We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

5 easy ways to keep your points from expiring

One of the easiest things to do is forget you have points or miles in a loyalty account and lose them to expiration. This is especially an issue since a lot of loyalty programs suspended point expirations during the pandemic, but now they have re-implemented their old policies. Thankfully, there are numerous ways to keep them alive, but here are 5 easy ways to keep your points from expiring.

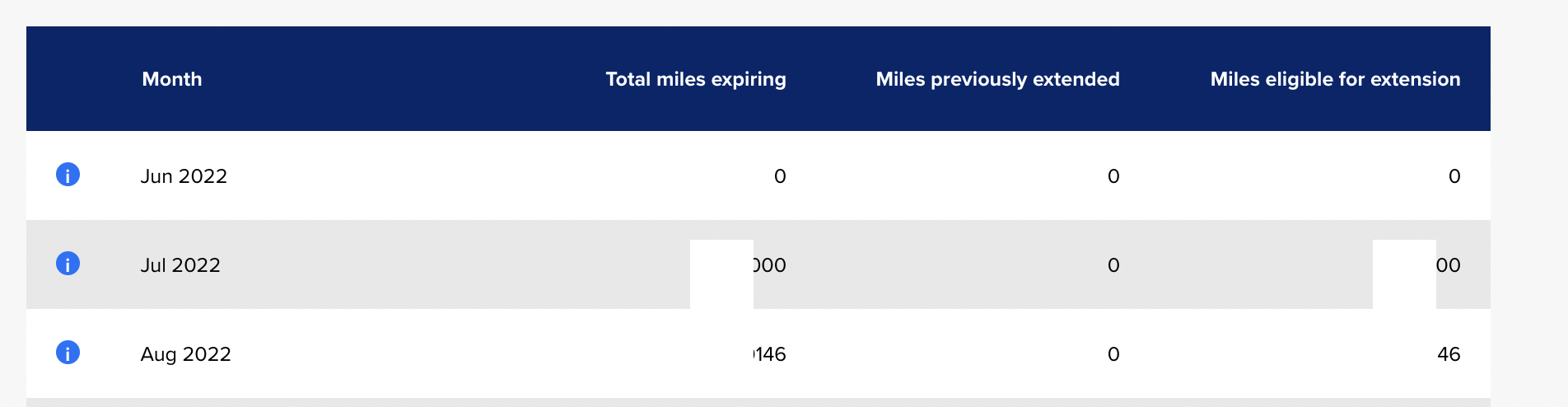

I was reminded that Singapore Airlines miles normally expire if you don’t use them within 36 months ( they’re automatically extending them for 6 months if they expire this year ). I received an email and checked my account. Without the pandemic extension, I’d lose nearly 100k miles to expiration!

How often do points and miles expire?

Great question….Here’s a basic chart that will help keep track

| Program | Expiration after | Extend? | Transfer Partner | |

|---|---|---|---|---|

| Aeromexico | 24 months | with activity | Amex | |

| Air Canada | 18 months | with any activity | Amex | |

| Alaska Airways | Accounts locked after 24 months of inactivity | Call to restart | Marriott | |

| American Airlines | 18 months | with any activity | Bilt, Marriott | |

| ANA | 36 months | nope | Amex | |

| Asiana | 10 years | nope | Marriott | |

| British Airways | 36 months | with any activity | Chase, Amex, Cap1, Marriott | |

| Delta | Never | Amex, Marriott | ||

| Emirates | 3 years | nope | Bilt, Chase, Amex, Citi, Cap1, Marriott | |

| Etihad | 18 months | Acitivty | Amex, Citi, Marriott | |

| EVA | 36 months | nope | Cap1, Citi | |

| Flying Blue: KLM/Air France | 24 months | Activity | Amex, Bilt, Chase, Citi, Cap1, Marriott | |

| Hawaiian | No expiration | Amex, Bilt | ||

| Iberia | 36 months | Activity | Chase, Amex, Marriott | |

| JAL | 36 months | nope | Marriott | |

| Jetblue | Never | Amex, Cap1, Marriott | ||

| Korean Air | 10 years | Marriott | ||

| Lufthansa | 36 months | nope Credit card holders of more than 3 months = no expiration Elites = no expiration | Marriott | |

| Malaysia | 36 months | activity | Citi, Marriott | |

| Qantas | 18 months | activity | Amex, Citi, Cap1, Marriott | |

| Qatar | 36 months | activity | Citi, Cap1, Marriott | |

| Singapore | 36 months from earning. | Not with activity. But you can pay a fee per 10,000 miles | Amex, Chase, Cap1, Citi, Marriott | |

| Southwest | None | Chase | ||

| Turkish | 36 months | For a fee ( $10 per 1k miles ) for another 3 years | Bilt, Citi, Cap1, Marriott | |

| United | None | Bilt, Chase, Marriott | ||

| Virgin Atlantic | None | Amex, Bilt, Chase, Cap1, Citi, Marriott | ||

| Hotels | ||||

| Accor | None | cap1 | ||

| Best Western | None | |||

| Choice | 18 months | Activity | Cap1, Citi, Amex | |

| Hilton | 24 months | Activity | Amex | |

| Hyatt | 24 months | Activity | Bilt, Chase | |

| IHG | 12 months unless elite then none | Activity | Bilt, Chase | |

| Marriott | 24 months unless lifetime elite | Activity | Amex, Chase | |

| Radisson | 24 months | Activity | ||

| Wyndham | 18 months | Activity | Cap1, Citi |

1) Transfer points to keep them active

This is why I love flexible point currenies…it gives you options. If you’re not staying at a hotel or flying on an airline to keep your points active…just transfer points in. Not every airline or hotel program is like this, but the vast majority of them are.

