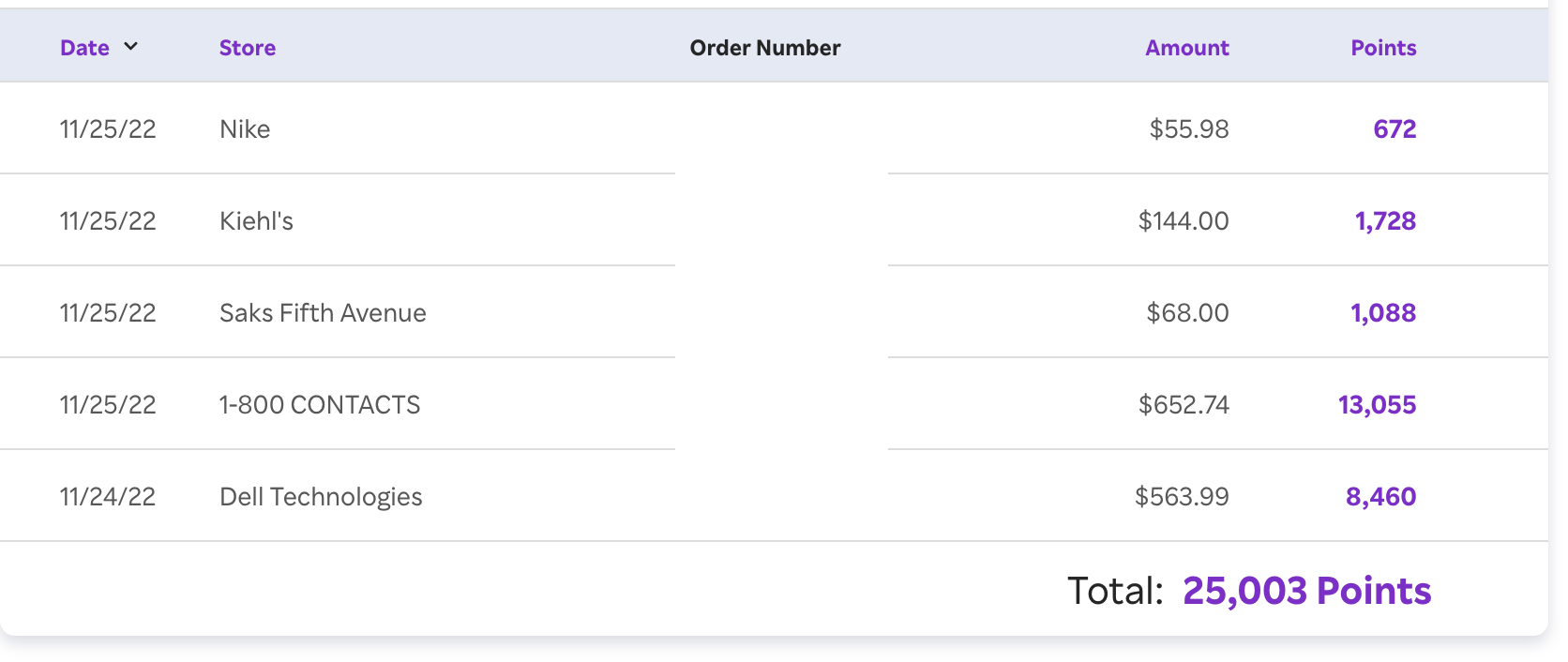

It’s a really great way to earn extra Amex points and since I value Amex points between 1.5 and 2 cents, you’re getting a bigger return back on your purchases than you’d otherwise get. Here’s an example of my Black Friday purchases ( bought a year’s supply of contacts and made use of my Amex Business Platinum Dell credits ). I spent about $1500 and earned 25k points.

Overall

One of the easiest ways to earn extra points on the purchases you’d already be making is via a shopping portal!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.