2) Keep a co-branded credit card to keep your points alive

Credit cards are an easy way to keep your points alive as well. Any activity you make on that card extends the life of your points. Also, cards like the IHG Rewards Premier from Chase keep your points from expiring just for holding the card.

3) Buy points

You can easily buy points to create activity. An easy purchase of 1000 points may set you back $30 or $40, but it’ll keep that cache of points active. Totally worth the money.

4) Dining Programs

If you aren’t participating in a dining program you definitely should. You simply link your credit card to the program and you’ll earn the points of that loyalty program, in addition to your credit card points, when you dine at participating restaurants You can read a full description of Dining Programs here, but these are the programs that currently offer them:

- Alaska Airlines

- United Airlines

- American Airlines

- Delta SkyMiles

- JetBlue

- Spirit

- Southwest

- Hilton

- Marriott

- IHG

- Choice

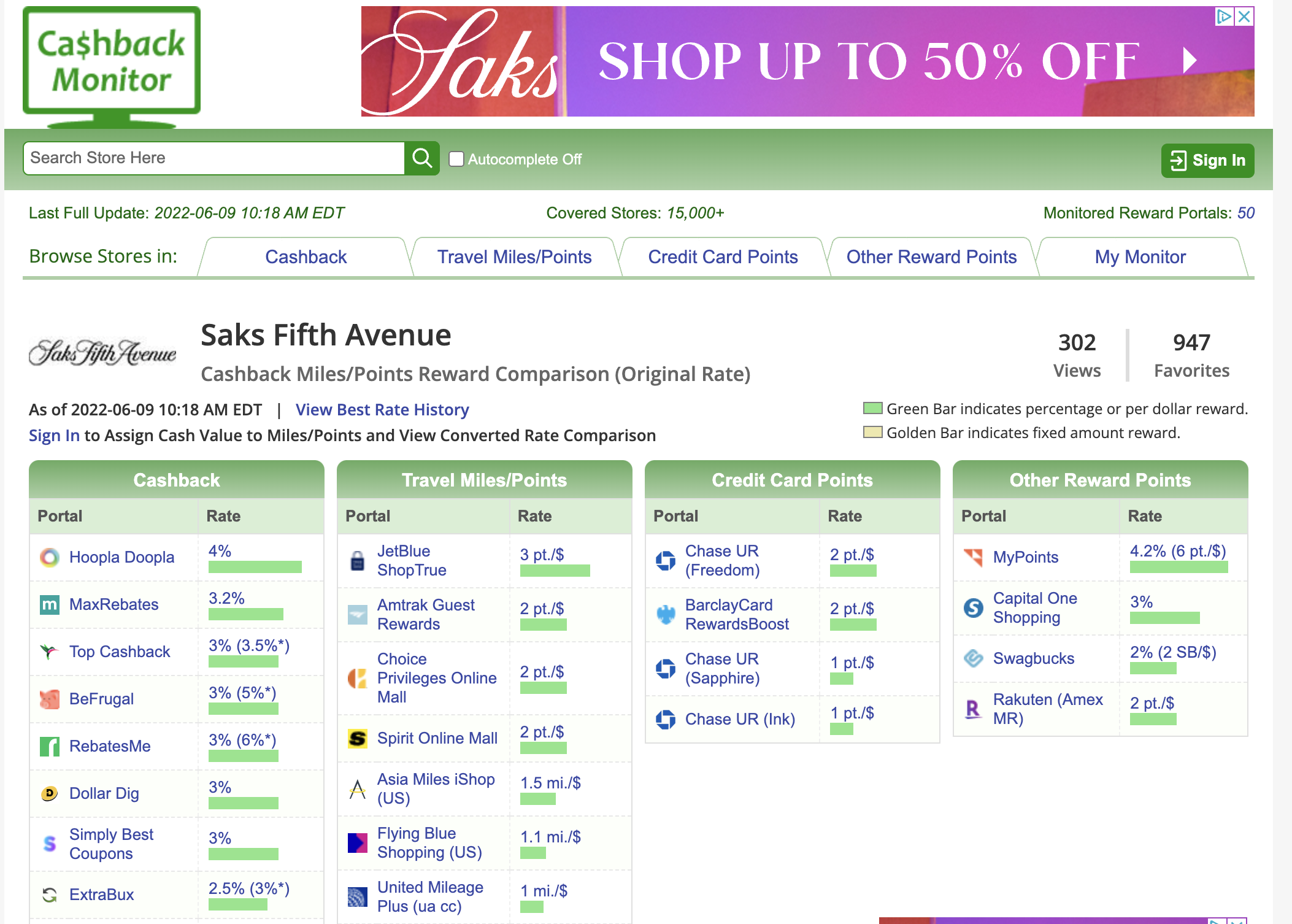

5) Use a shopping portal

Loyalty programs have their own online shopping portals that will code your order to earn points in their program. It’s a super easy way to keep your points alive, but also earn tons of bonus points for items you’d buy anyways. All you have to do is log into the mall and then link into the retailers’ normal site. You’ll not only earn your credit card points, but you’ll also earn the points of the portal you’re using.

- Aeromexico

- Air Canada Aeroplan

- Air France Flying Blue

- Alaska Airlines

- ANA

- American Airlines

- British Airways

- Cathay Pacific

- Delta

- Etihad

- Finnair

- Hawaiian

- Japan Airlines

- JetBlue

- KLM

- Lufthansa

- Qantas

- Singapore Airlines

- South African Airwaysf

- Southwest

- United

- Virgin Atlantic

- Virgin Australia

Hotels

Other

My favorite way to see which portal is offering the biggest bonus is CashBackMonitor

Overall

As you can see, these are 5 easy ways to keep your miles and points from expiring without even leaving your house.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.